Looking for another sign that Hillary Clinton appears to have momentum over Donald Trump in the U.S presidential race? Check out healthcare stocks, specifically big drugmakers and biotechs.

Clinton has promised to tackle the problem of high drug prices numerous times on the campaign trail -- in speeches and in a series of tweets. And pharmaceutical companies have typically taken a hit following her tough talk.

The recent controversy surrounding rising prices for the EpiPen allergy medication in late August has brought the issue of drug prices back to the forefront.

Clinton attacked EpiPen maker Mylan (MYL) in a tweet, saying there was "no justification" for the price hikes.

The iShares U.S. Pharmaceuticals (IHE) exchange-traded fund, which includes Johnson & Johnson (JNJ), Pfizer (PFE), Merck (MRK) and Mylan as top holdings, is down more than 5% since that tweet.

Meanwhile, the iShares Nasdaq Biotechnology ETF (IBB), which owns Biogen (BIIB), Gilead Sciences (GILD) and Amgen (AMGN), has plunged 7% in the past month and a half.

The EpiPen tweet echoes another one by Clinton from September 2015, when Martin Shkreli became a household name for the more than 5,000% price increase of the HIV and malaria treatment Daraprim by his company Turing Pharmaceuticals.

Clinton called that price hike "outrageous." Biotech stocks (and Shkreli) wound up getting taken to the woodshed as a result.

The sell-off in healthcare stocks is one of several market indicators that appear to be pointing to a victory over Trump next month.

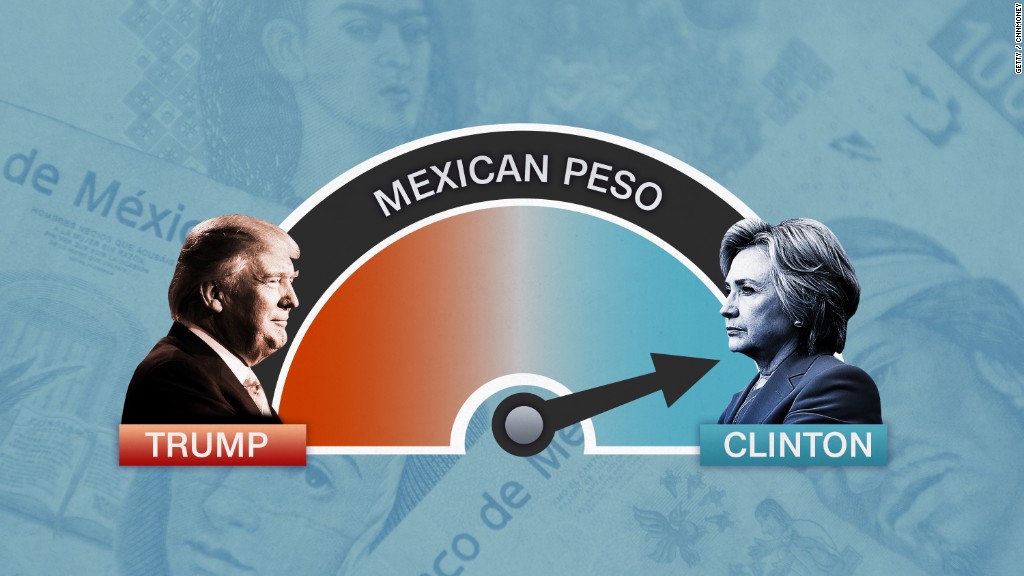

CNNMoney is also tracking the prices of gold and gasoline, as well as the value of the Mexican peso, to try and gauge what investors are thinking about the election.

Related: All market metrics point to Clinton win except one

But should drug stock investors really be that nervous about a Hillary Clinton presidency? After all, many investors were initially scared about the impact that President Obama's signature Affordable Care Act, aka Obamacare, would have on the sector.

However, leading health insurer UnitedHealth (UNH) has soared more than 300% since the law went into effect in March 2010.

The Health Care Select Sector SPDR (XLV) ETF, which includes top drug, biotech, medical equipment companies and insurers, is up nearly 120% too.

That's better than the overall market. So Obamacare didn't exactly kill the industry.

Along those lines, Martin Small, the head of U.S. ETFs for BlackRock-owned iShares, wrote in a recent report that the dip in healthcare ETFs lately may be an overreaction.

"The sector appears to be taking a 'breather' during the uncertainties of the U.S. election season," Small wrote.

Still, investors may be growing worried about the possibility of Democrats winning control of at least one, if not both, of the two chambers of Congress now that Trump's campaign seems to be going off the rails (on a crazy train?)

The likelihood of major legislation that could hurt the big drugmakers and biotechs is higher if Democrats control the White House and legislative branch.

It's still not clear if the turmoil in the GOP will actually lead to a Democratic sweep next month though. And even if it does, experts point to an increased appetite for healthcare mergers as another reason why the industry could continue to thrive.

Pfizer (PFE) announced earlier this year it was scooping up cancer drugmaker Medivation, while Abbott Labs (ABT) is buying medical equipment giant St. Jude (STJ).

Disclosure: The reporter or this story owns shares of Abbott as well as its spinoff AbbVie.