After four straight days of losses and tumult, stock markets around the world are actually rising.

Here are the five things you need to know before the opening bell rings in New York:

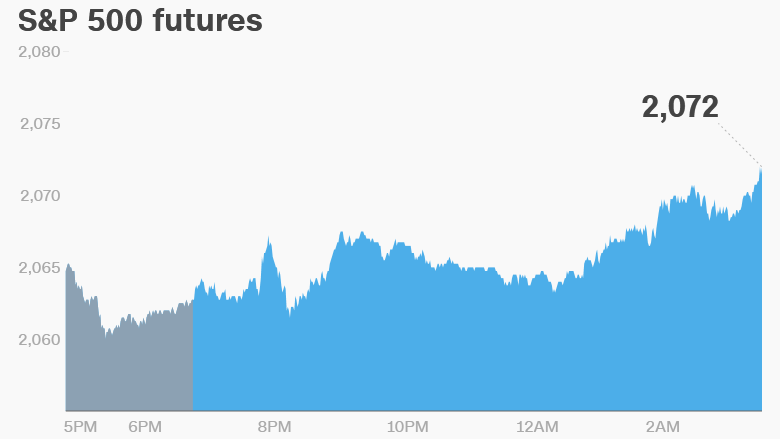

1. U.S. & European market overview: U.S. stock futures are edging up as European markets all post strong gains in early trading.

Investors seem to be taking a breather after days of selling. And some are feeling a bit more optimistic after new data from France showed consumer prices held steady in May after months of deflation.

The British pound is also rising versus all major global currencies as traders hope that U.K. voters will choose to maintain the status quo at a referendum next week and remain in the European Union. Fears about a British exit from the EU have been slamming markets for weeks.

The yield on Germany's 10-year government bonds have also crossed back into positive territory after falling below 0% on Tuesday for the first time ever.

Related: How much will U.S. stocks drop if there's a Brexit?

2. Ready, get set, Fed: The Federal Reserve is set to announce its latest decision on interest rates at 2 p.m. ET, but virtually no one expects it to raise rates. The odds of a rate hike right now are around 2%, according to investor expectations.

The Fed has been trying to raise rates this year but has been held back by unease about the U.S. economic recovery and global stability.

Fed chief Janet Yellen will hold a press conference 30 minutes after the announcement that could offer clues on a potential move in July.

3. Boeing + Iran: Iran says it has reached a deal to buy passenger aircraft from U.S. plane maker Boeing (BA).

The announcement came Tuesday from Abbas Akhoundi, the Iranian minister of roads and urban development. He said details on the agreement would be announced in the next few days, according to reports by Iranian news agencies.

If it goes through, the deal would be the first major contract between a U.S. company and Iran since nuclear-related sanctions on the country were lifted earlier this year.

4. Oil glut check-up: Traders will get an update on the state of U.S. oil inventories at 10:30 a.m.

U.S. oil stockpiles have receded a bit in recent weeks, thanks in part to supply outages in Canada and other parts of the globe.

Oil prices are currently slipping by about 1% to trade around $48 per barrel.

5. Disappointment in China: Chinese stocks aren't ready for the big time, according to index provider MSCI.

MSCI said Wednesday it would not add shares traded in Shanghai and Shenzhen to its widely-tracked global benchmarks because of continued concerns over access to China's markets.

The decision to keep China on the sidelines means the country has yet again failed to win a vote of confidence as an attractive destination for global capital.

If China were added, it could expect an influx of billions of investment dollars into the domestic stock market.

But Chinese markets shrugged off the decision Wednesday. The benchmark Shanghai Composite rose 1.6%, while Shenzhen stocks gained 3.1%. Both markets had suffered steep losses earlier in the week.