|

Ten steps to a great 401(k)

|

|

January 4, 2001: 9:09 a.m. ET

In the Me Generation of retirement investing, you do it yourself

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - There was a time when you didn't have to worry about things like asset allocation, pretax dollars or early withdrawal fees.

But this is the Me Generation of retirement investing, when nobody at your job cares much about how you're going to support yourself when you stop working. Your 401(k), for better or for worse, is yours to cultivate or destroy.

"The company says, 'Here's your 401(k), and this is your match,' " said Doug Flynn, a certified financial planner in New York. "Then it's all up to you. The shift of decision making for all of your retirement planning is thrown on your shoulders."

A recipe for success

To make matters more confusing, there's no single right way to build a 401(k), but countless wrong ways to do it that can obliterate any chance for a comfortable retirement.

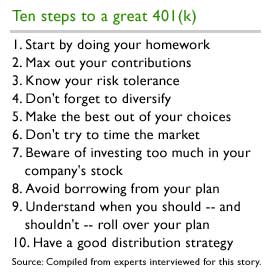

Scared yet? Then you might want to start by doing your homework. Scared yet? Then you might want to start by doing your homework.

Study after study shows people are ignorant when it comes to their 401(k), even though it will likely be their largest asset and primary income source in retirement.

One survey by Wiese Research Associates found most 401(k) investors are "woefully uninformed" about what they are investing in and how to maximize their savings. Nearly half of the people surveyed could not name any of the investments in their plans.

Educating yourself about your options should be a top priority, said Caroline Boyd, senior vice president of Fidelity Institutional Retirement Services Co., a division that runs corporate defined contribution plans.

Is your 401(k) a peach or a lemon? Click here to size up your plan.

"There's such a tremendous amount of education online," Boyd said. "You're always better if you can educate yourself."

Sites like Fidelity, T. Rowe Price and Morningstar have online tools that can help you build a portfolio and track its progress.

Your asset allocation – the way you divide your portfolio between different types of stocks, bonds and cash – will depend on your risk tolerance, or how well you handle volatility. Your asset allocation – the way you divide your portfolio between different types of stocks, bonds and cash – will depend on your risk tolerance, or how well you handle volatility.

An aggressive investor with 20 or 30 years to retirement might want to be 100 percent in stocks, while someone closer to retirement would want to have some bond exposure.

It's even more important these days to do your homework because 401(k) plans are offering more and more choices, said Steven Kaye, a certified financial planner in Watchung, N.J. It used to be you'd only have four choices, but now most plans offer about 10, he said.

While some plans will make you wait a year before you can participate, you should get in as soon as you can. Put the maximum allowed under the law -- now $10,500 a year before taxes -- or at least the maximum amount to get the company match.

Click here to read about the largest mutual funds in 401(k) plans.

In most cases, companies will match your contributions 50 cents on the dollar up to 6 percent, for a total of 3 percent of your salary, Boyd said. You can bump up your contributions less painfully by using your annual pay raise, she said. Money you don't see you won't miss.

"People who save 10 percent of their income throughout their working years, from their 20s on, are usually in good shape," Kaye said. "You want to at least put the full amount aside to get the match."

Making choices

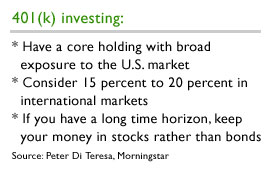

Peter Di Teresa, who writes the "Ask the Professor" personal finance column for Morningstar, said your portfolio should have a core of 50 percent or more in U.S. stocks. Many plans will offer an S&P index fund, or a total stock market index fund, that can fill this need.

Click here to read about the best funds for your 401(k).

He recommends 15 percent to 20 percent in international holdings. But he thinks anyone with a long-term horizon doesn't need to think about bonds.

Bill Dougherty, an analyst at the Boston fund researcher Kanon Bloch Carre, said he advises people to build a portfolio that mirrors the world markets: 75 percent in large caps, 15 percent in mid caps and 10 percent in small caps. About 85 percent of his portfolio would be invested in the United States. He'd put half the portfolio in growth funds, half in value. Bill Dougherty, an analyst at the Boston fund researcher Kanon Bloch Carre, said he advises people to build a portfolio that mirrors the world markets: 75 percent in large caps, 15 percent in mid caps and 10 percent in small caps. About 85 percent of his portfolio would be invested in the United States. He'd put half the portfolio in growth funds, half in value.

Flynn, the CFP from New York, said chances are good you won't have all of the asset classes covered in your plan. You might only have a company stock fund, a fixed interest rate fund, one or two equity funds and an international fund -- if you're lucky.

"What this comes down to is you have to take the best you can in your plan," Flynn said. "I suggest people talk to their companies and ask them to increase the options."

One big danger in 401(k) plans is that many companies offer their own stock as their match. There's nothing you can do if that's your only option, but you should make sure to think carefully about how your other choices will complement each other.

Click here to read why stocks can hurt your 401(k).

"You don't want to much money in your employer's stock," Flynn said. "You're already giving them 8 to 10 hours a day."

Riding out tough times

The advantage of a diversified portfolio is you won't suffer as much when the market is down, especially after a year like this one when most stock fund categories suffered, financial pros say.

"If you've come up with a strategy, you should be able to ride out bumpier markets without panicking," said Boyd. "The worst thing you should do is buy high and sell low." "If you've come up with a strategy, you should be able to ride out bumpier markets without panicking," said Boyd. "The worst thing you should do is buy high and sell low."

Don't sell a fund just because it's had a down year -- and don't invest in one just because it did well.

"Don't try to outguess the market," Kaye said.

Still, once or twice a year you should rebalance your portfolio by re-examining your asset allocation to make sure you're still on track. For example, if you want half your portfolio in growth and half in value, and growth outperforms value by a wide margin, you can scale back slightly on the winning category.

And if you've made a mistake by investing in the wrong fund or putting too much in one asset class, fix the error right away.

"What happened in the past is irrelevant," Kaye said.

Likewise, do everything you can to avoid borrowing from your 401(k). You'll miss out on investing growth and get a double tax whammy, Boyd said.

You'll pay the loan back with money that's already been taxed, and then years later when you take distributions you'll pay taxes on it again.

You'll also be paying the money back at a lower interest rate than you'd earn on your money in the plan, Boyd said.

The other disadvantage is if you leave your job, or get fired, you will have to pay back the loan within 60 days or it's considered an early distribution, experts say. An early distribution means you'll pay taxes on the loan and you'll pay a 10 percent penalty.

"People should really think about the effect this will have on their retirement," Boyd said.

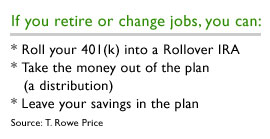

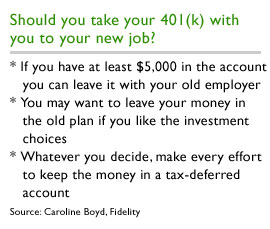

If you leave your job, you can leave your money invested in your old 401(k) if you like the mutual funds as long as you have at least $5,000 in the account.

Again, there's no single right answer. Flynn argues you should put the money into a Rollover IRA so you have complete control over the investments. As long as it's a Rollover IRA – and not mingled with other IRA money – you can eventually roll it over into a new 401(k) plan.

Regardless of the choices you make in your 401(k), as long as you take advantage of the savings, it will get the job done, Kaye said.

"The 401(k) can get you where you want to go, it's just a shame that you have to fund it yourself," Kaye said.

|

|

|

|

|

|

|