March 10 is the anniversary of the dot-com bubble, a reminder of just how foolish investors can be.

It was exactly 15 years ago that the tech-heavy Nasdaq Index hit its highest levels ever. It touched a peak of 5,132.52 during the trading day and closed at a whopping 5,048.62.

The Nasdaq hasn't approached anywhere near those dot-com peaks...until last week when it crested over 5,000.

The Nasdaq has since pulled back a bit, but investors are jittery and rightly wondering if the bubble is back.

Warning signs: Prominent investor Mark Cuban put up a blog post last week with the headline "Why This Tech Bubble is Worse Than the Tech Bubble of 2000."

When Cuban warns of a bubble, people listen. Those who know his story will recall that he rode the dot-com boom of the 1990's perfectly and sold off his big investment -- Broadcast.com -- just before it all went bust.

But Cuban was quick to clarify on CNBC that his concerns about a bubble this time are NOT in the public market. The worst of what he is seeing today is happening in the venture capital world with people betting on young, unproven companies in the mistaken belief that they are getting in early on the next Facebook (FB) or Twitter (TWTR).

Related: Profitless IPOs are all the rage. Bubble alert?

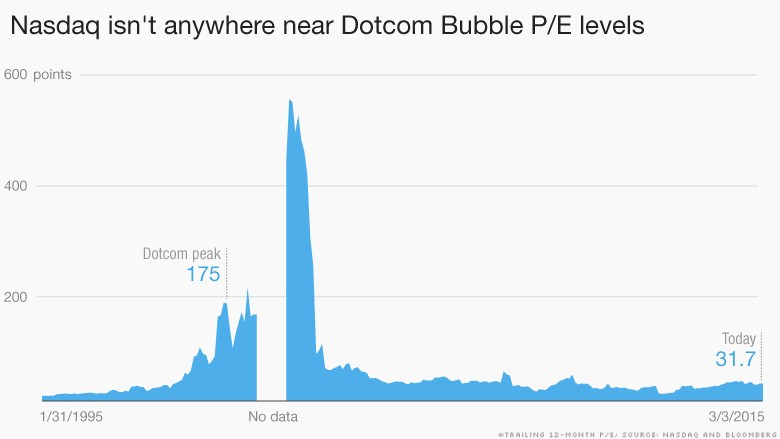

Reality check: A good barometer of how expensive stocks are is to look at the so-called P/E ratio. It's a way to see how much higher the stock price (the P in the equation) is compared to the actual earnings (the E in the equation) of companies.

In March 2000, the P/E for the Nasdaq was a sky-high 175, according to data pulled by Nasdaq and Bloomberg that looks at earnings from the prior 12 months.

Compare that to today: the P/E now is just under 32.

Today's P/E level is actually lower than the average for the past two decades and almost spot on with the median. You can argue that tech stocks are getting expensive, but the basic valuation gut check isn't indicating a wild level.

[For those who like to consider P/E ratios based on expected earnings for the upcoming 12 months, note that the Nasdaq's current P/E is 20 based on that metric, which is well below the dot-com high of about 75.]

Related: Apple stock is making regular Americans rich

More money, less problems: Another good stat to look at is how profitable companies are.

"The top 10 holdings today generate nearly five times the earnings of the top 10 as of December 31, 1999 (excluding WorldCom and its cooked books)," according to an analysis by Burt White and Jeff Buchbinder of LPL Financial.

Overall, companies today are earning a lot more and have much higher cash on hand. Apple is the poster child with its $175 billion in cash, but other companies also hold tremendous amounts of money.

Think of it as a combination of a great rainy day fund and extra money to invest. That cash enables them to invest for the future, return money to shareholders and weather possible crises.

Related: Why this Tech Party isn't like 1999

Investors aren't running in: In hindsight, the other warning sign in 2000 was the amount of "dumb money" flowing into the Nasdaq. Everyone wanted to get rich quick, and it pushed stocks up with Ponzi-like quickness.

"The significant investment flows into the [tech] sector pushed the Nasdaq up 189% during the two years leading up to the speak on March 10, 2000, a much steeper ascent than the 57% gain in the index in the past two years," LPL Financial notes.

Much like losing weight, slow and steady tends to be better than a massive move.

Related: Is it time to exit stocks?

A different Nasdaq today: Lastly, the very stocks that make up the Nasdaq are very different today than they were in 2000. Technology stocks made up about 65% of the Nasdaq Index in March of 2000. Now technology makes up only 43%. That's still "tech heavy," but it's a lot less of a weight.

Companies in the health care sector -- especially biotech -- and consumer services now make up a much larger share of the index than they did before.

Put all that together and it makes it easier to take a deep breath and think rationally about the market levels today.