1. Trade fears ease: Global markets were firmly higher following signs that the United States and China were pulling back from the brink of a potential trade war.

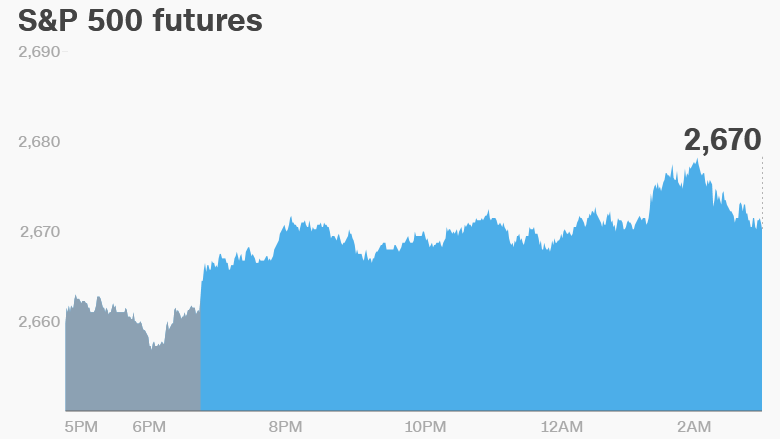

US stock futures were pointing higher on Tuesday.

The Dow spiked 669 points, or 2.8%, on Monday -- its third-biggest point gain on record. The Nasdaq gained 3.3% and the S&P 500 climbed 2.7%.

The upbeat mood in the markets marks a sharp reversal from last week, when fears over a trade war caused major losses.

"Trade relationships remain the dominant market driver, with market confidence skating on thin ice," said Joshua Mahony, a market analyst at IG.

CNNMoney's Fear & Greed index shows that "extreme fear" continues to drive investors.

2. Big pharma deal: GlaxoSmithKline (GLAXF) will buy Novartis' stake in a consumer health joint venture the two formed in 2014. The $13 billion deal will give GSK 100% ownership of the business.

The announcement comes less than a week after GSK dropped its bid to buy Pfizer's consumer healthcare business. Shares in GSK jumped 3.5% in London after the announcement.

Novartis (NVS) said divesting from the venture will enable it to focus on the development and growth of its core businesses. Its shares were trading 1.7% higher.

3. Facebook data scandal: Facebook shares dropped as much as 5% on Monday after the Federal Trade Commission confirmed it is currently investigating the company's data practices.

A late upswing erased those losses, however.

Facebook (FB) is struggling to cope with the fallout from the Cambridge Analytica data scandal. CEO Mark Zuckerberg is facing calls to testify before Congress.

Former Cambridge Analytica contractor Christopher Wylie will appear before a British parliamentary committee on Tuesday.

4. Global market overview: European markets were higher in early trading, following a positive trading session Asia. Japan's Nikkei was the biggest winner, gaining over 2.6%.

US oil futures were 0.2% higher at $65.70 per barrel.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: McCormick (MKC) is set to release earnings before the open. Sonic (SONC) will follow after the close.

Retailer lululemon athletica (LULU) will also report after the close. The company could face tough questions: Its CEO resigned in February after Lululemon claimed he "fell short" of its standards of conduct.

Shares in H&M (HNNMY) declined 6.7% in Stockholm after the Swedish fashion retailer reported a drop in its first quarter profit. The company blamed unusually cold weather for sluggish sales.

The Confidence Board will publish its US consumer confidence report for March at 10 a.m. ET. Last month it was at the highest level since 2000.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday — Lululemon earnings; US consumer confidence

Wednesday — Blackberry, Gamestop and Walgreens Boots Alliance earnings; US fourth-quarter GDP final look

Thursday — Constellation Brands earnings; UK fourth-quarter GDP final look; US personal spending and consumer sentiment

Friday — US markets closed for Good Friday