President Obama wants to raise the minimum wage to help working Americans escape poverty. But just hiking the hourly rate by $1.75 to $9 won't accomplish that.

A full-time job paying $9 an hour works out to about $18,000 a year. The poverty line is roughly $23,300 for a four-person household.

So a married couple with only one person earning a $9 minimum wage would also have to take advantage of two tax breaks aimed at working families -- the earned income tax credit and the child tax credit -- just to barely nudge them over the poverty line. These credits are worth about $7,500 for a married couple with two children. After accounting for payroll taxes, these folks would wind up about $850 above the line.

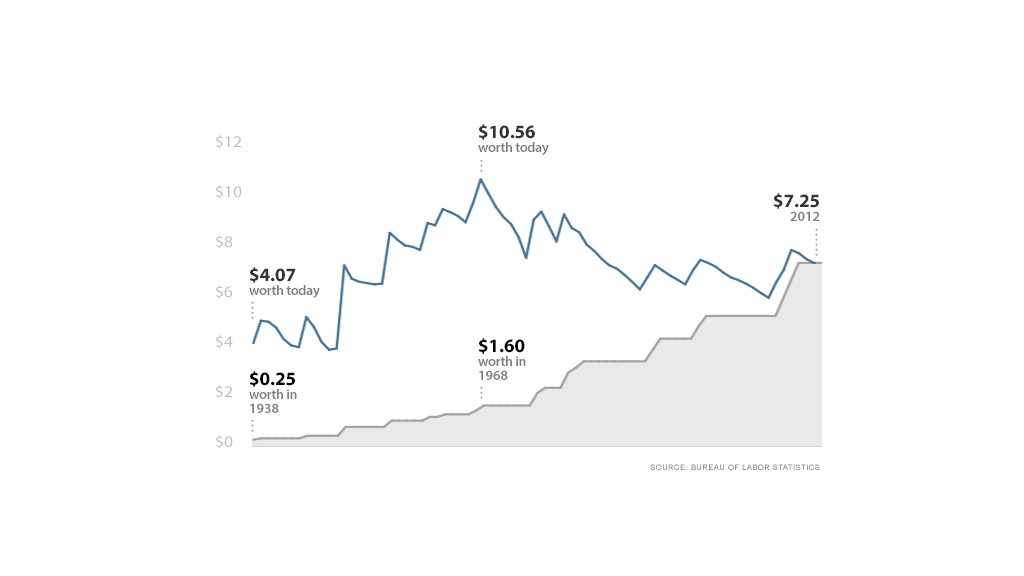

Still, that's better than today's $7.25 minimum wage, or $14,500 a year, which prompted Obama to push for an increase in his State of the Union address on Tuesday. And the president wants the wage to be indexed to inflation, which would prevent its value from being eroded over time.

"Let's declare that in the wealthiest nation on Earth, no one who works full-time should have to live in poverty," he said.

Related: Remember when corporate America supported minimum wage hikes?

In recent decades, policymakers have looked to address poverty more through tax breaks rather than cash payments. But worker advocates say that can mask how far the minimum wage has fallen below the poverty level. And, they note, many tax provisions are temporary and require extensions from Congress.

"It's a reminder how much we've let wages decline and how much we've tried to fill in on the tax credit side," said Shawn Fremstad, senior research associate at the Center for Economic and Policy Research, a progressive group.

While raising the minimum wage will certainly help many workers, advocates say it's more important to assist people in finding higher paying jobs.

"For too many people, low-wage jobs are a way of life," said Elizabeth Lower-Basch, senior policy analyst at CLASP, which advocates for low-income workers.