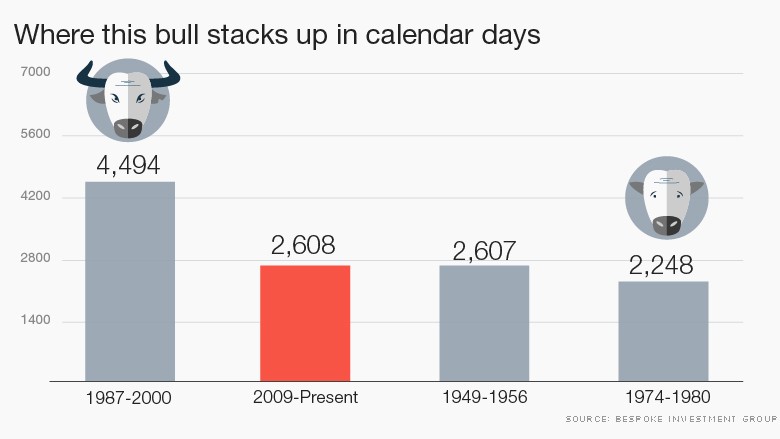

It's been 2,608 days since the bull market was born from the ashes of the Great Recession.

On Friday the market upswing became the second-longest in American history, surpassing the streak that spanned 1949 to 1956.

It's been a remarkable rebound from the scary days of 2008 and early 2009 when fears of a collapse of the financial system caused stocks to crater.

"People were basically pricing in Armageddon," said David Kelly, chief global strategist at JPMorgan Funds.

Eventually, the worst-case scenario was removed by the government bailout of Wall Street. Smart investors who were quick to jump in on early signs of an economic recovery had the most to gain. The S&P 500 is up 212% since March 2009, quickly surpassing the 20% rally needed to be technically considered a bull market.

Yet the market comeback has been marked by suspicion and frequent panic attacks (see: early 2016, aka the worst start to a year ever). In many ways, that deep skepticism has helped keep the bull market alive by preventing investors from getting overly exuberant at times and inflating a new bubble.

Related: America's bull market turns 7. Can it last?

Could this become the longest bull run ever?

Even Friday's bull market milestone should carry an asterisk because the S&P 500 is not at its high point, even though it is only 3% away from the record level of 2,134.72, set in May 2015. If the S&P 500 doesn't hit a new high soon, the record books would have to be amended to show the bull market actually ended in May 2015.

The question then is whether it is too late to get in. Or is this party going to last a bit longer? No one knows for sure (not even Warren Buffett) but it seems like it would take some good economic fortune for this to beat the longest bull market on record that went from 1987 to 2000. Stocks would have to avoid a bear market until 2021.

David Kotok, an influential money manager and chairman of Cumberland Advisors, thinks it's possible.

"This may be a very long market cycle," Kotok told CNNMoney. He pointed to "huge monetary global stimulus," low inflation and positive momentum.

Not if a bubble forms...

One risk is that a bubble could form first, as it did at the end of the longest bull market.

Bank of America Merrill Lynch warns that "remains a plausible risk scenario" given all the easy money being pumped by central banks. However, BofA noted in a recent report that the market mood has shifted in recent years from "raging bull" to "sitting bull" to "volatility bull" due to the slowdown in earnings.

The key thing to watch here is the market's valuation, which is definitely on the rise. In fact, the S&P 500's ratio of price to forward earnings recently rose to the highest level since 2009, according to S&P Global Market Intelligence.

Related: Stocks haven't been this expensive in 7 years

But stocks don't look as pricey as bonds

However, valuations don't appear to be near bubble territory just yet and many think stocks don't look quite so pricey when compared with ultra-expensive bonds.

Nicholas Colas, chief market strategist at ConvergEx, recently wrote that stocks "are (at best) fully valued," but very low interest rates around the world "make U.S. stocks look attractive on a yield basis."

Much will depend on the economic outlook and how aggressively the Federal Reserve raises rates. After all, bull markets don't die of old age. They're killed by recessions and higher interest rates.

While economic growth is slow -- nearly zero in the first quarter -- most economists don't see a near-term recession.

"The fact the economy is running very slowly actually could prolong this bull market. I think there's still a bit of room to run here," JPMorgan's Kelly said.

Related: Trump and Cruz predict stock market 'crash'

What if the recovery hasn't even started?

Bill Smead, a value-oriented contrarian investor with a very long time horizon, is even more optimistic. He believes an influx of Millennials getting married and forming households will be the next big driver of growth.

"We are at the beginning of an economic cycle," Smead told CNNMoney. "The recovery hasn't really happened yet. All that's happened is the repair from the prior recession."

If that's true, it would be very good for most stocks, especially the ones that do well when families spend money on things like houses, new cars and vacations.

But JPMorgan's Kelly thinks the best thing that the bull market has going for it is how unpopular it's been.

"It's a particularly unloved bull market -- and that gives us longevity. Only the popular die young," he said.