Dividend stocks often serve as the cornerstone of any well-rounded retirement portfolio.

While you will find some investors who've made their riches with high-growth technology or biotechnology stocks, the tried and true method to wealth appreciation via the stock market is through dividend-paying stocks. If you don't believe me, go talk to Warren Buffett, who's built his empire on the heels of dividend-paying stocks.

Why dividend stocks? A company willing to pay a dividend -- be it monthly, quarterly, semi-annually, or annualy -- is demonstrating to investors that its cash flow is strong enough, and its business model sound enough, to share a percentage of its profits with faithful investors.

Dividends are also a great buffer during recessions and volatile markets. Long-term investors tend to be attracted to steady and/or growing dividend stocks, meaning there's a potentially lower chance of volatility caused by emotional trading.

Related: The 3 Best Stocks to Invest in Biotechnology

But arguably the best aspect of dividends is the ability to reinvest them right back into the same stock. This way you can supercharge your wealth accumulation in combination with share-price appreciation, potentially even shortening the amount of time you'll need to work during your lifetime.

The highest dividend stocks in the Dow: One avenue commonly explored by income investors is the Dow Jones Industrial Average's 30 components. All 30 Dow stocks are (currently) profitable, and each is paying a dividend, ranging from 4.4% at the high end to 0.7% on the low end. Overall, though, the Dow's average dividend yield in the mid-2% range is higher than the approximate average dividend yield of 2% currently being paid by S&P 500 companies.

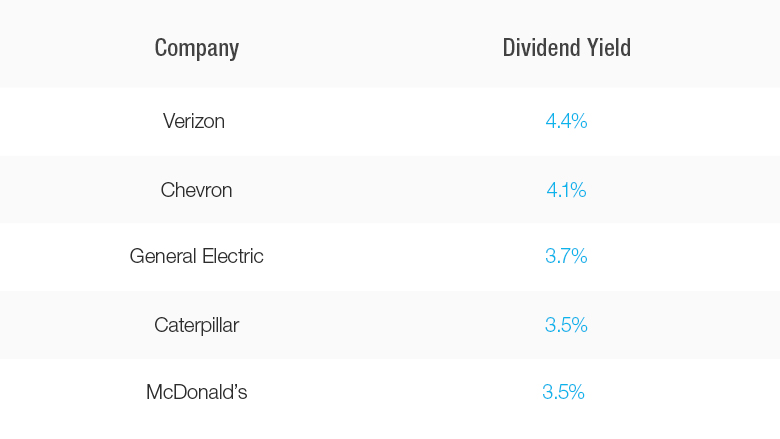

Five of the Dow's components could arguably be classified as high-yield dividend plays, which I'm defining as any stock yielding 3.5% or higher. The highest dividend stocks in the Dow are:

As you'll note, one relatively common aspect of most Dow components is they tend to be multinationals -- in other words, they operate all around the globe. I'd like to think that having a global market at their disposal, including high-growth emerging market countries such as China and India, as well as the entire continent of Africa, should help drive profit and dividend growth for all 30 Dow components.

Related: Netflix, Inc. Earnings This Week: Don't Overlook These Items

Not all high dividend stocks are created equal: However, the reality is that not all Dow stocks are created equal -- not even the highest dividend stocks in the Dow.

Sometimes the reason a dividend yield appears so robust has more to do with recent stock price weakness, which inflates yields, rather than substantial dividend growth.

For example, shares of Chevron (CVX) are off 28% from the 52-week high it hit last summer. Back then, and based on its current dividend payout of $4.28 per share annually ($1.07 per quarter), Chevron was yielding 3.2%. Its nearly-one-percentage-point-higher yield today is merely a result of its plummeting share price tied to the weakness in crude oil and natural gas prices.

In spite of being a Dividend Aristocrat -- a special group of more than four dozen companies to have raised their dividend in 25 or more consecutive years -- it's possible Chevron may not be able to reasonably increase its dividend in 2015.

Related: Over half of Americans have $0 in stocks

In other instances there's a concern about the longevity of a business model. Fast-food giant McDonald (MCD)'s was the progenitor of casual dining profitability for decades, but it's currently in the midst of a major turnaround after recently changing CEOs.

Among the company's laundry list of problems are its long drive-thru wait lines, a monstrously large menu that could be confusing customers, and concerns from the public that McDonald's food just isn't that good for you. Instead, consumers are opting for healthier casual choices such as Chipotle Mexican Grill (CMG), which costs about the same on a per meal basis.

Finally, there are companies like Verizon (VZ) which have a sound business model, but operate in a hypercompetitive and generally saturated wireless market that's likely going to constrain growth to the low single-digits over the long run. While it does mean that Verizon's high-yield dividend of 4.4% is probably sustainable, it also means there isn't likely to be much in the way of share price appreciation for investors.

Related: Warren Buffett Admits This Is A "Real Threat"

The high dividend stock to rule them all: Among the high dividend stocks of the Dow, the one I personally prefer is conglomerate General Electric (GE).

Does GE have risks? You bet. It's still in the process of removing risks tied to GE Capital that whacked the company during the Great Recession, and as an industrial-focused company it'll rely on U.S. economic growth in order to fuel backlog growth and pricing power. In short, recessions are going to be bad news for GE, as they are for most stocks in general.

However, General Electric has a lot working for it as well, specifically in energy and health care. Rising global energy demand, especially alternative energy demand, should (pardon the pun) fuel demand for the company's wind turbines for years to come. By a similar token, its medical diagnostics, such as MRI machines, should see a boost in demand as the Affordable Care Act lowers the number of uninsured people in this country and the nation's elderly live longer. Compound this with ample emerging market opportunities and I believe GE has a multi-decade opportunity for mid-single-digits growth.

Related: GE sells GE Capital unit for $26.5B

In GE's latest quarter it announced a mammoth backlog of $261 billion, which includes $72 billion in equipment and $189 billion in services. Both figures were up nicely year-over-year. It also generated $15.2 billion in cash flow from operating activities in 2014, which is more than enough to maintain and/or grow its payout for years to come.

If you're an income investor on the lookout for a high dividend stock in the Dow, General Electric would be my suggestion as a great starting point for your research.

Sean Williams writes for The Motley Fool. You can track his stock picks under the screen name TrackUltraLong and check him out on Twitter: @TMFUltraLong.