1. It takes one bad Apple: Tech behemoth Apple (AAPL) is the center of attention following the release of its earnings report.

The firm reported another decline in iPhone sales, which disappointed investors.

Shares in the company look set to decline a bit when trading begins.

Meanwhile, Apple also reported it had $256.8 billion in its cash stockpile at the end of the most recent quarter. To put that in perspective, the company has about $34.24 for every human on the planet.

2. Earnings: Humana (HUM), Estee Lauder (EL), Groupon (GRPN), New York Times (NYT), Sprint (S), Yum! Brands (YUM) and CNN parent company Time Warner (TWX) are set to release earnings before the opening bell on Wednesday.

Facebook (FB), Fitbit (FIT), Tesla (TSLA), Kraft Heinz (KHC) and tronc (TRNC) will follow after the close.

The bar will be set high for Facebook CEO Mark Zuckerberg, after his company's stock has enjoyed a 33% rally so far this year. Look for updates on Facebook's user growth and efforts to liven up Instagram with new Snapchat-like features.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

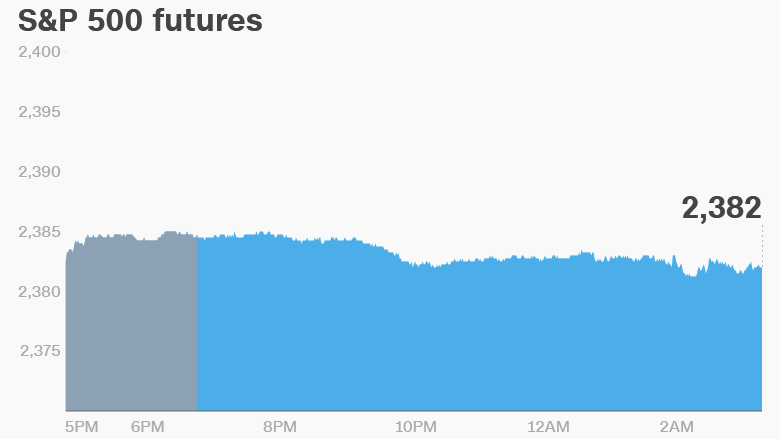

3. Global market overview: Stock markets around the world are mostly negative on Wednesday.

U.S. stock futures are dipping down alongside European markets.

Asian markets were mixed.

The Nasdaq hit an all-time high on Tuesday, surpassing the 6,100 level. The Dow Jones Industrial Average and S&P 500 are not far off record levels reached in March.

4. Stocks to watch -- Mondelez, Deutsche Bank: Shares in Mondelez International (MDLZ) are set to rise at the open as investors cheer the Oreo-maker's latest set of quarterly results.

Deutsche Bank (DB) is attracting attention after it was disclosed that China's HNA Group now owns just under 10% of the firm. That makes HNA the German bank's largest shareholder.

5. Economics: The U.S. Federal Reserve is due to release its latest monetary policy decision at 2 p.m. ET.

No interest rate hike is expected and Fed chief Janet Yellen will not hold a press conference. But Wall Street will be reading the Fed statement closely in search of hints on whether the central bank plans to raise rates at its next meeting in June.

The ADP Employment report for April is set to be released at 8:15 a.m.

A preliminary estimate of first quarter GDP growth showed that eurozone economies grew by 1.7%, on average, compared to the same time last year. That was in line with estimates.

6. Slip sliding: Crude oil prices hit their lowest level of 2017 late on Tuesday, sliding to $47.43 per barrel.

Investors should expect more moves from oil on Wednesday as a new weekly crude inventory report is set to be released at 10:30 a.m.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Wednesday -- Fed rate decision; Facebook (FB) and Tesla (TSLA) earnings Thursday -- CBS (CBS) earnings, U.S. trade balance data

Friday -- U.S. jobs report for April

Saturday -- Berkshire Hathaway (BRKA) annual shareholder meeting