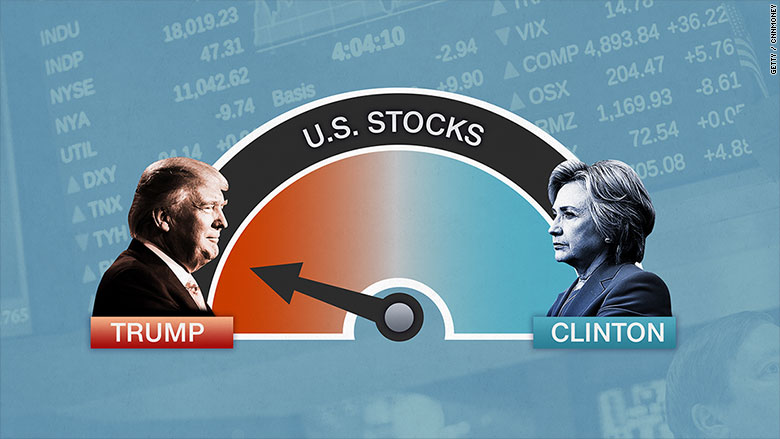

Good news for Hillary Clinton: U.S. stocks jumped Monday morning.

The Dow rose nearly 150 points before ending the day up 89. The S&P 500 gained just shy of 0.5%. It's not the rally of the century, but it's strong enough to indicate that investors think Clinton won the bitter second debate and will triumph on Election Day. (Wall Street wants to see Clinton in the White House).

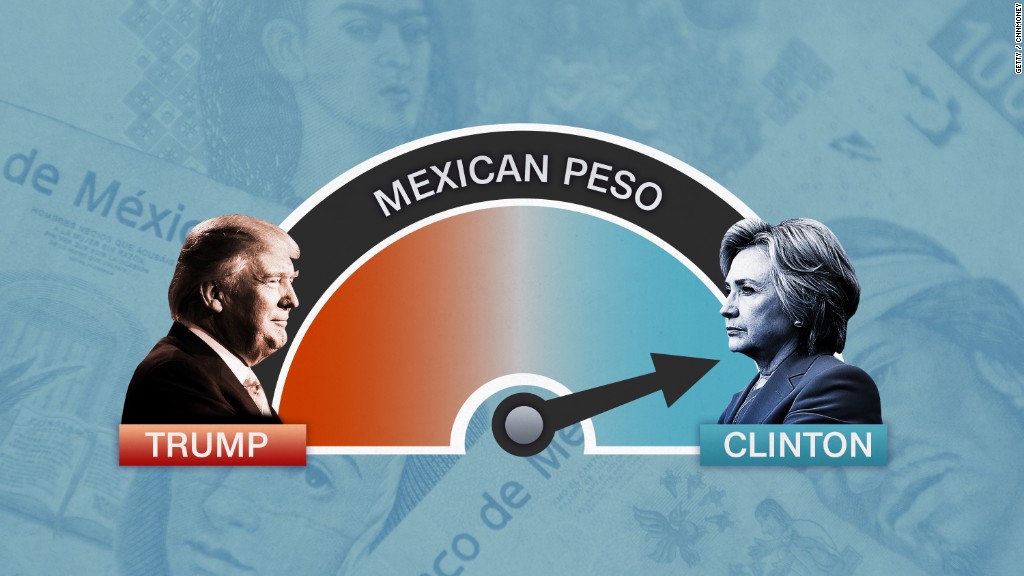

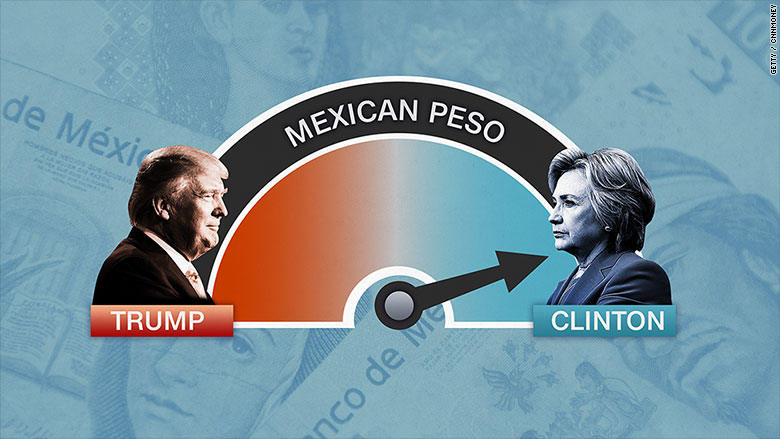

The Mexican peso also pointed to a terrible weekend for Donald Trump. The peso has become another closely watched marker of how Trump is faring. The peso surged 2% Sunday as investors digested the fallout from the bombshell video from 2005 where Trump makes extremely vulgar comments about women. The peso gave back some gains during the debate, but it still ended over 1% higher.

At this point, all the "market metrics" point to a Clinton victory -- in the debate and on Election Day -- except for one. CNNMoney is checking in on what the market tests tell us at the start of each week in October. Here's the latest run down:

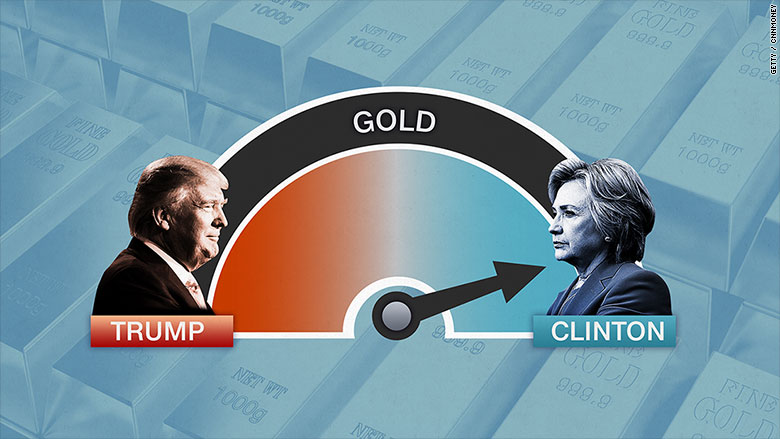

Related: Gold prices sinking. Bad sign for Donald Trump?

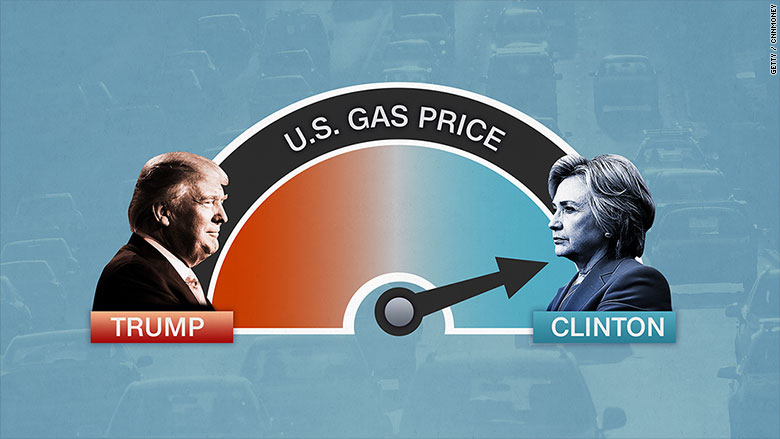

'It's the economy, stupid'

The number crunchers over at Moody's Analytics have a special model to predict who will end up in the White House based on how the economy is doing. The model has correctly predicted the winner every election since 1980.

This year, the model points to a solid Clinton win because of a relatively healthy economy.

Only two factors could change the model enough to point to a Trump victory: if gas prices spike above $3 a gallon, or President Obama's approval rating falls substantially.

Right now, Obama's approval rating is at 55%, the highest of his second term. And the average price of gas is $2.25 a gallon, according to AAA. That's up a few cents, but it's not a major jump.

Related: The Obama economy has now created 15 million jobs

The Mexican factor

It might sound odd to look at Mexico's currency for clues on who will win the U.S. presidency, but the Mexican peso has become a new proxy for the Clinton v. Trump matchup. At the moment, it's signaling a Clinton victory.

Why? It all comes down to Trump's comments on Mexico. He wants to build a wall between the U.S. and Mexico (that he wants Mexico to pay for), renegotiate NAFTA and come down hard on U.S. companies that move factories, and supposedly jobs, south of the border.

So every time investors think Trump's chances of winning improve, the Mexican peso falls. And when Wall Street believes Trump doesn't have much of a shot at the White House, the Mexican peso rises.

After the first and second debates, the Mexican peso jumped.

Related: I survived: How many Americans feel these days

Follow the yellow brick road

Take a peek at gold. The price was creeping up all year long as investors got nervous about China, Brexit and then the U.S. election.

But gold prices have been falling lately. Prices plunged 3% alone on Tuesday. The yellow metal is now trading below $1,300 an ounce for the first time since June.

Some experts think that Trump's recent woes may be a reason for gold's slump. Investors seem a little less worried he'll win.

The 1 metric pointing to Trump

There's just one market metric pointing to Trump: the S&P 500 test developed by Sam Stovall, a market expert at CFRA Research.

How the broader market performs between August 1 and October 31 has been an incredibly reliable predictor of who ends up in the White House. If the S&P 500 (the main U.S. stock market gauge) goes up in that critical three month period, Clinton to win. If it falls, expect a Donald Trump victory.

Right now, the stock market is signaling a Trump win. The S&P 500 is about 1% below where it was on August 1.

"I remind investors that these type of studies should be viewed as a guide and never gospel," Stovall told CNNMoney over the weekend.

--CNNMoney's Patrick Gillespie and Paul R. La Monica contributed to this report.