It's been a hellish week for biotech stocks.

All triggered by a single tweet.

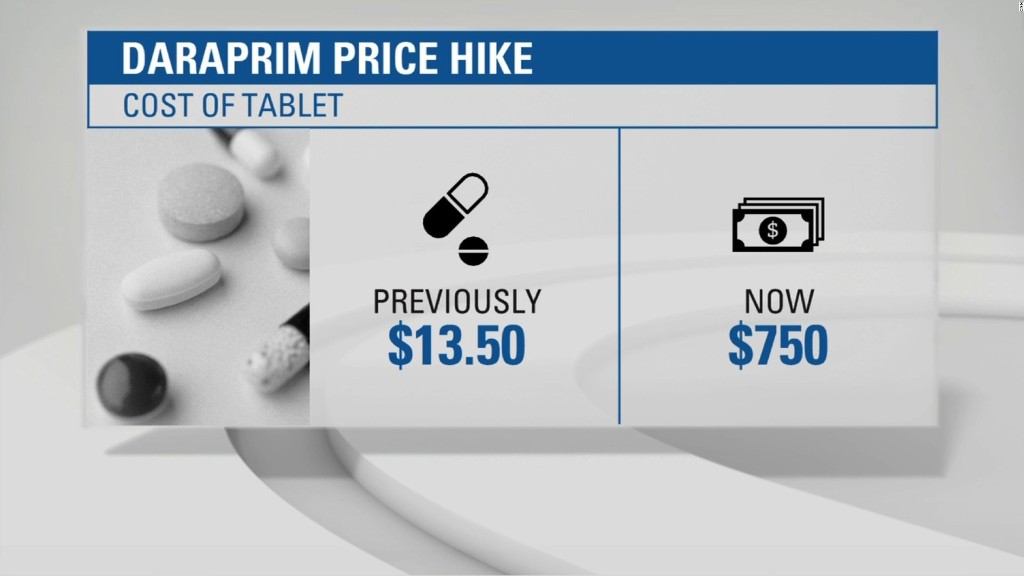

Hillary Clinton on Monday railed on Twitter against a ridiculous overnight 5,000% price hike on a drug used by HIV patients. The ensuing firestorm resulted in the drug maker backing down from the price increase and its founder, former hedge fund manager Martin Shkreli, being dubbed the "most hated man" in America by the Daily Beast.

The episode raised jitters that Washington could take action against drug price hikes.

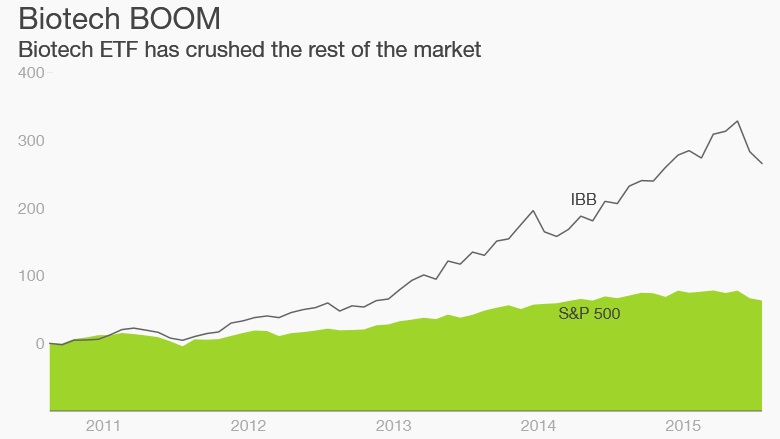

Biotech stocks of all sizes tumbled on Monday following Clinton's tweet. The iShares Nasdaq Biotechnology ETF (IBB) plunged nearly 8% on the week as of Thursday's closing bell. Individual biotech stocks like Celgene (CELG), Biogen (BIIB) and Regeneron (REGN) also suffered steep losses.

It's worth remembering this sector was long overdue for a breather. Despite this week's slide, the Nasdaq biotech ETF has skyrocketed nearly 600% since the bull market in U.S. stocks began in March 2009. That's an unbelievable rise for an entire industry and crushes the S&P 500's own amazing rally of nearly 200% over that span.

More recently, it's been a rough stretch for biotech. The sector is on track for its first quarterly slump since the end of 2012, according to Ryan Detrick, an independent market strategist.

Related: Meet the guy behind the $750 AIDS drug

Political pressure = turbulence ahead

So now investors are left wondering: Is this an amazing time to scoop up beaten-down biotech stocks or is this area too dangerous to touch at this point?

"Investors in biotech need to be aware that this election cycle will be volatile," said Paul Yook, a portfolio manager at biotech-focused ETF called BioShares Funds. "It will present trading opportunities for short term investors and buying opportunities for long-term investors."

It's important to take stock of the political situation first. Clinton unveiled a plan this week to reform the pharma business by stopping drug makers from spending government grants on advertising and by giving the federal government power to negotiate prescription drug costs lower.

Some believe Wall Street overreacted to Clinton's tweet considering she's not even the Democratic nominee for president at the moment, let alone in the White House. Any proposal from a President Hillary Clinton would need to get through Congress, where Republicans will likely control at least one chamber.

"I think it's more headline risk than actual risk. We believe the decline in biotech stocks was unwarranted and see buying opportunities," said Jeffrey Loo, an equity analyst at S&P Capital IQ.

Related: Hillary Clinton unveils plan to lower medical costs

Prices can't skyrocket forever

Still, Morgan Stanley said "political pressure and market forces are likely to moderate drug price inflation," especially after 2016.

These concerns could divide the biotech world.

Morgan Stanley said drug companies that rely on price hikes for growth will be more vulnerable than those that treat rare diseases.

Yook also expects companies that make non-innovative and high-priced drugs to be pressured by greater scrutiny in the future. He singled out Valeant Pharmaceuticals (VRX) and Retrophin (RTRX), a drug maker Shkreli founded but was later fired from.

Related: Hillary Clinton tweet crushes biotech stocks

Rare disease drug makers could shine

On the other hand, Yook believes companies that target rare diseases could represent "huge buying opportunities as they still will produce life-saving new drugs." He pointed to Celgene, Gilead Sciences (GILD) and Juno Therapeutics (JUNO).

"The pipeline looks very attractive. That's going to be a catalyst for continued solid sales growth," he said.

Related: Fear is back! Gold glitters as stocks tank

Sticker shock or discounts?

Investors also need to be wary over valuations in the biotech space. The monstrous rally over the past six years and a powerful wave of mergers & acquisitions have raised the price tag on many stocks. In fact, just last summer the Federal Reserve too warned of a possible bubble in small biotech stocks.

But Loo said the S&P biotech sub industry group is trading at just 15.2 times next year's earnings. That's below the healthcare industry and the broader stock market.

"Most investors automatically assume it's valued at astronomical valuations. In reality, biotech is clearly not overvalued," said Loo.