America's four living Federal Reserve chairs say the U.S. is not in a bubble, but that doesn't mean everything is fine.

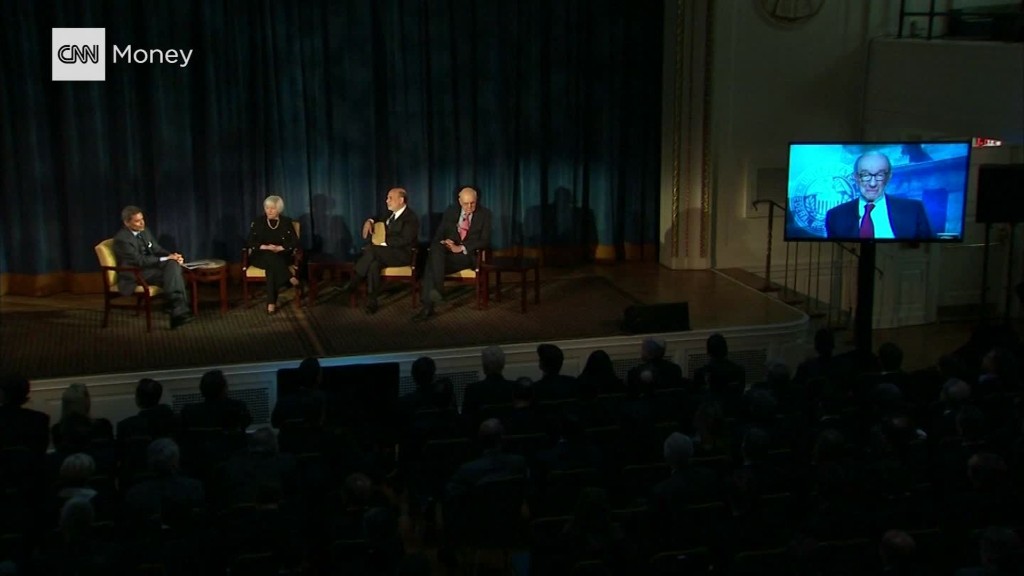

Current Federal Reserve chair Janet Yellen and former chairs Ben Bernanke, Alan Greenspan and Paul Volcker all agree that a bubble isn't a concern. They were interviewed together for the first time ever on Thursday by CNN's Fareed Zakaria, with Greenspan on a live feed.

"This is an economy on a solid course, not a bubble economy," said Yellen said at the event at International House in New York.

Bernanke backed her up.

"Just because we've been in 7 years of recovery doesn't mean we're due for another recession at all," Bernanke said. He went as far as to say he doesn't think there's any greater risk of a recession this year than there normally is.

But the four Fed chairs also agreed on this: They worry a lot. It comes with the job of being at the helm of the world's number one economy.

Right now, Yellen's top concern is the health of the rest of the world. She said the U.S. is "suffering from a drag from the global economy."

The Fed didn't raise interest rates in March and almost certainly won't do it at its next meeting in April because of the weakness abroad.

The former Fed chairs were even more blunt about their concerns.

For Bernanke, it's Congress, especially if another recession were to hit.

"When central bank is out of ammunition or ammunition is low, fiscal policy has a role to play," he said, taking a swipe at Congress for not doing enough stimulus to boost growth.

Greenspan thinks the biggest issue is that productivity isn't growing in America -- or much of the developed world. That's a fancy way of saying the same workers aren't making a whole lot more than they used to.

Related: Has the Federal Reserve messed up?

"I think the major problem that exists is essentially the issue that productivity growth across the spectrum of all economies has been under 1% a year for the last five years," said Greenspan.

The solution in Greenspan's mind isn't for government to spend a lot more, it's for companies to invest more. Many big businesses have been holding on to large cash reserves.

Volcker, who served as Fed chair from 1979 to 1987, considers himself the seasoned veteran. He says economies go up and down and that's natural.

While Volcker doesn't believe there's a bubble, he did admit he thinks there are "aspects of the financial world that are overextended."

Related: U.S. economy may have hit the pause button

He referred to parts of the financial system that don't contribute to productivity. He didn't say explicitly what those are, but he seemed to be hinting at certain hedge fund activities.