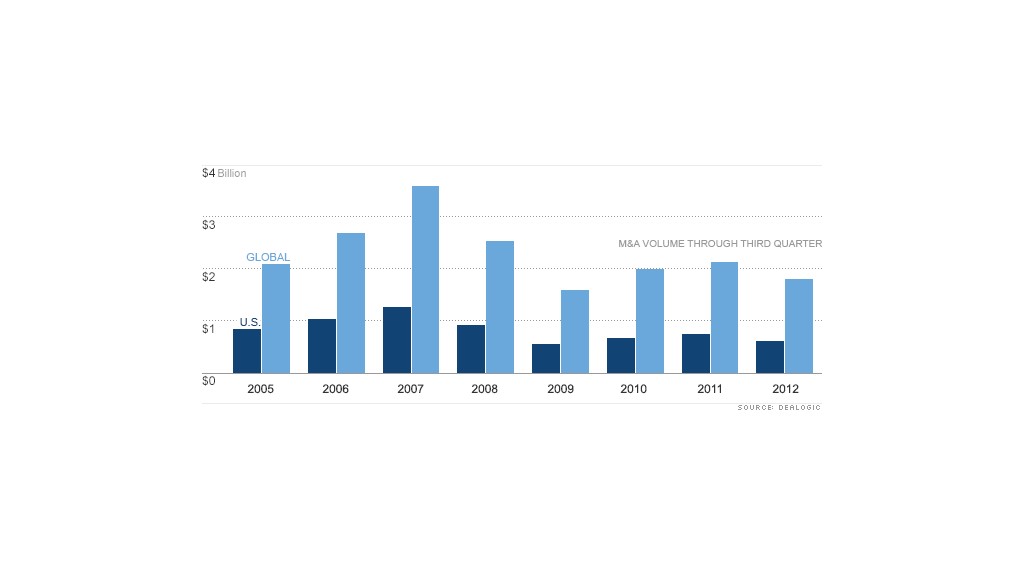

What should have been the year of the mega-mergers is turning out to be a bust, with M&A activity on pace for its slowest year since 2009.

Why? Chief executives and corporate boards are worried about the U.S. fiscal cliff, Europe's debt crisis, a global growth slowdown and a host of other issues.

"This business has always been about CEO and board confidence," said Mark Shafir, co head of global mergers and acquisitions at Citigroup (C). "If you are uncertain about how well your business will do in the next six, nine or twelve months, it tends to dampen enthusiasm for going out and making deals."

Typically, a hot stock market (the S&P 500 is up 14% year to date), availability of cheap corporate debt, and record levels of cash sitting on corporate balance sheets would be the perfect recipe for aggressive dealmaking.

"Over the long-term, we've almost always seen that the stock market and the M&A market are highly correlated," said Jeff Raich, managing director and co-founder of investment bank Moelis & Co.

But this year, global M&A activity is down 15% from a year earlier, according to Dealogic data through Sept. 30.

Related: A sticky problem: Mergers and consumers

"People keep hoping that improvement in the equity market will be a precursor to more deals, but we're not seeing them coming in large quantities," Raich said.

Raich and several other investment bankers say they expect few so-called mega-deals, typically ones that top $10 billion, to be announced in the next few months.

In fact, what would have been the largest deal of 2012, a $45 billion tie-up between European aerospace and defense companies EADS (EADSY) and BAE Systems (BAESF) didn't win support from shareholders and was called off this week.

Related: Private equity's 'golden hangover'

It's not all doom and gloom.

The oil and gas industry has been a standout this year, with $222.6 billion of deals completed during the first three quarters, according to Dealogic. That's up 12% from last year.

Low natural gas prices have been the biggest driver behind that surge, said Phil Weiss, a senior energy analyst at Argus Research. Earlier this year, the drop in natural gas prices forced Chesapeake Energy (CHK) to unload assets to pay off its burgeoning debt.

Another hot area is Asia: Chinese and Japanese firms have bought a record number of overseas companies, also mostly in the oil and gas sector.

One of the largest Chinese deals this year is CNOOC's (CEO) $15 billion proposed acquisition of Canadian oil and gas exploration firm Nexen (NXY), but that still needs to be approved by Canadian regulators.

And banks could emerge relatively unscathed. Typically, M&A moves hand in hand with lending but this year, low interest rates have prompted companies to refinance debt and take out new loans at a record pace.

So, while Goldman Sachs' (GS) July prediction for an uptick in M&A activity hasn't happened, the bank has managed to retain the number one spot as top M&A advisor with a 22.3% share of all global deals.

JPMorgan Chase (JPM), which kicks off bank earnings Friday, and Morgan Stanley (MS) took the second and third spots respectively through the first three quarters of 2012, according to Dealogic.

Investment bankers are hopeful that once some of the economic uncertainty clears up, companies will start making deals again. And in typical fashion, no one wants to be left behind so all it will take is one or two big deals to heat things up.

"The one positive now is that, in the past, when things turn in M&A, they turn very quickly," said Citi's Shafir.