With revenue numbers in for June, the Bipartisan Policy Center now projects the U.S. Treasury will face a cash crunch by the first half of October if Congress fails to raise or suspend the country's debt ceiling soon.

That so-called X date -- which BPC expects to come in early to mid-October -- is the point when Treasury won't have enough cash and revenue on hand to pay all bills in full and on time.

Previously, BPC had predicted the X date could occur sometime in October or November.

"We now have a better sense of what revenues and spending will be over the next few months after seeing the Treasury data on individual and corporate tax receipts for June," said Shai Akabas, BPC's director of fiscal policy.

Related: The deductions that may be killed by tax reform

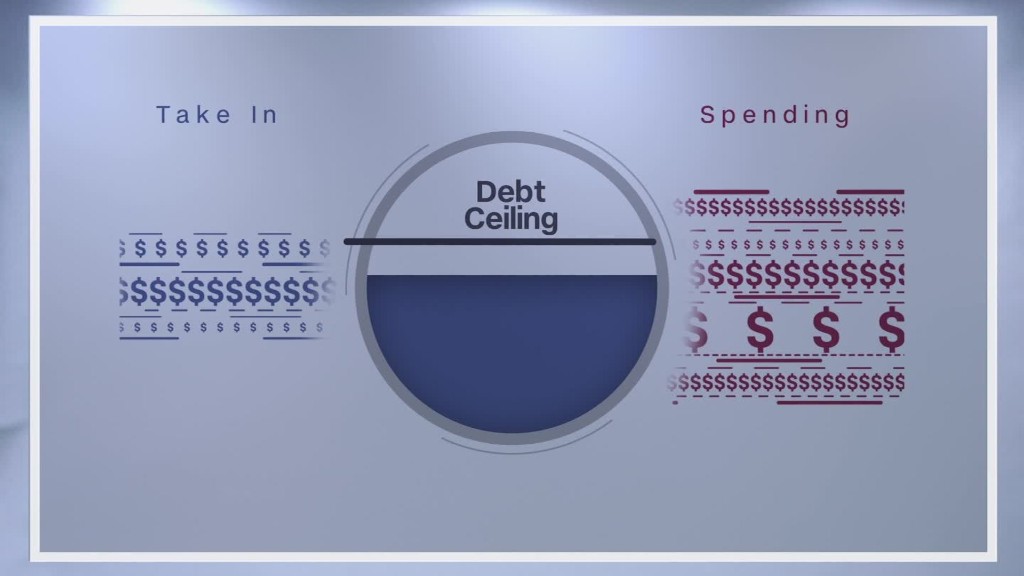

Currently the legal borrowing limit is set at $19.81 trillion. Since mid-March, when the most recent debt ceiling suspension ended, Treasury has been using special accounting measures to allow the government to continue borrowing as needed.

BPC's latest projection is in line with that of the Congressional Budget Office, which late last month also estimated that Treasury could risk defaulting on some payments in the first half of October.

"The exact date when the federal government will be unable to fully pay all of its bills remains uncertain, but it has become clearer that it will be reached sooner rather than later," Akabas said.

In addition to payments for Social Security and Medicare, Treasury must make a big payment on Oct. 2 to the Military Retirement Trust Fund. Because of such obligations, spending typically outpaces incoming revenue in October, by an average of $104 billion in the past five years.

Treasury Secretary Steven Mnuchin still hasn't offered any official Treasury estimate of when it won't have enough money on hand to pay all bills as they come due. Instead he's repeatedly urged lawmakers to raise the debt ceiling before they go on August recess.

Related: Will a corporate tax cut benefit the middle class?

Trying to pin down an exact X-date, down to the day, isn't necessarily possible -- certainly not months out -- because the flow and magnitude of incoming revenue and spending obligations can vary greatly from day to day.

That's all the more reason, fiscal policy experts warn, that lawmakers shouldn't wait until the last minute to raise or suspend the debt ceiling.

First, there's no indication of how badly financial markets would react because it would be unprecedented. And second, if the U.S. fails to meet all of its legal obligations -- whether to seniors, veterans, government contractors or any number of other individuals and businesses -- that could hurt the economy.