Investors around the world are reacting with shock to Donald Trump's victory in the U.S. presidential election.

Most global stock markets are dropping, Mexico's currency has tanked and U.S. stocks are poised for a rough open.

Markets hate uncertainty, and many investors believe Trump's unpredictable nature and anti-trade stance could bring global turmoil.

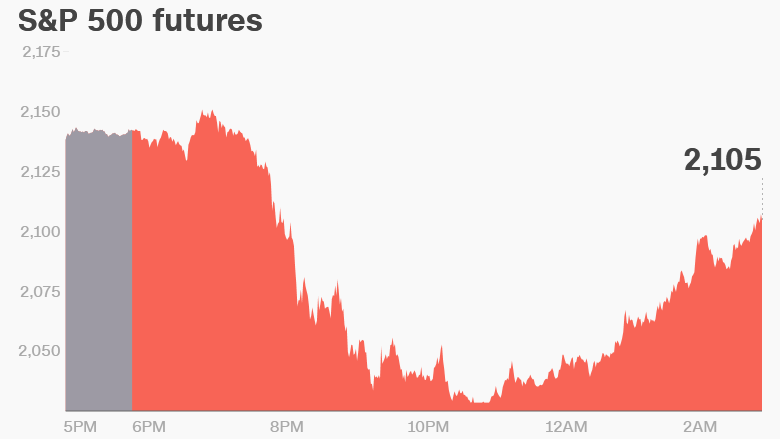

Dow futures were down about 300 points early Wednesday morning, or about 1.5%. At their low point on Tuesday night, Dow futures were down more than 900 points.

Nervous investors may have been soothed after Trump called for Americans to unite after the brutal election campaign.

"Trump definitely sounded more presidential than he has done at any stage during the election campaign," Kathleen Brooks, a research director at City Index in London, said of his speech. "In fact, one could argue that this outsider has delivered an establishment-style victory speech."

Most European stock markets are declining, but the losses are not huge. Russia was one of the few winners. Its main market index was rising about 1.5% as investors expect Trump and Russian President Vladimir Putin to form a closer relationship.

Stock indexes across Asia closed the day in the red. Japan's Nikkei plummeted 5.4% and the Hang Seng in Hong Kong fell by 2.2%.

Related: Live election results

Stock futures began tumbling after 9 p.m. ET as it became clear that Hillary Clinton's chances of winning crucial states such as Florida, North Carolina and Ohio were in serious doubt. She would later lose all three to Trump.

"It is looking like another Brexit-type surprise," said Ryan Detrick, senior market strategist at LPL Financial.

By comparison, the Dow fell 610 points, or 3.4% on June 24 after Britain's shocking vote to leave the European Union.

The U.K.'s FTSE 100 dropped 3.2% the day after the vote. The British pound had one of its biggest one-day declines on record, falling 9% to $1.33, then the lowest it had been since 1985.

Markets have rebounded since then, partially because the weak pound helped support the economy.

The U.S. dollar hasn't been hit as hard as the pound was -- it dropped sharply but then recovered most of its losses Wednesday morning.

While Wall Street is on track for post-election losses, they are not nearly as bad on a percentage basis as those experienced during the 2008 financial crisis when several plunges of greater than 6% occurred.

Wall Street appears to have been caught leaning in the wrong direction before the vote. The Dow raced nearly 400 points on Monday as investors bet that Clinton's chances of winning improved after the FBI cleared her in the email investigation.

Looking south of the border, the Mexican peso has plunged about 9%, though earlier in the night it had crashed by more than 11% to an all-time low.

Trump's anti-Mexico rhetoric has affected the value of the peso for weeks. Trump has talked about renegotiating or even ending NAFTA, the free trade deal between the U.S., Mexico and Canada.

"The Mexican economy is most tied to Donald Trump's criticism of global trade. It really is ground zero of this discussion economically," said Nicholas Colas, chief market strategist at brokerage firm ConvergEx.

Investors are turning to assets that are seen as safer bets in times of uncertainty. For example, gold is surging 2% and the Japanese yen is climbing against all other major currencies.

Crude oil prices were down nearly 4%, but have since recovered nearly all their losses.

-- Alanna Petroff contributed to this report.