1. Preparing for a rate hike: The U.S. Federal Reserve is widely expected to raise interest rates on Wednesday.

The last time the Fed hiked rates was December 2015.

After the interest rate decision is announced at 2 p.m. ET, market attention will turn to Fed chair Janet Yellen's press conference at 2:30.

President-elect Donald Trump has criticized Yellen for keeping interest rates low, raising questions about the central bank's political independence.

Paul Donovan, global chief economist of wealth management at UBS, said that investors will be closely monitoring Twitter (TWTR).

"Will Trump retweet the Fed's Twitter feed? Will he comment? Will he stay silent? This could matter to market perceptions of the Fed's future direction and independence," he said.

2. Tech giants meet Trump - Top executives from Apple (AAPL), Google (GOOGL), Amazon (AMZN), Facebook (FB) and half a dozen other large tech companies are slated to meet with Trump at 2 p.m.

The focus of the meeting is supposed to be jobs, but it's also expected the executives will discuss trade, corporate tax reform and immigration, among other issues.

Tech leaders across Silicon Valley were broadly supportive of Hillary Clinton. Trump has repeatedly attacked tech companies.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Pharma deal falls through: American pharma giant Johnson & Johnson (JNJ) said it has ditched plans to buy the Swiss biotechnology firm, Actelion (ALIOY).

Actelion announced Wednesday it's begun talking with a different suitor.

Paris-based Sanofi (SNY) is reportedly the third party that's swooped in to woo Actelion.

Shares in Actelion are down about 9% in early trading because investors expect any takeover deal will be less lucrative than Johnson & Johnson's offer.

4. Post-election shopping?: Consumer confidence numbers surged following the tumultuous U.S. presidential election campaign. But did that lead Americans to actually spend more? November retail sales are due at 8:30 a.m.

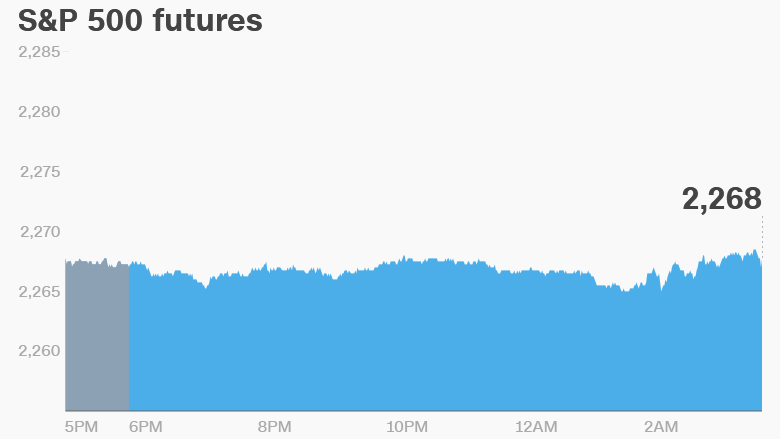

5. Global market overview: Stock markets around the world are looking a bit weak and investors are bidding up sovereign bond prices.

The real action will likely happen when markets get to react to the Fed announcement and press conference.

U.S. stock futures also look soft despite all three major U.S. indexes closing at record highs on Tuesday. The Dow Jones industrial average is now less than 100 points away from the 20,000 mark.

European markets are slipping a bit in early trading. Asian markets ended the day with mixed results.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Wednesday - FOMC meeting finishes with a news conference; First rate hike in a year expected

Thursday - Bank of England rate decision; Super Mario Run for the iPhone releases; Venezuela's new currency debuts

Friday - "Star Wars Rogue One" nationwide release in the U.S.