1. A record-setting run: The Trump stock market rally seems to have petered out in other parts of the world.

But signs point to a continued climb for the Dow Jones industrial average, which hit a fresh record high on Monday.

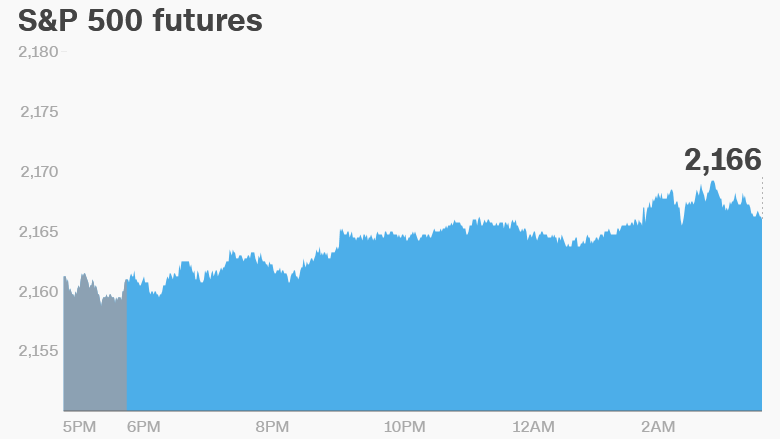

U.S. stock futures are moving up, though the gains are small.

European markets are mixed in early trading. Asian markets ended the day with mostly negative results.

Meanwhile, the sharp sell-off in the bond market has eased. Yields on many 10-year government bonds are coming back down.

Donald Trump's promises to unleash massive infrastructure spending and gigantic tax cuts had spooked bond investors. The rate on 10-year Treasury notes had surged to 2.3%, from 1.77% before the election.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Take to the skies: Warren Buffett is betting big on U.S. airlines, according to a regulatory filing disclosed Monday.

During the third quarter, Buffett's Berkshire Hathaway (BRKB) took stakes in American Airlines (AAL), United Continental (UAL) and Delta Air Lines (DAL), according to the filing.

Berkshire also made an investment in Southwest Airlines after the quarter ended, he told CNBC.

The investments mark a surprising reversal for the man who once lambasted the industry's thirst for cash. In 2007, he called airlines a "bottomless pit."

Buffett's money decisions are closely monitored by the investment community. Don't be surprised if these airline stocks rise again Tuesday as investors make copy-cat trades.

3. Yuan in focus: China's currency continues sinking against the dollar.

Beijing has allowed the yuan to tumble past six- and seven-year lows in the wake of Trump's election win. The fall continued Tuesday, with one dollar buying around 6.86 yuan, the weakest the Chinese currency has been since the dark days of the global financial crisis in late 2008.

The Chinese government is known for retaining tight control of its currency.

4. Earnings and economics: A range of retailers are reporting earnings Tuesday morning, including Dick's Sporting Goods (DKS), Home Depot (HD) and TJX (TJX).

The U.S. Census Bureau is releasing its retail sales report for October at 8:30 a.m. ET.

And new U.K. inflation data shows consumer prices rose by 0.9% in October compared to the same time last year. Prices in the country are rising as the pound has plummeted in reaction to the U.K. Brexit referendum.

5. Tough tobacco takeover: Investors will pay close attention to tobacco firms British American Tobacco (BTI) and Reynolds American (RAI) on Tuesday.

British American Tobacco announced a $47 billion bid in October to take control of Reynolds American, the No. 2 U.S. tobacco company.

But now reports say BAT may have to ratchet up its offer to help seal the deal.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday - Megyn Kelly book release, Home Depot (HD) earnings

Wednesday - Target (TGT) earnings

Thursday - Walmart (WMT) earnings; Janet Yellen testifies about economic outlook

Friday - "Fantastic Beasts and Where to Find Them" release, "The Grand Tour" premieres on Amazon Prime