|

Roth IRAs for teens

|

|

October 16, 2000: 8:04 a.m. ET

Flipping burgers may be more profitable than your child ever thought

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - If you could invest tax-free money now, let it compound for 40 or 50 years, and then take the proceeds out tax-free, you don't need to be knocked over the head to realize that's a great deal.

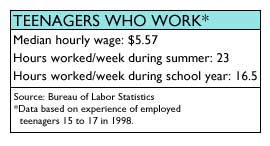

But it's one only your child can take advantage of if he or she has a Roth IRA and makes less than $4,400 annually from a part-time or summer job.

That's because teen-agers who earn less than $4,400 this year will not be required to pay income tax unless they have a significant amount of unearned income from dividends and interest. If they invest part of their earnings - or if you, in a tax-free gift to them, invest the equivalent of part of their earnings -- in a Roth, it will grow tax-free.

Roths good for all

But even if your child makes more than $4,400, chances are his or her income tax bracket will still be at the lowest level in his or her working life. That's why contributing to a Roth at an early age is a great deal for anyone, financial experts say, since they will get the most value from the after-tax earnings they invest.

"They're not losing anything in the way of deductions," said certified financial planner (CFP) Frank Armstrong, president of the Miami-based firm Managed Account Services. "And their money is locked up for a long time." "They're not losing anything in the way of deductions," said certified financial planner (CFP) Frank Armstrong, president of the Miami-based firm Managed Account Services. "And their money is locked up for a long time."

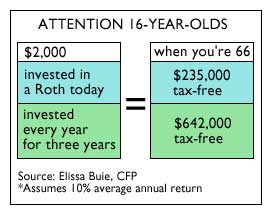

For instance, $2,000 invested today and left to compound for 50 years grows to $235,000 tax-free, assuming a historic average annual return of 10 percent, said CFP Elissa Buie of Financial Planning Group in Falls Church, Va. If $2,000 was invested every year for three years and left untouched for 50 years, your teen-aged son-turned-retiree gets to draw on $642,000 tax-free.

"You look at the numbers. It's just unbelievable," Buie said.

From Mohawk to mortgage

Of course, 50 years is a long way off and retirement is inconceivable to most teen-agers, who are more likely to view age 25 as the great divide between young and old.

But when your children hit their late 20s or 30s, they may be very happy for those early Roth investments, experts say.

Say your child wants to buy a first home. He or she may withdraw any contributions made to the Roth free of tax and early withdrawal penalties. Earnings in the account up to a maximum of $10,000 are fair game, too, presuming the Roth account has been open for five years and presuming all contributions have been withdrawn already. Say your child wants to buy a first home. He or she may withdraw any contributions made to the Roth free of tax and early withdrawal penalties. Earnings in the account up to a maximum of $10,000 are fair game, too, presuming the Roth account has been open for five years and presuming all contributions have been withdrawn already.

College or graduate school expenses, whether your child's or even your grandchild's, are another legitimate justification for early Roth withdrawals. You and your child should know, however, that money taken out for qualified higher educational costs, while free of early withdrawal penalties, will be subject to income tax, said certified public accountant Barry Picker of Brooklyn, N.Y.

Opening an account for your child

Since minors are not allowed to set up their own investment accounts, parents must act as custodian. The account will fall under the child's control when he or she reaches the age of majority.

In order to open a Roth IRA on your child's behalf, there are a few simple ground rules. First and foremost, a child needs to have earned income and you should have proof of that income. That won't be a problem if your teenager works for a company that deducts FICA taxes from paychecks, but if he or she works for cash, Buie recommends you file an income tax return on his or her behalf, even if the earned income falls below the $4,400 cap.

Second, there is nothing barring you from making contributions on your child's behalf, if you wish your child to keep his earnings. Since the annual limit on contributions to a Roth is $2,000 per year, any amount you put in your child's account will be treated as a tax-free gift, since the limit on tax-free gifts is $10,000. Second, there is nothing barring you from making contributions on your child's behalf, if you wish your child to keep his earnings. Since the annual limit on contributions to a Roth is $2,000 per year, any amount you put in your child's account will be treated as a tax-free gift, since the limit on tax-free gifts is $10,000.

Lastly, contributions to a child's Roth may not exceed the amount of income earned, although they may be made in advance of when that income is paid. So if you want to invest $2,000 at the beginning of the year and your child will only work during the summer, that's fine, so long as he or she earns at least $2,000.

But if you mistakenly contribute more to the account than your son or daughter ends up earning for the year, you can take out the excess contribution without penalty before you file your tax return for the year. But any earnings on that excess contribution must be taken out as well and you will be charged a 10 percent withdrawal penalty on that money as well as income tax, Picker said. The law is less clear on what you need to do if the excess contribution lost value, so you should check with your accountant.

Not every shop offers the option

Not every brokerage house or fund company will set up a Roth for a minor, but plenty do.

Janus, for instance, requires a minimum initial investment of $500 and subsequent purchases of no less than $50. If you go to Schwab, the initial minimum is also $500, but there is no minimum for additional purchases. At T. Rowe Price, parents may open a Roth for their teen-agers with a $1,000 minimum or $50 automatic monthly contribution. And at Vanguard, new accounts require a $1,000 minimum investment, with no less than $50 subsequent contributions.

While fund choice and investment minimums may differ depending on where you go, whichever source you choose, be sure to put the money into growth-oriented investments, Buie said. That's because your teen-agers have a long way to go before they reap.

|

|

|

|

|

|

|