When Prime Minister Narendra Modi suddenly banned most of India's cash on Nov. 8, he warned that "difficulties" could persist for 50 days. The payoff, he said, would be less corruption and less tax evasion.

He was right about the difficulties. Indians endured an acute cash shortage and massive lines at banks as they sought to exchange worthless notes for new currency. Change was nearly impossible to find. Some businesses resorted to barter.

Modi's 50 days have now passed. But as 1.3 billion shell-shocked Indians try to recover from the country's cash crisis, there are questions over whether their economy can do the same.

Here's where things stand:

What happened

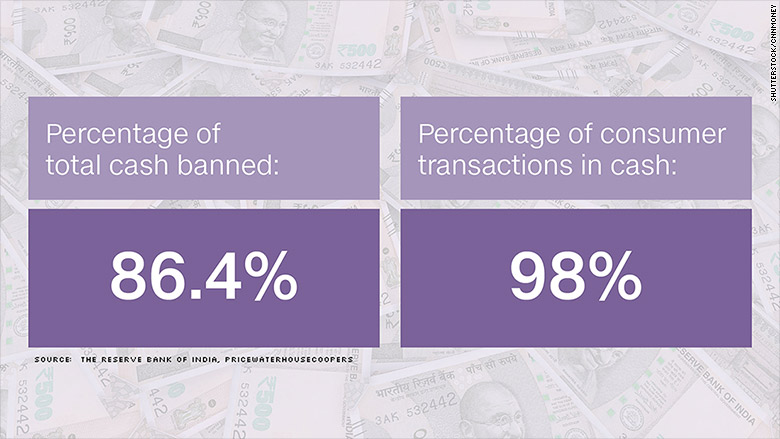

The 500 rupee ($7.50) and 1,000 rupee ($15) notes Modi declared to be "worthless pieces of paper" made up about 86% of all cash in circulation. Few countries are as dependent on cash as India.

The Reserve Bank of India rushed new 500 and 2,000 rupee notes to banks and ATMs. But chaotic scenes became routine, with frantic Indians waiting in line for hours just to get cash for daily needs.

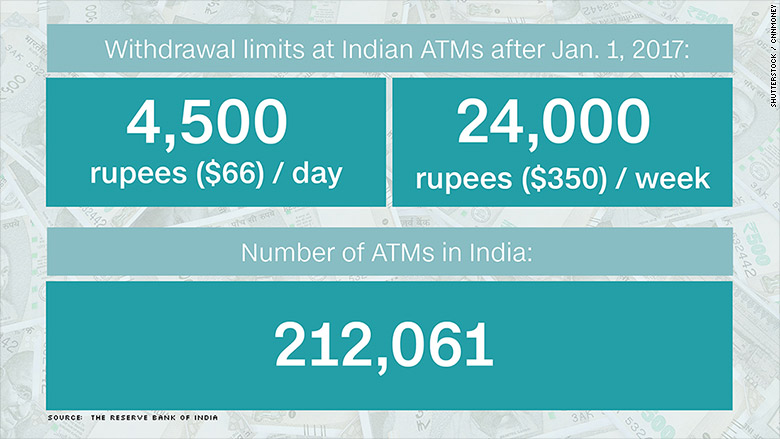

The currency swap was further complicated because the new notes issued by the government were smaller than the ones they replaced. India's ATMs -- which number more than 200,000 -- had to be refitted before they could dispense the new notes.

Even now, daily and weekly withdrawal limits remain in place. There are still long lines at banks and ATMs.

The final numbers

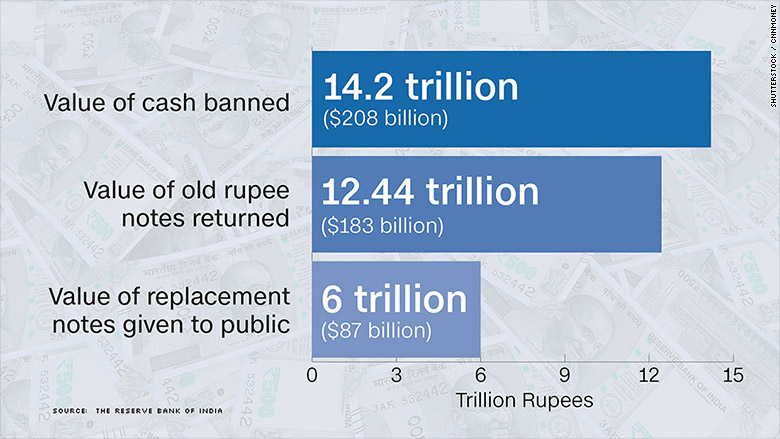

On Dec. 13, three weeks before the deadline to deposit old cash, the central bank said around 87% of the banned notes had been returned. The final number is expected to be even higher.

The swap was designed to expose tax evaders who were stockpiling cash at home. Critics, however, argue that only a small fraction of India's enormous untaxed income is held in cash.

They say the inconvenience caused to the public outweighs any potential benefits.

The government and its supporters counter that the move will bring more people into the banking system and increase the number of taxpayers -- less than 3% of the population currently pays income tax.

"The stock of currency which used to fuel the black market ... has come down, because it has now come into the banking system," said Manoj Pant, a professor of economics at Jawaharlal Nehru University.

But the currency ban will be meaningless unless it is followed by additional reforms, he added.

Who was hit hardest

it's common for Indians to pay for big-ticket items like cars, jewelry and even houses with cash. Many of these sectors have taken a major hit.

Manufacturing was also affected, with factory activity decelerating in December for the first time in a year.

The cash crunch has pushed many Indians to adopt digital payments, but that isn't an option yet for the country's poor.

India's 1.3 billion people have only 25 million credit cards between them, and more than 85% of its 660 million debit cards are only used for getting cash out of ATMs.

According to a report from PricewaterhouseCoopers, 233 million Indians still didn't have a bank account in 2015.

Related: India is giving away $50 million for going cashless

"A move towards digital economy cannot happen overnight," said Anubhuti Sahay, head of South Asia economic research at Standard Chartered. "There are issues around bank accounts, there are issues around internet penetration."

Why it matters

India's economy had been thriving. Its 7.3% growth rate was the best of any major global economy.

After demonetization, that may no longer be the case.

Related: India's cash crisis could kill its economic boom

Analysts predict that India's growth will plunge in the coming months, potentially by as much as one percentage point. The central bank recently downgraded its own forecast for the current financial year from 7.6% to 7.1%. Many expect it to fall even further.

What happens next

In a speech to his party in late November, Modi said that the rupee note ban was only the "beginning" of his government's battle against untaxed income.

Additional reforms could be announced in India's next annual budget, which the government plans to roll out on Feb. 1.

Related: These big economies suffered self-inflicted wounds in 2016

"The prime minister has already announced a few important measures," Sahay said. "Anything on top of it in the budget ... will be watched very carefully."

More economic troubles could lie ahead. India is slated to begin implementing a nationwide sales tax that will greatly simplify its convoluted system of state and local duties.

The measure, called the Goods and Services Tax (GST), will be a major positive in the long run. But the rollout will be anything but straightforward.

Indians will be bracing themselves for a bumpy road ahead.