Is the bull getting tired?

It's just the second trading day of December and investors already look wary of letting the rampage run to the end of the year.

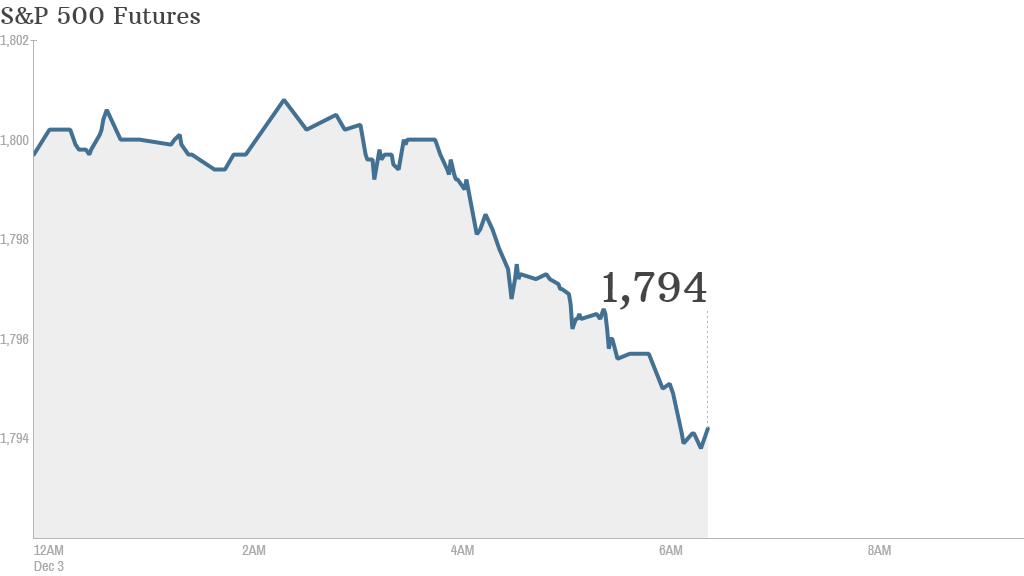

U.S. stock futures were modestly lower ahead of the opening bell Tuesday.

The S&P has managed gains in December for 24 of the past 30 years, but with the index up 27% so far in 2013 investors are ready to take a break.

"It's likely that markets will be in a holding pattern as we head into the business end of the week that starts with ADP employment tomorrow, the ECB on Thursday and ending with payrolls on Friday," wrote Deutsche Bank analyst Jim Reid, in a market report.

U.S. stocks slipped Monday as disappointing Black Friday sales weighed on retailers, and an upbeat manufacturing report revived talk that the Federal Reserve could begin scaling back its massive stimulus program as early as this month.

Related: Fear & Greed Index gets greedy

Friday brings the publication of the monthly jobs report which investors hope will send a much clearer signal as to the likely next move by the Fed.

There's little corporate or economic news expected Tuesday but the world's major automakers will release their monthly sales figures over the course of the day.

Sony (SNE) said that it sold 2.1 million Playstation 4s worldwide as of Dec. 1.

European markets were outpacing Wall Street losses with dismal morning trading. France's CAC 40 down 1.7%.

Asian markets ended mixed, with Japan's Nikkei advancing 0.6% as the yen weakened. Shares in Shanghai joined the rally, adding 0.6% while Hong Kong's Hang Seng declined by 0.5%.