There's plenty going on Wednesday. Let's get straight to it.

Here are the four main things you need to know before the opening bell rings in New York:

1. Pharma deal on the brink: Shares in the U.K. pharmaceutical giant Shire (SHPG) dropped like a rock this morning -- down by as much as 29% -- following indications that U.S. drugmaker AbbVie (ABBV) may ditch its $55 billion takeover of the company.

AbbVie said Tuesday that its board of directors is taking another look at the deal after the Obama Administration introduced measures last month to make it harder for American companies to reduce their tax bills by merging with foreign firms and moving abroad.

"Beware the fallout," warned Mike van Dulken, head of research at Accendo Markets.

The withdrawal of this deal could hurt market sentiment, he said, which has been boosted by strong corporate deal-making activity this year.

Related: $55 billion pharma deal could fall victim to new Obama tax rules

2. Ready for earnings: Investors are preparing for a slew of big earnings announcements Wednesday.

Bank of America (BAC) and BlackRock (BLK) will report quarterly results before the opening bell. American Express (AXP), eBay (EBAY) and Netflix (NFLX) will report after the close.

Markets are also ready to react to Intel (INTC) earnings. Shares are rising by about 1.5% premarket after the company reported a 12% jump in quarterly income compared to last year.

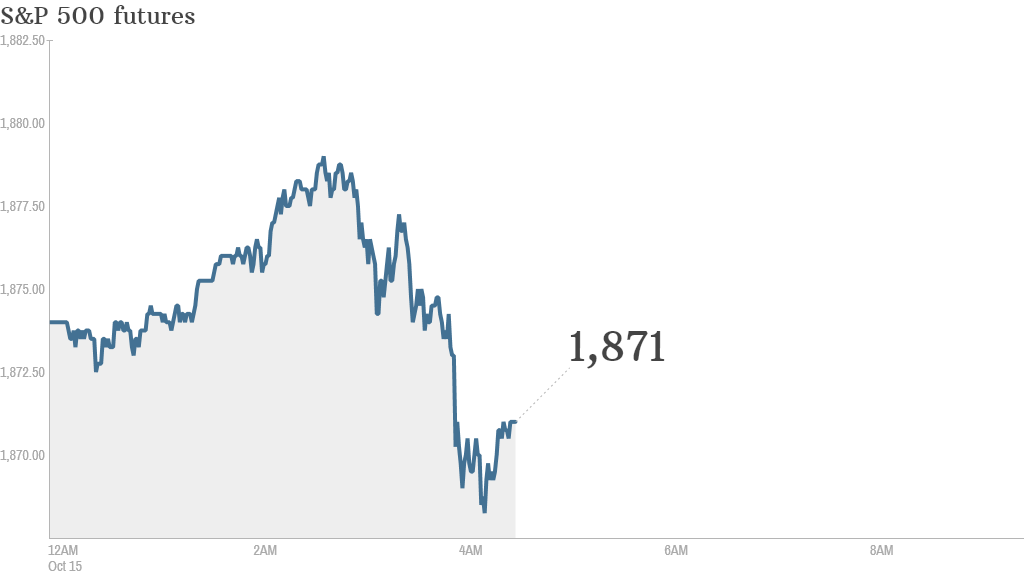

3. Mellowing markets: U.S. stock futures were relatively calm, with the indexes not straying far from Tuesday's closing levels.

U.S. stocks posted mixed results over the previous session. The Dow Jones industrial average slid slightly into the red, losing about 6 points. But the S&P 500 rose 0.2% and the Nasdaq ended the day 0.3% higher.

Markets seem to be mellowing out after taking a sharp dive between Thursday and Monday. However, the CNNMoney Fear & Greed index is still indicating that extreme fear persists in the markets.

On the other side of the pond, European markets were lower. Asian markets mostly closed with gains.

Shares in Toyota (TM) edged slightly higher in Japan despite the automaker's announcement of major recalls covering more than 1.75 million cars. The company's stock has declined by 7% since the start of the year.

Related: 3 key numbers to watch in the markets

4. Economic agenda: The U.S. Census Bureau will report monthly retail sales at 8:30 a.m. ET.

At 2 p.m., the Federal Reserve will release its Beige Book, which is a compilation of anecdotal information about the state of the U.S. economy.