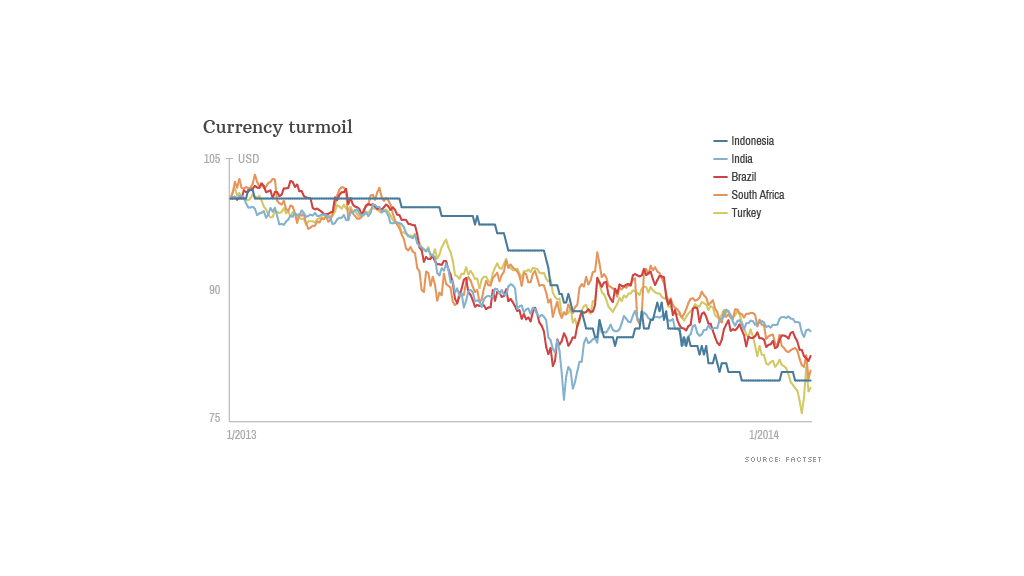

Last year was painful for emerging markets and 2014 is shaping up to be even worse.

Among the hardest hit are Brazil, India, Indonesia, Turkey, and South Africa -- dubbed the 'Fragile Five' by Morgan Stanley last August.

Those countries have seen their currencies tumble 15% to 20% over the past year. And that plunge has continued this month, despite a series of aggressive and, in some cases, unexpected interest rate rises aimed at stopping the rot.

So after years of rapid expansion, and relative calm, what's going wrong?

For one, economic growth has slowed. As a group, emerging and developing economies grew on average by 6.4% over the past decade. Last year, that number was 4.5% and it's forecast to rise only modestly in 2014.

And signs of instability in China's huge shadow banking system have raised fears of a credit crunch that would make it hard for Beijing to deliver its 7.5% growth target. The first decline in factory activity in six months has only made matters worse.

Cheap money is also drying up. The Federal Reserve said Wednesday that it would continue pulling back on its stimulus, to the tune of $10 billion.

That means the U.S. central bank will pump $65 billion a month into the U.S. economy, down $20 billion from December. And the flow of cash is likely to cease completely by the end of this year.

But that doesn't entirely explain the dramatic moves seen in some markets. Take India, for example. "The (Fed) decision was expected and should not in any way surprise or affect the Indian markets," the Indian finance ministry said Thursday. That country's central bank surprised investors with an interest rate hike this week, in an effort to calm the turmoil.

Related: Is this an emerging markets crisis or not?

Still, the gradual normalization of monetary policy and rising U.S. interest rates make it less attractive to invest in emerging markets, particularly those which have failed to tackle deep-rooted problems during the years of plenty, or where other risks abound.

And that's where the Fragile Five come in. Over the past year or two, all have experienced slower growth, along with a heavy dependence on foreign capital, and stubbornly high inflation of between 6% and 11%.

"Several of the most vulnerable emerging markets in terms of external balances -- Turkey, South Africa and Brazil -- have not yet seen their currencies fall to fair value," UBS noted this week.

HSBC Chief Economist Stephen King said some of the weakest were experiencing a loss of competitiveness similar to that seen in countries of the eurozone periphery before the euro crisis.

Political upheaval is another thing they have in common, and may be the single factor that determines whether they can bounce back or not.

The Fragile Five all face elections at some point in 2014, making painful reforms even less likely.

In Turkey, where the lira fell to a record low this week despite interest rates almost doubling overnight, the prime minister has faced calls to resign over a wide-ranging probe into corruption. Local and presidential elections are due later this year.

Related: Buckle up! 2014 will be a bumpy ride

The African National Congress may well lose ground in parliamentary elections this year but are still likely to form the next South African government. That will reduce the chances of major reform.

India's finance minister was talking up his country's prospects at last week's World Economic Forum ahead of national elections, but a weak coalition and continued policy stagnation remains the most likely outcome.

Brazil may catch a break from hosting the soccer World Cup in June, and in Indonesia, the popular governor of Jakarta is a clear front-runner for July's presidential election. But the biggest economies in Latin America and southeast Asia are not out of the woods.

"There is a risk of the problems spreading to other countries. Brazil and Indonesia, for example, have current account deficits, exposure to China and lofty inflation," noted BNP Paribas economist Dominic Bryant.

-- Charles Riley in Hong Kong contributed to this article