1. Earnings flood: Investors will hear from a slew of corporate titans on Thursday.

Alibaba (BABA), Blackstone (BX), Boston Scientific (BSX), ConocoPhillips (COP), DowDuPont (DWDP), Hershey Foods (HSY), MasterCard (MA), Ralph Lauren (RL), UPS (UPS) and CNN parent company Time Warner (TWX) will publish results before the bell.

Google parent company Alphabet (GOOG), along with Amazon (AMZN), Apple (AAPL), GoPro (GPRO), Mattel (MAT), and Visa (V) will follow after the close.

In Europe, Royal Dutch Shell (RDSA) earnings were boosted by higher oil and gas prices. But the company also took a $2 billion charge related to new U.S. tax rules.

2. EBay ditches PayPal: EBay (EBAY) announced Wednesday that it's dropping PayPal (PYPL) as its main payment processor in favor of Dutch company Adyen.

Shares in eBay surged 8% in extended trading, while PayPal stock was down about 11%.

EBay acquired and owned PayPal for years but spun off the company in 2015. EBay said the move to Adyen would result in lower costs for sellers and more payment options for buyers.

EBay and PayPal both reported earnings on Wednesday.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Stocks to watch -- Facebook, Pandora: Shares in Facebook (FB) were volatile after CEO Mark Zuckerberg told investors that content tweaks led to a 5% drop in the amount of time users spend on the social network. The stock initially fell as much as 5% in extended trading, but then rebounded.

Shares in music streaming company Pandora (P) ticked higher after it announced job cuts and a restructuring.

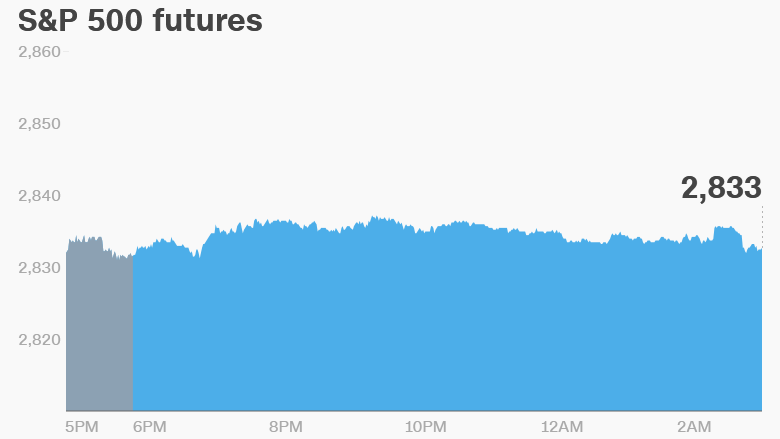

4. Stock market overview: U.S. stock futures were up and European markets advanced in early trading.

Asian markets -- except those in China -- ended with gains.

Investors appear to have brushed off warnings from Alan Greenspan, who has warned about record asset prices in the U.S.

"There are two bubbles: We have a stock market bubble, and we have a bond market bubble," the former Federal Reserve chairman told Bloomberg TV on Wednesday.

Greenspan famously described the dotcom mania of the 1990s as "irrational exuberance."

That memorable phrase, from late 1996, ended up being right -- albeit several years early. The Nasdaq didn't peak until March 2000.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Thursday -- Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN) earnings

Friday -- U.S. monthly jobs report