Investors are afraid. Very afraid. How can you tell? Just look at gold.

Stocks were tumbling for a third straight day Thursday, in large part due to bad news from Caterpillar (CAT). Most of the 30 Dow stocks were lower and just a handful of companies in the S&P 500 were in the black.

But gold prices were up 2%. And the top stock in the S&P 500 Thursday was gold miner Newmont (NEM), gaining more than 6%.

Gold has been glittering since the broader stock market started convulsing in August.

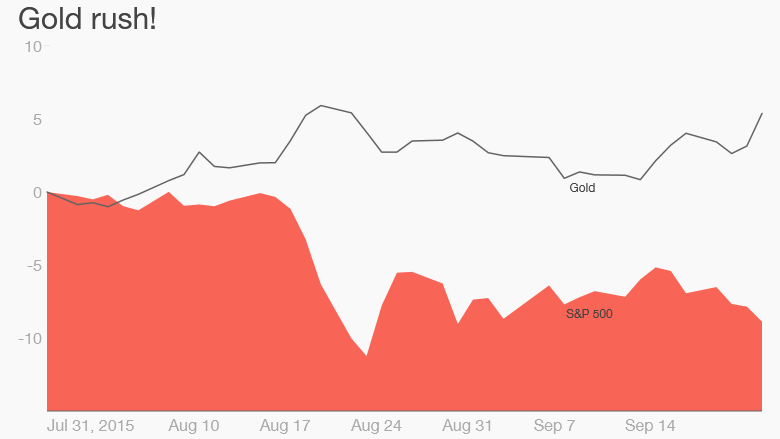

The SPDR Gold Shares (GLD) exchange-traded fund, a popular ETF that seeks to mimic the price of the actual metal, is up more than 5% since the end of July while the S&P 500 is down 9%.

What's more, the Market Vectors Gold Miners ETF (GDX), which owns Newmont and other big miners like Goldcorp (GG), Rangold (GOLD)and Barrick (ABX), has also held up well lately, gaining nearly 2% in the past two months.

Related: Stocks back in correction territory

It makes sense. Gold is often considered a safe haven during global economic turmoil.

"Investor uncertainty is helping. Gold is a place people move into when they are worried about the market. There is a definite increase in physical demand for the metal as well," said Chris Gaffney, president of EverBank World Markets.

Still, it's a stunning turnaround for gold and miners.

It wasn't that long ago that investors were worried about a gold bust due to fears of slowing gold demand in China and India, a strong U.S. dollar and expectations of an imminent interest rate hike by the Federal Reserve.

China demand is still a concern. But it seems that gold is now benefiting from the fact that the U.S. dollar has softened, now that the Fed has held off on raising rates.

Gold bugs view the metal as an alternative currency, one whose value cannot be manipulated by central banks.

Gold is a tangible, physical asset.

Related: Is the stock market holding Janet Yellen hostage?

An added bonus? Gold usually does well when the greenback weakens.

The collapse in most other commodity prices in the past few months could also help since it could lead to more fears about deflation. Gold often holds up well when other asset prices are doing their best impersonation of Tom Petty's Free Fallin'.

But it's not clear if the current rally in gold is the start of a new gold rush or just another fool's gold head fake.

The GLD ETF is still down nearly 3% this year and more than 40% below its all-time high from four years ago.

Gold prices are currently around $1,150 an ounce -- a far cry from their record (not adjusted for inflation) of more than $1,920 in September 2011.

Gold's peak took place during the last stock market correction -- a 10% pullback from a recent high -- prior to this one. Stocks plunged in the aftermath of Standard & Poor's downgrading the credit rating of the United States in August 2011.

Related: Could gold prices plunge as low as $350?

So maybe the timing is right for gold to keep climbing?

"We never tell people to load up on gold. But it's a good thing to have a little of in your portfolio as a hedge against market volatility," said Ralph Aldis, portfolio manager with U.S. Global Investors.

Aldis thinks gold could get back to $1,200 in the near-term as the Fed continues to sit on the sidelines.

It's possible that the worries about China and angst over the Fed's hemming and hawing on a rate hike (Will the Fed finally raise rates in December? 2016? 2017?) could fuel a further run in gold.

The spike in gold isn't the only sign of market anxiety either.

The VIX (VIX), a key measure of volatility, has more than doubled since the start of August. And CNNMoney's Fear & Greed Index, which looks at the VIX and six other gauges of investor sentiment, is indicating levels of Extreme Fear as well.

But heightened investor panic often sets the stage for big market rallies afterward -- even if the market unease won't evaporate overnight.

That's why Kate Warne, investment strategist at Edward Jones, thinks now is the time to start thinking about buying stocks again and not chase gold.

She says the Fed is going to eventually raise rates. And China should start to stabilize.

"Gold is a measure of fear. Just because fear is high doesn't mean you want to buy fear," Warne said. "Most of the concerns right now are more short-term than long-term."