|

U.S. blue chips tumble

|

|

February 16, 2000: 5:44 p.m. ET

Dow, S&P 500 end lower amid rate fears; Nasdaq manages a gain

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - The Dow Jones industrial average ended sharply lower Wednesday, falling for the first time this week, as worries about higher interest rates pressured many large-cap stocks, including financial and retail issues.

Meanwhile, the Nasdaq composite index posted a slight gain, bolstered by strong earnings from components Applied Materials and Lycos.

"The focus of the market has shifted almost entirely to technology and Internet stocks to the exclusion of all the basic industries," said Thom Brown, money manager at investment advisory firm Rutherford Brown & Catherwood.

The Dow Jones industrial average plunged 156.68 points, or 1.5 percent, to 10,561.41, and the broad-based S&P 500 index fell 14.38, or 1 percent, to 1,387.67. The Nasdaq composite index rose 6.88 to 4,427.65.

Breadth was negative on the New York Stock Exchange, with declines trouncing advances 1,749 to 1,275 on trading volume of 1 billion shares. On the Nasdaq, losers also led gainers, 2,171 to 2,039, with 1.8 billion shares changing hands.

In other markets, Treasury prices were mixed, with the 30-year bond losing 6/32 of a point, its yield unchanged from 6.25 percent late Tuesday. The dollar rose against the yen but fell against the euro.

Investors wary

Rate hike fears plagued the Dow Industrials and S&P 500 ahead of the week's key inflation reports and testimony from Federal Reserve Chairman Alan Greenspan. With the U.S. economy in a record period of expansion at 107 months, the central bank raised short-term interest rates four times since last June in order to keep inflation in check.

The Labor Department is scheduled to report on January producer prices Thursday, and data on last month's consumer prices come Friday. U.S. international trade deficit data also are scheduled for release Friday.

But before then, Greenspan delivers his semiannual Humphrey-Hawkins testimony to Congress Thursday. His words will be closely watched for clues to whether the strengthening economy needs to be slowed by tightening credit.

In addition, surging crude oil prices and a stronger-than-expected housing report heightened investors' fears. U.S. housing starts rose 1.5 percent to an annual rate of 1.78 million in January, according to the Commerce Department. Analysts polled by briefing.com had expected starts to fall to an annual rate of 1.65 million.

"The housing starts did cast a shadow over the market, which currently has to contend with lots of short-term challenges," said Alan Ackerman, senior vice president at Fahnestock & Co.

Ned Collins, head of trading at Daiwa Securities America, agreed. "People are concerned. You've got some unknowns out there," he said.

Financial, retail stocks slide

In a turnaround from the previous two sessions, the Dow industrials lost ground. Thomas Schreier, stock market strategist at U.S. Bancorp Piper Jaffrey, told CNNfn that market leadership belonged to the Nasdaq. (371K WAV) (371K AIFF)

The financial and retail sectors were among those weighed by rate jitters. Stock investors fret about higher interest rates because tighter credit can hurt corporate profits. Higher rates can be particularly tough on financial services firms, which make money on lending and underwriting stock and bond deals, all of which slow when rates go higher.

Among the Dow components, American Express (AXP: Research, Estimates) declined 5-9/32 to 153-27/32, Citigroup (C: Research, Estimates) retreated 1 to 53-7/8 and J.P. Morgan (JPM: Research, Estimates) dipped 3-5/16 to 112-13/16.

Many retail stocks were in the red. Kmart (KM: Research, Estimates) fell 1/4 to 8. Home Depot (HD: Research, Estimates) declined 3 to 56-3/4, and Wal-Mart Stores (WMT: Research, Estimates), the world's No. 1 retailer, slumped 5-1/8 to 52-7/8. Both Home Depot and Wal-Mart are Dow components.

"Greenspan and the Fed are trying to slow down consumer spending. It's hitting the retail sector across the board, the big multiples especially," said Alan Mak, retail analyst with Argus Research.

Also on the skids was Viacom (VIA: Research, Estimates), falling 3-1/2 to 55-3/4. The media company Wednesday announced a $1 billion stock buyback plan after posting fourth-quarter earnings of $133.1 million, or 19 cents a share.

Applied Materials, Lycos lift Nasdaq

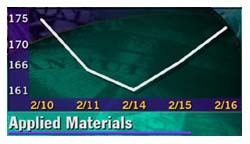

Strong earnings news from Applied Materials and Lycos helped the Nasdaq. Applied Materials (AMAT: Research, Estimates) rose 6-7/8 to 173-3/8. The world's No. 1 chip equipment maker late Tuesday reported fiscal first-quarter operating earnings of 80 cents per diluted share, 3 cents better than forecast by analysts surveyed by earnings tracker First Call. The company also announced a 2-for-1 stock split.

Following the earnings results, numerous Wall Street brokerage firms raised their 2000 earnings estimates on the company. In addition, Prudential Securities upgraded the stock to "strong buy" from "accumulate."

Lycos (LCOS: Research, Estimates) jumped 3-9/16 to 72-5/8 after the Internet media firm late Tuesday posted fiscal second-quarter earnings of $3 million, or 3 cents a share, against expectations of 1 cent.

Gregory Spear, editor of The Spear Report, told CNN's Ahead of the Curve the reports from Applied Materials and Lycos show the Nasdaq continues to lead the market. (194K WAV) (194K AIFF)

After the market close, Hewlett-Packard (HWP: Research, Estimates) reported fiscal first-quarter earnings of 80 cents per diluted share, slightly above expectations of 78 cents. The world's No. 2 computer company was the last Dow component to report earnings. During regular trading hours, the stock rose 4-5/8 to 129-3/8. In after-hours trade, shares rose to 132.

Biotechs and small-caps gain

The red-hot biotech sector also contributed to the Nasdaq's gain. These companies use advanced biochemistry to discover the next generation of treatments for a wide variety of illnesses.

Human Genome Sciences (HGSI: Research, Estimates) soared 33-1/4, or more than 21 percent, to 188, after the company was issued a U.S. patent on a human gene that may be beneficial in the treatment of AIDS.

Amgen (AMGN: Research, Estimates), the largest of the biotech companies, jumped 4-13/16 to 69-7/8.

Smaller technology stocks also posted gains, pushing the Russell 2000 Small Stock Index to a record close at 547.76, surpassing its previous all-time high close of 542.21 on Feb. 10. Along with the Nasdaq, small-cap stocks have performed well this year, with the Russell 2000 gaining more than 8 percent.

(Click here for a look at today's CNNfn hot stocks.)

(Click here for a look at today's CNNfn technology stocks.)

|

|

|

|

|

|

|