AT&T's first day out of the Dow was a lot like its days as a member of the most exclusive stock market club. Its shares lagged the rest of the market.

Ma Bell was replaced in the Dow 30 by Apple (AAPL) ... a company that ironically has helped boost AT&T's (T) sales over the past few years thanks to the success of the iPhone.

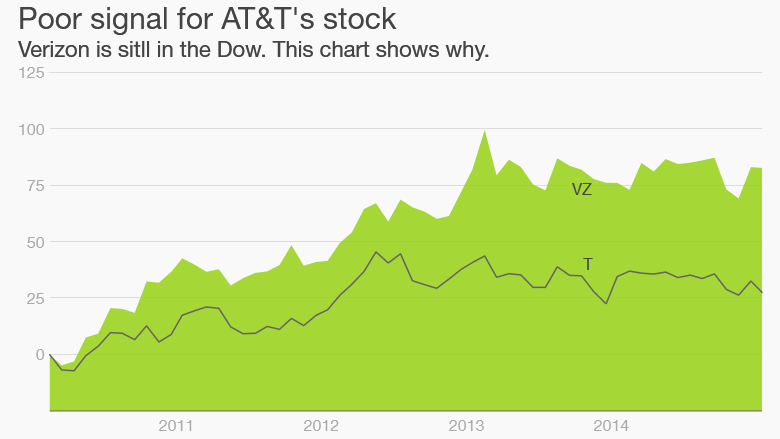

But AT&T's stock, which was down nearly 1% Thursday, has underperformed the Dow and its top rival Verizon (VZ) for a while now.

AT&T's shares are up just 27% in the past five years, compared to a 66% gain for the Dow and 73% increase for Verizon.

So what's next for AT&T? Some market experts joke that getting tossed from the Dow is actually a blessing in disguise and that Apple could underperform since it's now keeping company with some stodgier stocks.

The Dow is not as relevant to hardcore traders and fund managers because it's only 30 stocks -- and a lot of them are older, more mature companies. Think IBM (IBM), GE (GE), Coke (KO) and 3M (MMM).

Some former Dow components have actually done quite well once they got booted from the average. Alcoa (AA), Kraft (KRFT) and Hewlett-Packard (HPQ) come to mind.

Related: 131 years of the Dow. What's in and what's out

But it may be tougher for AT&T to become a stock market darling again.

For one, the wireless business is brutally competitive. The industry is in a full-blown price war, with T-Mobile (TMUS) and Sprint (S) leading the way as they try to gain market share from AT&T and Verizon.

Lower costs for monthly plans are great for consumers. But not investors. Wireless profit margins are thinner than the new Oppo R5 smartphone. (4.85 mm versus 6.9 mm for the iPhone 6 if you are keeping score at home.)

Related: T-Mobile will pay $650 for you to switch carriers

This is a big reason why analysts think AT&T's earnings will increase by less than 5% annually -- on average -- for the next few years.

AT&T is trying to find other ways to grow its business. It's making a giant bet on video with last year's plan to buy DirecTV (DTV).

That deal would also give AT&T access to the extremely lucrative Sunday Ticket programming that DirecTV offers to its customers. Sunday Ticket subscribers can watch any NFL game they want as opposed to just the ones airing on broadcast TV.

AT&T could make a killing by extending this package to its mobile subscribers.

Still, the DirecTV merger is currently stuck in regulatory limbo -- along with Comcast's (CMCSA) proposed acquisition of Time Warner Cable (TWC).

The Federal Communications Commission is going to take a long hard look at what these mergers might mean for consumers, especially in light of the FCC's new net neutrality rules.

Related: FCC hits pause on Comcast and AT&T merger reviews ... again

There are many concerns about the growing power that AT&T and Comcast will have in cable and satellite TV as well as broadband Internet access. Any further delays could make AT&T investors nervous.

Nonetheless, AT&T is still one of the most widely held stocks in the world. Many investors own it because it pays a gigantic dividend that currently yields 5.7%.

The stability of this dividend has made AT&T a popular investment for so-called widows and orphans -- people who want the security of a quarterly dividend payment.

Related: AT&T is still a stock that many CNNMoney readers love

But even that dividend might not be enough to keep investors satisfied. After all, many investors now prefer to reinvest dividends back into the stock instead of cashing the dividend check.

What's more, Verizon also pays a solid dividend. It yields 4.5%. And Verizon's stock has been a better performer because its earnings have grown at a faster clip than AT&T's. They are expected to keep doing so.

Heck, Apple has now emerged as a viable stock for dividend-hungry investors too. Its yield is 1.5%.

So AT&T may not enjoy a post-Dow bump. If its stock was doing better, it probably would still be in the Dow. Verizon could have been kicked out to make way for Apple.