A strengthening job market isn't good enough to pull stocks out of their malaise.

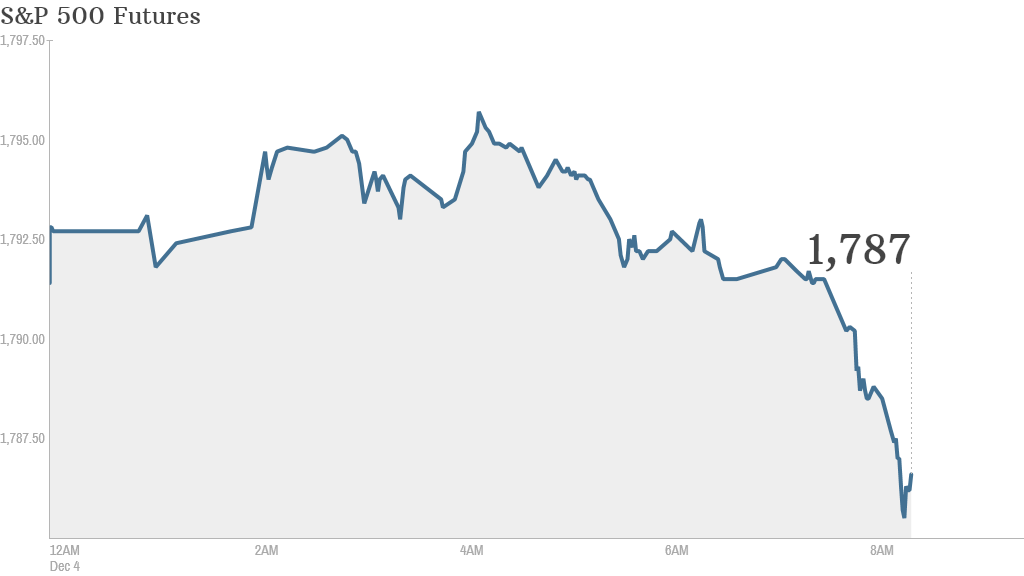

U.S. stock futures were lower ahead of the opening bell, reversing earlier premarket gains.

The pessimism comes despite a report showing the economy added 215,000 private-sector jobs in November. That's well above the 160,000 gain that was expected.

Looking ahead, the Census Bureau will publish data on new home sales at 10 a.m. ET. The Federal Reserve will release its Beige Book, a summary of regional economic conditions, at 2 p.m. ET.

Peter Cardillo, chief market strategist at Rockwell Global Capital, said ongoing concerns about when the Federal Reserve will start pulling back on its stimulus is giving investors an "excuse" to do some selling before the year is up.

Related: Fear & Greed Index, still greedy

U.S. stocks slipped Tuesday. The S&P 500 and Dow Jones Industrial Average were lower for a third straight session.

European markets slid in midday trading, shrugging off the final purchasing managers' data for November that came in a little better than expected. The DAX in Frankfurt led fell more than 1%.

The European Union levied a record antitrust fine of €1.7 billion ($2.3 billion) on six European and U.S. banks and brokers for rigging benchmark interest rates. The largest fine, of €725 million ($986 million) went to Deutsche Bank (DB).

Stocks in Asia were mixed at the close. The Shanghai Composite led the region with a 1.3% gain, while Hong Kong's Hang Seng fell 0.8%. Japan's Nikkei lost more than 2% as the yen bounced between gains and losses.