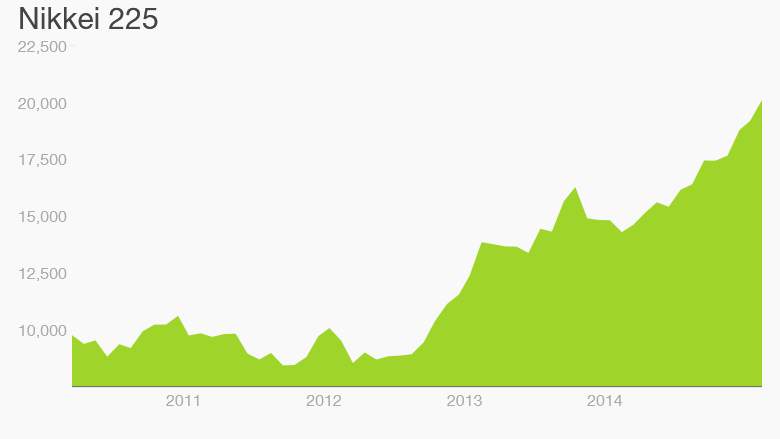

Japan's main stock market index has closed above the 20,000 level for the first time in 15 years.

The Nikkei 225 has surged by just over 15% this year, building on an incredible 140% boom since June 2012.

It's easy to find reasons for the index's performance: The central bank is pumping money into the economy at a rapid pace, and Prime Minister Shinzo Abe has pledged to reform the way Japan Inc. does business.

Alex Treves, head of Japanese equities at Fidelity Worldwide Investment, said companies are listening to the government's calls for corporate reform.

"We are seeing signs of positive evolution ... as companies utilise excess cash for dividends and share buybacks and increase returns on equity," Treves said.

"The coordinated pro-growth policies, the changes in corporate behaviour that are occurring, and the fact that Japan offers reasonable valuations in a global context should support the case for Japan," he said. "We believe that the mid-term outlook for Japanese equities is attractive."

Related: The unlikely company behind the Nikkei's dramatic rise

The prime minister's ambitious plan for Japan's economy -- dubbed Abenomics -- has helped end deflation, boost corporate earnings and send stock prices through the roof.

Most recently, Abe has been lobbying to get companies to raise worker wages. The idea is that workers will then increase spending, completing a so-called "virtuous cycle" that will deliver sustained economic growth across the nation.

His lobbying efforts have even extended to the golf course, where Abe is reportedly in the habit of inviting business titans for a round, and then asking them to raise wages.