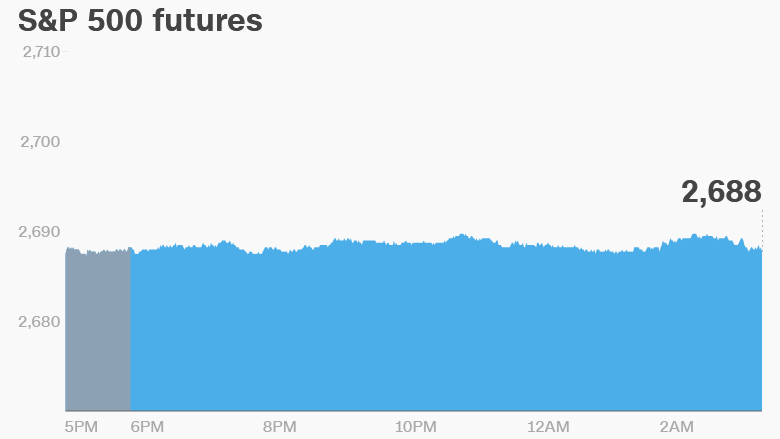

1. Steady stocks: Investors have bid up U.S. stock markets to record highs this month but it doesn't look like they're going to move much further on Wednesday.

U.S. stock futures are holding steady. The Dow Jones industrial average is about 100 points away from an all-time high.

European markets are mixed in early trading.

Most Asian markets ended the day with gains, though the key stock indexes in mainland China dipped a bit.

2. Crude watch: Traders are keeping their eyes on oil after crude prices rallied to $60 a barrel on Tuesday for the first time in two and a half years.

Prices spiked after a pipeline exploded in Libya.

Crude futures are down a tad in early morning trading, just below the $60 level.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Top shipbuilder sinks: Hyundai Heavy Industries, parent company of the world's largest shipbuilder, saw its stock price plummet around 29% on Wednesday, after announcing a plan to sell shares worth 1.3 trillion won ($1.2 billion) in an effort to raise money for its operations.

The outlook for the firm is not great: The company forecast sales would slump in 2017 to 15.4 trillion won ($14.3 billion), down by more than 50% from 2016. It also expects sales to keep falling in 2018.

4. Bouncing Bitcoin: Bitcoin prices remain volatile Wednesday, with the price of a single coin rallying to nearly $16,500 overnight and then quickly dropping again below the $16,000 level.

The price nearly hit $20,000 per coin last weekend before slumping to around $12,000.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Wednesday -- Conference Board releases U.S. consumer confidence report for December at 10 a.m. ET

Thursday -- Weekly U.S. crude inventories report out at 11 a.m.

Friday -- Russia reports latest quarterly GDP