The fuel for the next leg of the economic recovery is literally sitting in the bank.

Companies are hoarding cash.

Instead of hiring workers and investing in the future, businesses are sitting on their money or giving it back to shareholders. Neither strategy does much good for the real economy.

It's a chicken-and-egg dilemma for companies. They aren't seeing enough demand from their customers to justify investing in major projects for the future. But that lack of investment is preventing the job creation and wage hikes needed to accelerate economic growth.

As the stock market and Europe are showing flu-like symptoms, plenty of people would like to see U.S. businesses unleash money to get the economy going again.

Related: Stocks are plunging. Don't panic

There are signs that Corporate America is slowly gaining the courage to spend.

"It's starting to turn," said Russ Koesterich, global chief investment strategist at BlackRock. "Hopefully it becomes self-reinforcing growth. Companies spend more, that creates jobs and you get this virtuous cycle."

Thanks to record profits, non-financial companies in the S&P 500 were sitting on a whopping $1.35 trillion of cash as of the end of June, according to FactSet. That's up 7% from the year before and just a fraction below the all-time record.

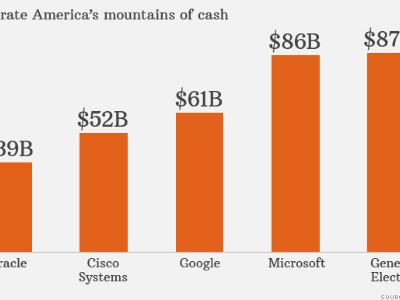

Among American companies, General Electric (GE) has the most -- an astounding $87 billion, according to FactSet -- followed closely by Microsoft (MSFT) and Google (GOOGL).

Real economy vs. Wall Street: Many companies are returning generous amounts of profits back to shareholders in the form of dividends and share buybacks. These distributions rose 2.2% in the second quarter to $168 billion, FactSet said.

Related: The stock market scare: 3 key stats to watch

Another popular use of leftover cash is deploying it to acquire rivals. Fueled by easy credit, companies are buying each other up.

For the most part, investors aren't complaining.

"You get an immediate bang for your buck for shareholders with buybacks, dividend increases and M&A [merger and acquisition] activity," said Randy Bateman, chief investment officer at Huntington Asset Advisors. "The fact you're building a new plant in Oshkosh, Wisconsin doesn't usually stimulate that level of investor intrigue."

But long-term growth tends to come when companies invest in new ideas, new products or more people. That's why some, including Mexican telecom tycoon Carlos Slim, have raised concerns that companies are shooting themselves in the foot by failing to invest in the future.

"Low interest rates are a big opportunity for investment. But the issue is that this money should go to the real economy, not the financial economy," Slim, the world's richest man, recently told CNNMoney.

Related: Is it time to exit stocks?

Glimmers of hope: Capital expenditures, or "capex" may finally be coming into fashion.

The U.S. government recently raised its estimate of second-quarter GDP growth to a healthy 4.6% thanks in part to stronger reinvestment. Capex jumped nearly 10% in the past year.

"We could be entering a sweet spot for corporate capital spending," Kristina Hooper, chief U.S. strategist at Allianz, wrote in a note. "The economy is improving enough to give corporate executives the confidence they lacked in past years to invest in their businesses."

Even those executives who aren't that confident may have their hand forced by the fact that factories and machinery can't last forever. Eventually, these systems become obsolete and can begin to hurt the bottom line.

Related: It's reality check time for stocks

Tech titans to capitalize: Of course, it's far from a sure bet that companies are ready to finally open their coffers to spend on the future. Those hopes could be dashed by a further deterioration of global growth, a geopolitical shock, the Ebola crisis or more turmoil in the stock market.

But capital investment is the most desirable form of growth for the U.S. economy and stock market because it would fuel real demand from consumers.

"Capital investment-led growth would be more stable and many would argue healthier than debt or leverage-driven growth or even consumption driven growth," said Stephen Wood, chief market strategist at Russell Investments.

So what should investors do if this bullish forecast turns into a reality? One obvious strategy is to take a closer look at companies that sell products and services to other companies.

"A return to a more robust capex environment would benefit technology companies, particularly those geared to corporate spending," BlackRock's Koesterich wrote in a note.