Elon Musk thinks he could take Tesla private at $420 a share. But one Tesla investor thinks that's a bad idea -- because the stock could be worth nearly ten times that amount in the most optimistic of scenarios.

Cathie Wood, CEO of money management firm ARK Invest, wrote an open letter to Musk earlier this week saying that Tesla could be valued somewhere between $700 and $4,000 per share in five years.

Wood tweeted out a link for the letter to Elon Musk Wednesday night. Musk responded in less than an hour, telling Wood "thank you for the thoughtful letter."

In an interview with CNNMoney Thursday, Wood said that Tesla's investor relations responded quickly to her letter as well and passed it on to the board, but the board has not gotten back to her as of yet.

Tesla (TSLA) shares surged after Musk's now infamous "funding secured" tweet earlier this month, hitting a peak of $387.46 in the process.

But the stock has since slid back to about $320 due to growing skepticism about Musk's ability to actually get a deal done.

Going private now would be a mistake

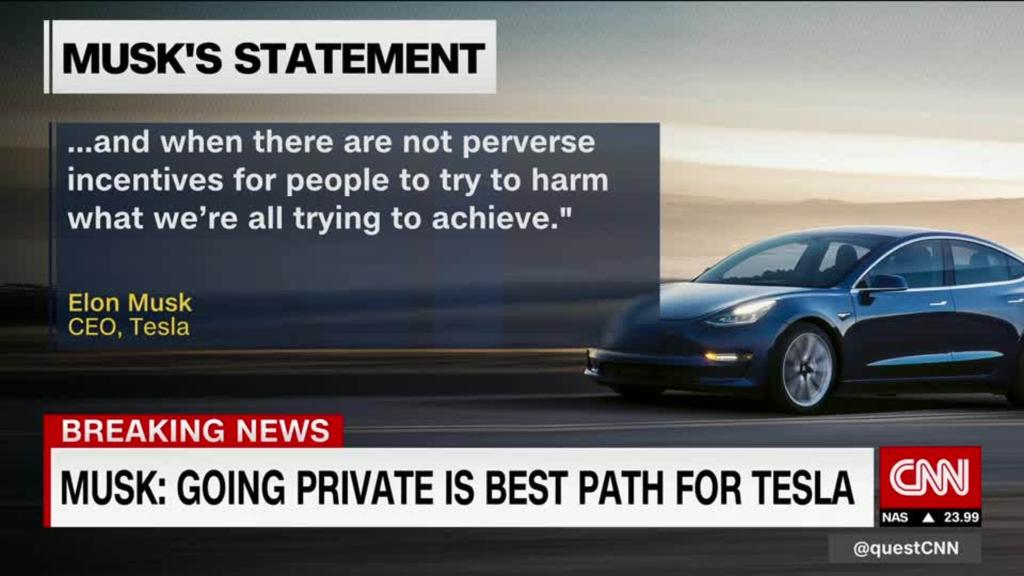

Still, Wood argues that Musk should resist the urge to go private, even if he could pull a deal off.

"Taking Tesla private today at $420 per share would undervalue it greatly, depriving many investors of the opportunity to participate in its success," she wrote.

Wood argues that Tesla could evolve beyond the relatively low profit business of making electric cars. She envisions a Tesla that is generating fat profit margins from autonomous taxis, drones, energy storage services and a bigger presence in China.

If Tesla is able to do all that, the stock could eventually hit her $4,000 target. But Wood admits it will take time -- and patience on the part of shareholders. She realizes that some Tesla shareholders are impatient.

"Because of the short-term investment time horizon of investors in the public markets and inflated valuations in the private markets today, I understand why you may want to take Tesla private, but I must try to dissuade you," she said.

Tesla is either the largest or second largest holding in three ETFs run by ARK, according to Wood -- the ARK Innovation (ARKK), ARK Industrial Innovation (ARKQ) and the ARK Web x.0 (ARKW) funds.

Shorter leash if Tesla went private?

Wood thinks there are other investors out there like her that would be willing to give Musk a chance to make his vision a reality.

"If you do not take Tesla private, you will be surprised and gratified at investor reaction once they realize and understand the scope and ramifications of your long-term vision," she said, adding "with time, I believe that truth always wins out in the public markets."

She pointed to Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Salesforce (CRM) as other companies with visionary leaders whose stock prices have soared. Wood also said if Tesla went private, it may have fewer investors, which actually could make life tougher for Musk.

"Please do not let the short-term thinking of professional public equity investors persuade you to take Tesla private," she said.

"I believe you will be on a much shorter leash in the private markets and will deprive a broad and loyal investor base of one of the most important investment opportunities of their lifetimes," Wood wrote at the end of the letter.

Wood added in the interview with CNNMoney that she understands many Tesla bears are skeptical of her extremely bullish $4,000 target. But she said that "even if we are half right, the stock could double."