Families who have been worried about losing thousands of dollars worth of tax breaks this year can stop panicking.

The fiscal cliff deal extends four key tax credits that benefit parents. The Child Tax Credit, the Earned Income Tax Credit and the American Opportunity Tax Credit are safe for five more years, while the Child Dependent Care Tax Credit will be permanently extended.

These credits were initially expanded under the Bush and Obama administrations, and they would have been reduced significantly if Congress hadn't taken action to extend them before the beginning of the year. As a result, many Americans would have been worse off by hundreds -- or even thousands -- of dollars a year.

"These are meaningful numbers to your lower or middle income taxpayers," said Arthur Bloom, a CPA and Partner at Marks Paneth & Shron LLP. "Now you can put your mind at ease, because we do have an extension, and now we at least know what the rules are going forward."

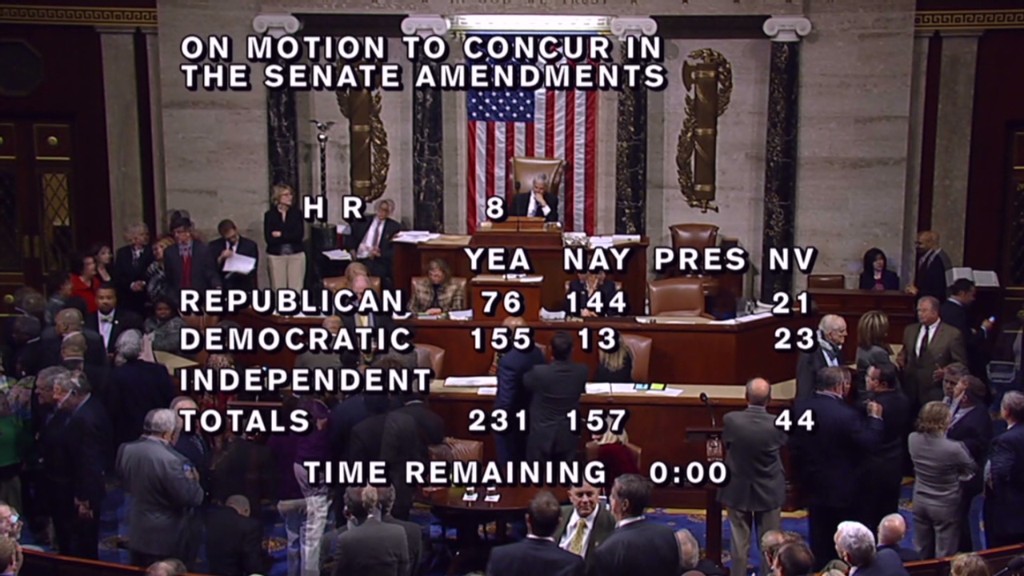

Related: Your taxes under the fiscal cliff deal

Charlie and Jessica Shivers, parents of two, were bracing for a tax hit of $1,000 if the Child Tax Credit wasn't extended. Had Congress let the expanded credit expire, the maximum amount they could receive would have dropped from $1,000 to $500 for each of their children.

Another parent, Linda Sadlouskos, said she would have trouble affording her son's education if she lost access to the full $2,500 American Opportunity Tax Credit she was expecting. That credit was slated to revert to the smaller Hope Credit, meaning the maximum credit would slip to $1,800, it would no longer be refundable and it would only be available for two years instead of four.

The Earned Income Tax Credit, which is estimated to keep millions of Americans out of poverty each year and especially benefits working parents with children, will also be restored for five years rather than being scaled back.

Related: Smaller paychecks coming - bosses say, don't blame us

Finally, the Child and Dependent Care Tax Credit was extended permanently, meaning that working parents will continue to receive a credit of as much as 35% of child care-related expenses up to $3,000 per child or $6,000 per family. If this hadn't been extended, parents would only be able to report up to $2,400 per child or $4,800 per child -- and receive a maximum credit of 30% of expenses.

One tax break that will disappear, however, is the payroll tax cut that was passed in 2010. Roughly 160 million workers can expect to pay more payroll tax, which funds Social Security, in the new year. People earning the national average salary of $41,000 will get $32 less in their biweekly paychecks. Shivers, who makes $84,000, will see his annual pay shrink by a total of $1,700.