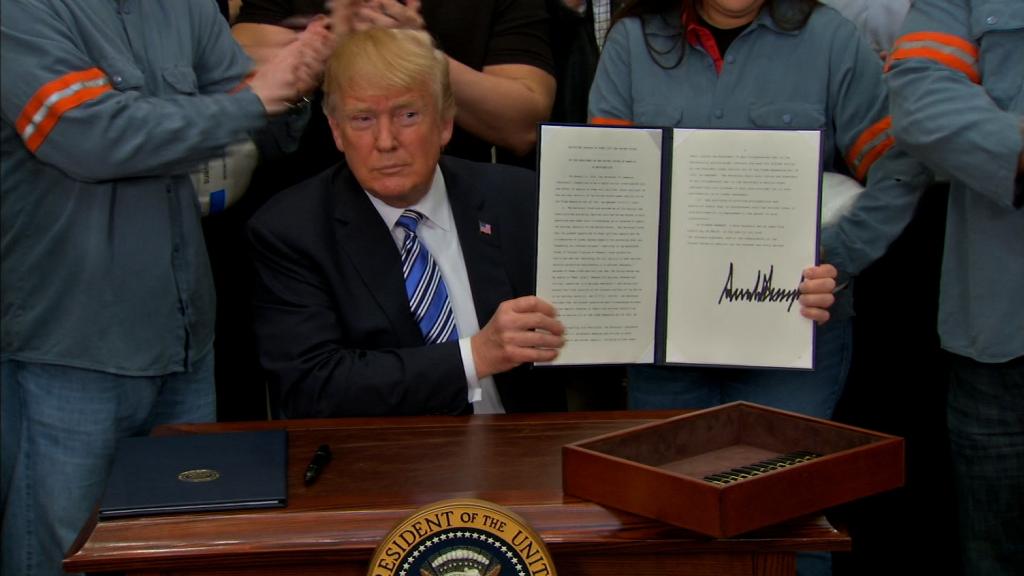

President Trump's steep steel and aluminum tariffs are official. The question now is how the rest of the world will respond.

Trump has said the tariffs are a simple way to restore American industry to its former glory. But politicians, businesses and foreign nations have denounced the tariffs, and there's talk of an impending trade war.

Here's what you need to know.

What did Trump just sign?

Trump is imposing a 25% tariff on steel imports and a 10% tariff on aluminum imports.

Right now, only Canada and Mexico are exempt. But Trump left the door open for other countries to receive exemptions as well.

"America will remain open to modifying or removing the tariffs for individual nations as long as we can agree on a way to ensure that their products no longer threaten our security," he said.

The tariffs will take effect in 15 days.

What are tariffs?

A tariff is a tax or duty that the government places on a class of imported goods (tariffs on exports are very rare). In theory, this makes the foreign products more expensive — boosting domestic makers of the product, which don't have to pay the tax. The tariff is collected by customs officials and goes to the government.

Why does the United States want to put tariffs on steel and aluminum?

The goal is to protect domestic industry by propping up American steel and aluminum manufacturers. The hope is that as steel and aluminum from other countries gets more expensive due to the new taxes, more businesses will turn to American steel and aluminum makers to fill demand. Theoretically, that would breathe new life into industries that have been struggling for years.

It's also meant to address dumping, or the process by which a country sends cheap, excess steel into the global market. China is considered a major perpetrator of this.

Will these tariffs actually help American manufacturers?

Yes and no. American steel and aluminum manufacturers will get a boost, but it's not clear that they actually have the capacity to meet a huge surge in demand.

Other sectors of American manufacturing could be hurt by rising steel and aluminum prices. The tariffs would raise the cost of raw materials for automakers like Ford (F) and General Motors (GM), as well as Boeing (BA) and Anheuser-Busch (BUD). That could be bad for jobs in factories owned by those companies.

Will the tariffs cause prices to go up?

The cost of products like beer, baseball bats and cars could go up due to the tariffs, if the companies that make these products decide to pass the increased cost of steel and aluminum on to consumers.

Commerce Secretary Wilbur Ross has insisted that any related price increases would be very, very small. He said last week that the price of a can of Campbell's soup would go up only six-tenths of one cent.

What are other countries saying?

First and foremost, they care about the negative impact the tariffs will have on their domestic steel and aluminum industries, hurting sales and jobs.

"An imposition of a tariff like this will do nothing other than distort trade, and ultimately ... will lead to a loss of jobs," Australia's trade minister said in a statement last week.

Other countries are also worried about the mechanism the United States is using to impose the tariffs.

Trump is using a little-known trade law to claim that steel and aluminum imports pose a threat to national security. Critics claim that undermines the rules of the World Trade Organization, and will ultimately disrupt the whole global trading system.

Allies like the European Union have bristled at the notion that their trade practices pose a security threat.

How will they respond?

A number of affected countries and political blocs have been very clear that if they're hit with tariffs, they intend to hit back.

The European Union, for example, has said it's ready to impose tariffs on Harley-Davidson (HOG) motorcycles, bourbon whiskey, Levi's jeans, peanut butter and cranberries.

The strong possibility of retaliation by some countries has ignited fears of a global trade war.

What is a trade war?

A trade war is one potential result of protectionism. It describes a situation in which countries retaliate against a country that imposes trade barriers such as tariffs and quotas. This could kick off a string of tit-for-tat responses that escalate international tensions.

Which American industries could be exposed in a trade war?

US agricultural exports like soybeans are thought to be particularly vulnerable. Other nations could also choose to buy planes from Airbus instead of Boeing.

If China retaliates, it could focus on consumer electronics — which would hurt Apple (AAPL) — or semiconductors, which would harm US chipmakers like Qualcomm (QCOM) and Intel (INTC).

What does China have to do with all this?

A lot. In the past, the president has directed much of his harsh rhetoric on steel toward China, the world's largest steel exporter.

Whether a trade war erupts now depends in large part on China's reaction. The country has denounced the tariffs but hasn't shown its cards just yet.

The Chinese Commerce Ministry on Friday called Trump's tariffs "a serious attack on normal international trade order," and said that Beijing is "firmly opposed" to the measures.

China has threatened to be tough in response to steel and aluminum tariffs in the past. There are a number of US industries against which China could retaliate, if it chooses to do so.

The Trump administration is also investigating intellectual property theft by China. The outcome of that probe could play into Beijing's response.

What about our trade deficit?

Trump keeps mentioning the US trade deficit with China in the context of tariff discussions.

"We're going to cut down the deficits one way or another. We have a deficit with China of at least $500 billion," Trump said Thursday.

By focusing on the gap between the value of goods that are imported and exported, Trump misses an important point.

The U.S. economy no longer primarily makes goods. It's now overwhelmingly service-based, relying significantly on financial services, media, transportation and technology. And in terms of importing and exporting services, the US posted a $243 billion trade surplus last year.

What does this mean for NAFTA?

That's a good question. Trump said that Mexico and Canada would be exempt from the tariffs as all three countries continue to renegotiate NAFTA.

But it's not clear what would happen if negotiations fall through.

How is the stock market responding to everything?

Wall Street has been on edge for a week about the tariffs, which could raise costs for companies and hurt the economy, especially if other countries retaliate.

But investors were encouraged by the exemptions for Canada and Mexico, and the prospect that other trading partners might be carved out, too. The Dow finished up 93 points. The S&P 500 and the Nasdaq also moved higher.

Steel companies took a hit. Their stocks' had climbed in anticipation of broader tariffs. US Steel (X), Steel Dynamics (STLD) and Nucor (NUE) each dropped 3% Thursday, and AK Steel Holdings sank 4%.

Did I hear Trump mention Elon Musk in his speech?

You did. Here's the back story.

Shortly before the event, Elon Musk, CEO of SpaceX and Tesla (TSLA), tweeted at Trump: "Do you think the US & China should have equal & fair rules for cars? Meaning, same import duties, ownership constraints & other factors."

He continued, in another tweet: "For example, an American car going to China pays 25% import duty, but a Chinese car coming to the US only pays 2.5%, a tenfold difference."

Trump read the latter tweet aloud on national TV, and responded that the US would "be doing a reciprocal tax program at some point — so that if China is going to charge us 25%, or if India is going to charge us 75% ... we're going to be at those same numbers."

What happens next?

A number of US trading partners and allies had been waiting to see if they'd receive an exemption. But for now, only Mexico and Canada won't have to pay the tariffs — leaving countries like Australia, Brazil and South Korea in the lurch, as well as the European Union (and, of course, China).

The next stop is probably Geneva, where the World Trade Organization is based.

The European Union said earlier this week it would file a complaint with the WTO, which will then need to determine whether the Trump tariffs violate its rules.

There's also a chance that countries circumvent the WTO — just as the Trump administration did when it instituted the tariffs unilaterally.