Don't be surprised if the next Warren Buffett or Ray Dalio is a Lafayette College grad.

Instead of hitting up Happy Hour on Friday afternoons, about 100 Lafayette students head to an auditorium to talk about stocks and bonds.

This isn't a class. It's the oldest student-run investing club in America.

Its origins go all the way back to World War II, when the U.S. military assigned Officer John Tarbell to give basic investing tips to veterans returning from Europe to America. Tarbell was a finance professor before joining the Army and the veterans needed the advice -- many were born in the Great Depression and were afraid of the markets.

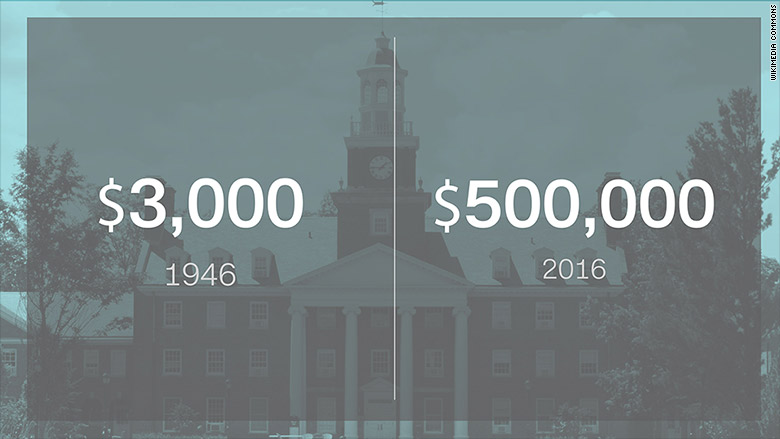

Several vets were so grateful to Tarbell that they gifted him $3,000 to start an investing club at Lafayette, a small liberal arts school in Pennsylvania, where he returned to teaching finance full-time after his military service.

Today the portfolio is worth over $530,000.

It has gained more than 17,500% since the first stock was purchased in 1946. It's a solid return that beats the overall stock market (the S&P 500 index without reinvesting dividends).

Related: I went from Wall Street...to working at Waffle House

Investing is for everyone

"Investing is for everyone" is the club's unofficial motto. Members major in everything from economics to art. It is one of the most popular organizations on campus.

"We welcome anyone to give a stock pitch, even if we don't think it's the best idea," says Othman Guennoun, a junior from Morocco who is co-president of the club.

Some CNNMoney readers point out that if the club had reinvested all of its dividends over the years, it could have amassed nearly $4 million. But the club is educational and often uses the money from dividends to fund activities, speakers and field trips.

Beating the S&P 500

Plenty of high school and college students play online trading games, but that's fake money. Young investors act differently when real cash is at stake.

"We consider the portfolio of the club to be like our own personal portfolio," says Rand Lewis, a junior from Connecticut and chairman of the club.

Lewis and Guennoun feel the pressure to uphold the very successful investing tradition at Lafayette College. Alumni often inquire how the portfolio is doing and send along tips or stock research.

Related: 77-year-old trader: How I made a lot of money

What the club owns

Club newbies have to stay up-to-date on the market and present weekly updates. Then students work their way up to pitching stocks the club should buy or sell. Sometimes there are even "stock pitch battles" where club members duke it out.

At the end of the meeting, everyone votes yay or nay on the latest pitch. Currently, the top holdings are UnitedHealth (UNH) and Home Depot (HD), both of which have made strong gains in the past year.

"We try to buy companies with healthy and high-yield dividends," says Lewis, who is a defensive back on the school's football team. He regrets convincing the club to buy Ferrari (RACE), which has struggled mightily since its IPO in October, but it's taught him the power of diversifying your stock bets.

Related: Why dollar-cost averaging doesn't make sense

The club almost didn't make it

Today the investing club seems like a no-brainer. Many universities have them. But Professor Tarbell thought it was a terrible idea initially.

"I resisted due to the fact that students have rather unwise desires to speculate rather than invest," he said in a speech in the 1950s that the Lafayette College Archives shared with CNNMoney.

When Tarbell saw how well the students were doing, he allowed the portfolio to be entirely run by the students by 1949.

Many students who get involved aspire to a Wall Street career. Guennoun will intern at Ernst & Young this summer and Lewis at Barclays. But some just want to learn the basics. Half of Millennials don't believe Social Security will be around for them, so understanding how to invest for retirement is a necessary life skill.

The club's current portfolio has 41 stocks, a size that's similar to a lot of professional stock funds. The focus is long-term. After all, the portfolio has already been around 70 years.

Related: There's a big sale on Puerto Rican homes

The takeaway for students

Economics professor Michael Kelly "advises" the club, but he sees his role as a fly on the wall.

"My job is to sit in the back of the auditorium, which is usually filled with 70 to 100 people every other Friday, and keep my mouth shut unless they are breaking the law," says Kelly, who worked for many years on Wall Street as a bond investor before switching to teaching.

For Lewis, the biggest takeaway after three years in the club is that there is no such thing as a "safe stock," only safe portfolios.