The world is once again growing nervous about the health of big banks -- especially those based in Europe.

Not only are bank stocks plummeting at an alarming pace, but investors are raising their bets that some could even default on their debt if the global economy sinks into recession or the crash in oil prices deepens.

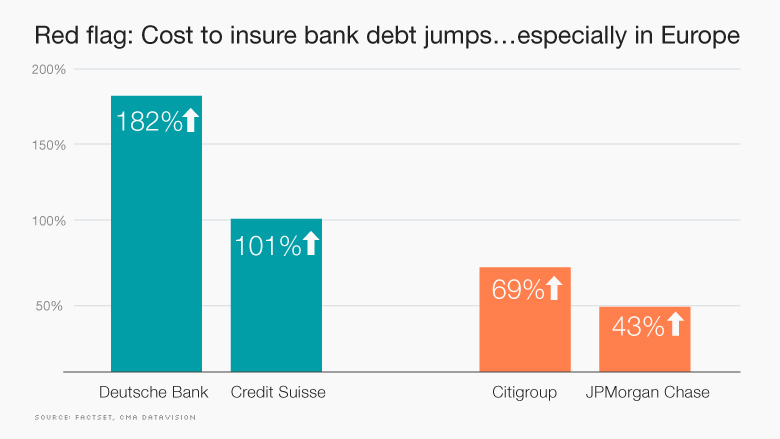

The cost to insure Deutsche Bank's (DB) debt has skyrocketed 182% over the past three months to the highest level since the 2011 sovereign debt crisis, according to FactSet. Credit Suisse (CS) is also under fire, with the cost to insure its debt doubling.

Fear about European banks is adding to the global gloom. It's sent stock markets around the world spiraling lower in 2016.

"There is still this trauma of 2008 hanging over the market. It doesn't take much into scaring everybody into fearing we're going to have another global financial mess," said Ed Yardeni, president of investment advisory Yardeni Research.

Of course, the current turmoil in banks is not even close to the 2008 crisis at this point. And big banks in the U.S. and Europe have gotten much stronger since that meltdown.

Related: Forget oil stocks. Banks are killing your portfolio

Still, banks are getting clobbered this year. Shares of Bank of America (BAC) are down 27% this year, while Goldman Sachs (GS) is off 18%. By comparison, the Dow is down "only" 8%.

European banks have fared even worse, with the Euro STOXX bank index plummeting 24% despite a big rebound on Wednesday. Likewise, Deutsche Bank's German-listed shares soared 13% on Wednesday, but remain down by one-third this year.

"Now every banking institution in Europe and otherwise is having its viability questioned," Michael Block, chief market strategist at Rhino Trading, wrote in a client note.

So why are banks in a nosedive?

Recession, oil crash jitters

First, investors are guarding against the increased risk of a global recession. They fear that banks, especially big European ones that rely on risky trading revenue instead of more reliable deposits, could suffer in a downturn.

Rumors that Deutsche Bank may have trouble paying interest on some debt due in April forced Germany's biggest bank to reassure panicked investors twice in the span of 24 hours. John Cryan, the bank's co-CEO, insists Deutsche Bank is "absolutely rock solid." Deutsche Bank shares rallied on Wednesday after the Financial Times reported it may buy back a chunk of its debt.

Related: Deutsche Bank tries to quell the panic

The other big driver is the crash in commodities -- especially oil. Energy companies took on tons of debt when oil was trading at $100 a barrel. Now that it's at $28, energy loan defaults are on the rise and dozens of companies have filed for bankruptcy.

Investors are worried big banks haven't done enough to brace for the coming storm of oil defaults, especially if oil stays below $40 for a long time. Will shale loans turn into the 2016 version of subprime?

Central bankers are also making investors jittery. U.S. bank stocks rallied last year on hopes the Federal Reserve would significantly raise rates in 2016. Higher rates give banks more room to make money on the difference between the interest they pay out on deposits and what they charge on loans.

But the 2016 market turmoil has lowered the chances the Fed raises rates much this year. In fact, global central bankers are aggressively moving in the opposite direction. The European Central Bank is printing money and has hinted at even more stimulus, and the Bank of Japan shocked the markets by introducing negative interest rates.

"The potential for a prolonged sub-to-near-zero interest rate environment has turned the market tide against European banking shares," Relte Stephen Schutte, an analyst at research firm Markit, wrote in a note.

Related: Global central banks are running 'out of ammo'

Big banks are way healthier than 2008

But some believe the financial freakout is overdone.

"There's very, very little detail that supports systemic concerns like there were in 2011, let alone 2007/2008," Bespoke Investment Group wrote in a note.

Bespoke pointed out that big bank balance sheets are "dramatically" less leveraged and that lenders have been forced to stockpile lots of capital to absorb future losses.

Even in a worst-case scenario, Bespoke said big banks could swallow a writedown of all their energy loans by using just one quarter of their profits.

"I don't think there is any financial crisis risk here. Bank capitalization in the U.S. and Europe is extremely good. It's hard to feel worried about it," said David Kelly, chief global strategist at JPMorgan Funds.

-- Jim Boulden and Ivana Kottasova contributed to this report.