If you thought India's decision to ban 86% of its cash was ambitious, wait until you hear what it may do next.

The head of a government-run policy institute said on Thursday that the country could completely eliminate the need for credit cards, debit cards and ATMs in the next three years by switching to biometric payments.

Amitabh Kant said that even electronic payment methods may be "totally redundant" by 2020. Instead, all Indians will need for transactions is their thumb or eye.

"Each one of us in India will be a walking ATM," Kant said at the World Economic Forum in Davos. That would represent "the biggest technological leapfrogging ever in the history of mankind," he added.

Related: India is no longer the world's fastest-growing economy

Arundhati Bhattacharya, head of the State Bank of India, agreed that such a dramatic shift was possible.

"This is something that's eminently doable," she said, pointing out that nearly 1.1 billion of India's 1.3 billion people have already registered their biometric data under the government's unique identification program.

The Indian government is testing a payments app that makes use of that biometric data, coupled with portable fingerprint scanners that cost about 2,000 rupees ($30) each.

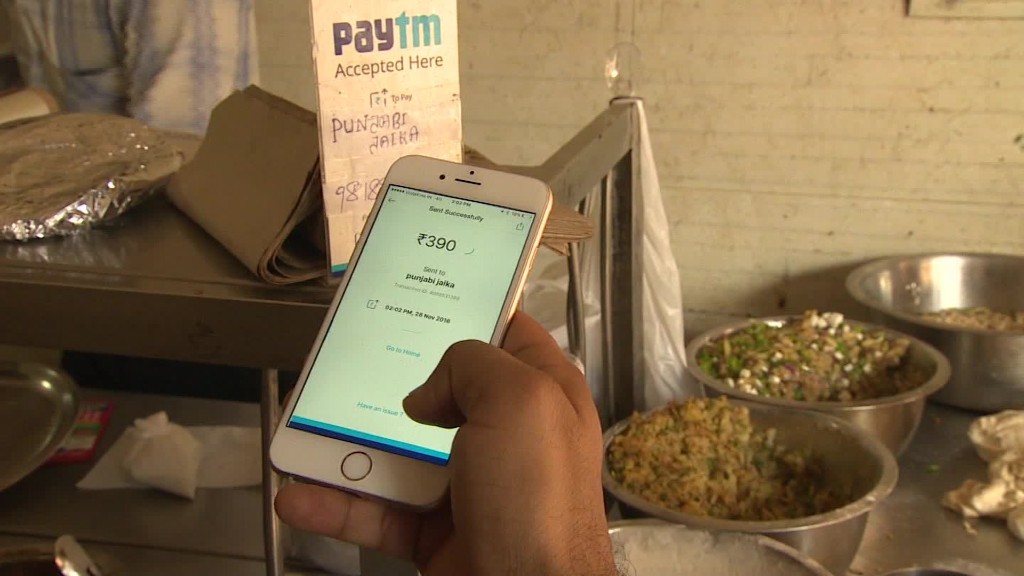

India is already reeling from a ban on all 500 and 1,000 rupee notes announced on Nov. 8 by Prime Minister Narendra Modi. The two notes accounted for almost all of India's currency, and the move hit hard in a country where over 90% of transactions are in cash.

Related: 50 days of pain after India trashed its cash

Modi has said the note ban, aside from reducing tax evasion and money laundering, will help India move towards a cashless society. Moving to biometrics could also help crack down on corruption.

Digital payment methods have enjoyed a massive boost since the cash ban, but extending them to the entire country is a big ask since more than 70% of Indians don't have smartphones.

Eliminating credit cards will likely be even tougher, but India appears determined to try.