1. Dow records: The Dow Jones industrial average has now closed at a record high in 10 consecutive trading sessions.

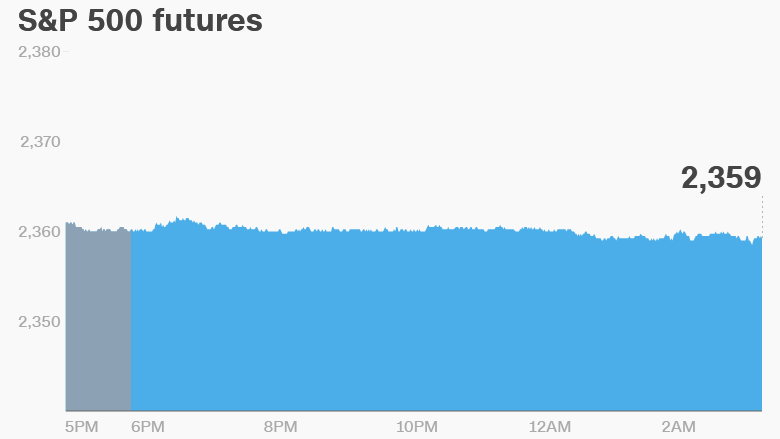

Will its momentum hold? U.S. stock futures weren't making any big moves on Friday.

The gravity-defying run matches the index's best streak of consecutive records from 1987. Market historians might ominously note that 1987 was also the year that the stock market suffered its worst one-day drop ever.

Hopes for tax cuts and a rollback on regulations from President Trump and the Republican-led Congress have helped to fuel investors optimism. The Nasdaq and S&P 500 also hit record highs earlier in the week.

Elsewhere, global stocks were having a rough Friday. European markets were lower in early trading, and most Asian markets closed the week with modest losses.

The CNNMoney Fear & Greed index shows that investor sentiment is pointing towards extreme greed.

2. Retailers need therapy?: Keep an eye on U.S. retailers this morning.

Shares in companies like Walmart (WMT), Target (TGT), Nike (NKE) and Dollar Tree (DLTR) took a swift drop around 3:30 p.m. ET on Thursday after Trump told Reuters that a border adjustment tax could result in more U.S. jobs.

Retailers have been lobbying against a proposal by Congressional Republicans that would increase the tax bite on any company that imports goods into the U.S.

"The headline hit late in the day and sent a number of retailers and apparel-related companies lower because they are the largest importers in the country," explained Mike O'Rourke, chief market strategist at JonesTrading.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Market movers -- Nordstrom, Hewlett Packard Enterprise, RBS: Shares in Nordstrom (JWN) advanced in extended trading while shares in Hewlett Packard Enterprise (HPE) slipped after each company reported quarterly results on Thursday.

Shares in Royal Bank of Scotland (RBS) dipped by 3.6% in London after it reported a ninth consecutive year of losses. The bank has posted total losses of $73.5 billion since receiving a government bailout in 2008.

4. Earnings on tap: Foot Locker (FL), J. C. Penney (JCP) and US Cellular (USM) are releasing earnings before the open.

Berkshire Hathaway (BRKB) will release its earnings and annual report on Saturday morning. The American conglomerate, which is among the largest in the world, tends to report results at unusual times.

5. Economics: A final reading of the Michigan Consumer Sentiment Index for February will be published at 10 a.m. ET. A preliminary reading for February showed sentiment dropped, pulled down by Democratic supporters who are worried about the future.

The Census Bureau is set to release its New Home Sales report for January at 10 a.m.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Friday - J. C. Penney (JCP), Foot Locker (FL) earnings

Saturday - Berkshire Hathaway (BRKB) earnings