The calm on Wall Street has finally been punctured by a rare bout of selling.

The Dow tumbled 363 points on Tuesday. The 1.4% drop is the index's worst since May. And the two-day loss of 2% is the worst since September 2016.

Although stocks are hovering just below all-time highs, back-to-back declines have been uncommon lately. The Dow has lost 540 points in two days.

Up until Tuesday, the S&P 500 had enjoyed a record-long streak without consecutive drops of 0.5%, according to Bespoke Investment Group.

One major concern for Wall Street: The bond market has been selling off lately. That's raising fears that the era of extremely low bond rates -- which has been very good to the stock market -- could soon be over.

Health care stocks dragged the market lower on Tuesday after Jeff Bezos, Warren Buffett and Jamie Dimon unveiled a plan to get into the health insurance business. UnitedHealth (UNH), CVS (CVS) and Walgreens (WBA) shed between 4% and 5% apiece.

Related: Wall Street's 'nonstop euphoric cabaret' can't last forever

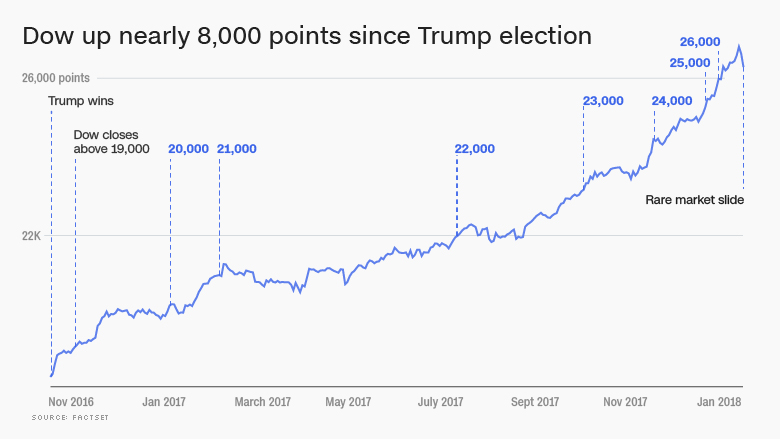

The market selloff comes amid what had been a relentless climb. Pullbacks are normal and even healthy. They prevent stocks from overheating and give investors stuck on the sideline an opportunity to get in.

"We are long, long overdue for a serious correction," said David Kotok, co-founder of Cumberland Advisors. "Will this be the one that takes the market down 5% or 10% and scares the hell out of everyone?

Kotok suggested such a selloff could be good for the market in the long run because it would "create a new psychological base" from which to build on.

The Dow is up nearly 8,000 points since President Trump's election. A growing global economy, strong corporate earnings and a surge of consumer confidence have sent stocks soaring. CEOs and investors are feeling very optimistic thanks to Congress' tax cuts and Trump's deregulation agenda.

Despite this week's slide, the Dow is still up more than 5% in January. That would be its best month since March 2016.

"It's been an amazing start to the year," said Kate Moore, BlackRock's chief equity strategist. "A pause for a breath feels prudent."

Related: This is the calmest stock market rally in history

There are still signs that the market could be entering a long-overdue pullback, which some analysts believe would be a healthy cool down.

The VIX (VIX), Wall Street's fear gauge, has soared about 35% this week to the highest level since August.

The bond market is unnerving stock investors. The 10-year Treasury yield climbed to 2.73% on Tuesday for the first time in nearly four years. Yields, which move opposite prices, have climbed sharply as investors anticipate faster growth and increased government borrowing. While bond rates remain historically low, a rapid rise above 3% could spook Wall Street.

Crossing the 3% level "may, or may not, send global risk sentiment into a funk," according to Societe Generale fixed income strategist Kit Juckes. He noted that's what happened in 2013 when stocks and bonds tanked during the infamous "taper tantrum."

"My gut sense is that the world won't end just because we reach some magic level in the bond market," Juckes wrote in a report on Tuesday.

Yet Wall Street is watching very closely because historically low rates have forced investors for years to seek out returns in risky stocks. Higher rates could lead investors to conclude that stocks aren't worth gambling on, especially at these levels.

The other worry is that inflation and stronger growth could force the Federal Reserve to speed up its interest rate hikes, lifting bond yields even higher. The Fed begins a two-day policy meeting in Washington Tuesday.

"We have become an asset price dependent economy and one addicted to artificially low rates," Bleakley Advisory Group's Peter Boockvar wrote in a note Tuesday.