Lo and behold, stocks around the world are getting a little boost. You can thank oil. Again.

But will this rally last?

Here are the four key things you need to know before the opening bell rings in New York:

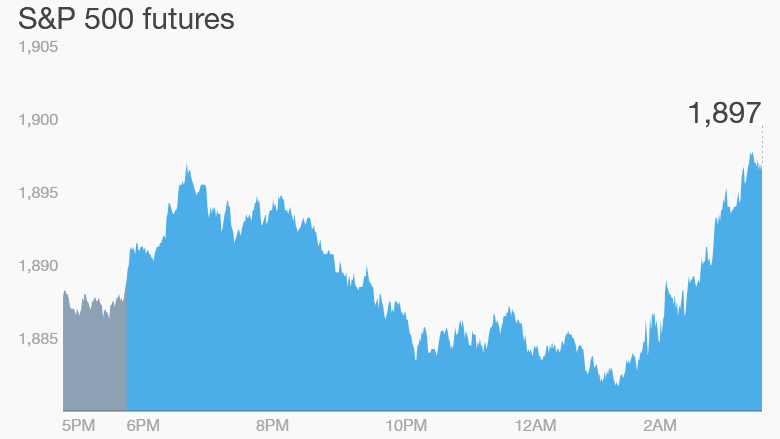

1. Market overview: U.S. stock futures are rising and holding onto the big gains made over the previous two trading days.

Markets have been wildly volatile recently and stock market moves have been heavily correlated with big oil price moves.

Oil prices are up about 2% to $29.50 a barrel in early trading.

European markets are also getting a boost, rising by about 1%, while Asian markets ended with mixed results.

In the debt market, yields on U.S. Treasuries are dipping alongside many other global government bonds.

2. Stock market movers -- Kinder Morgan, Staples: Shares in energy infrastructure firm Kinder Morgan (KMI) are surging after billionaire investor Warren Buffett's Berkshire Hathaway (BRKA) revealed that it had bought a $395.9 million stake in the company.

Staples (SPLS)' stock is rising as investors bet that the company's planned merger with rival Office Depot (ODP) will clear all antitrust hurdles after Staples agreed to offload some of its business to Essendant. That should help convince U.S. regulators that the planned Staples-Office Depot merger won't violate antitrust laws. The Federal Trade Commission successfully blocked a merger of the two office suppliers back in 1997.

Related: America's bull market may end soon, but...

3. Earnings : T-Mobile (TMUS), Priceline (PCLN), Dr Pepper Snapple (DPS) and Outback Steakhouse owner Bloomin' Brands (BLMN) are all reporting before the opening bell.

This afternoon, companies including Marriott (MAR), Barrick Gold (ABX), and Jack In The Box (JACK) will release earnings.

4. Economics: The federal government will post January's Producer Price Index at 8:30 am ET.

At 9:15 a.m., the Federal Reserve will post an update on industrial production and capacity utilization in January.

And then the Fed will release the minutes from its latest policy meeting at 2 p.m. Investors will parse through these documents for any clues about the Fed's plans for rate hikes in 2016.