Boom! The European Central Bank has fired its big bazooka once again in a bid to get the economy moving again.

The bank cut its main interest rates to new record lows on Thursday -- taking the deposit rate even deeper into negative territory -- and said it would print more money as it tries to head off deflation in the eurozone.

Starting in April, it will buy 80 billion euros ($87 billion) worth of bonds each month -- up from 60 billion euros at present. The stimulus program will run at least until March 2017.

The measures are designed to reduce the cost of borrowing, and encourage banks to lend to businesses and households so they invest and spend more freely. Negative rates penalize banks for keeping excess cash on deposit.

Economists were expecting a rate cut and more asset purchases. But the ECB went further: It said it will start buying debt issued by companies as well as governments.

Related: Borders could cost Europe $20 billion a year

Explaining the bold move, ECB President Mario Draghi said the uncertain outlook for the global economy -- as well as unspecified geopolitical risks -- were making it hard for the eurozone recovery to gather pace.

The ECB cut its 2016 forecasts for eurozone growth and inflation to 1.4% and 0.1%. Prices in the eurozone fell in February, largely due to weak oil prices.

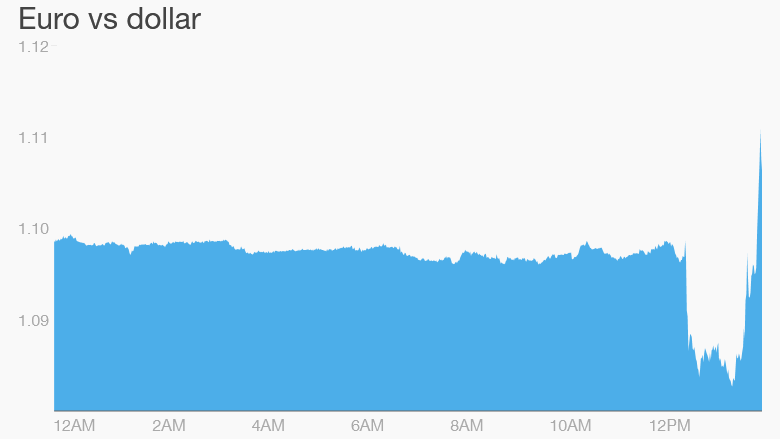

Markets initially cheered the news of more monetary stimulus. European stocks jumped by more than 2%, and the euro dropped more than 1% against the U.S. dollar. But stocks quickly gave up some gains, and the euro move was reversed.

"The comprehensive package exceeds expectations by enough to have a positive impact not just on financial markets but also on business confidence in the eurozone," noted Holger Schmieding at Berenberg bank.

Related: Global bank body warns of negative interest rate risks

Some investors have warned of the dangers of relying on central bank stimulus to boost growth, arguing that it risks inflating market bubbles and is ineffective in driving the economy forward.

"The ECB has belatedly delivered, but it can't work miracles," noted Jonathan Loynes at Capital Economics.

"There is no guarantee that its latest 'bazooka' will be any more effective than previous ones in securing the strong and sustained growth required to eliminate the threat of deflation."