Have investors run out of steam? Markets were poised for a quiet start to Wednesday's session, pausing for breath after another record-breaking run.

Here are the 4 things you need to know before the opening bell rings in New York:

1. Oil bounces: Oil prices were clawing back more ground -- rising about 1% to $67.40 a barrel in electronic trade -- after taking a beating following OPEC's decision not to cut production last week. That was seen as an attempt to choke off the U.S. shale boom.

2. Mixed leads: International markets were giving out mixed signals. European stocks notched modest gains in early trading, with Germany's DAX moving higher while the U.K. FTSE 100 index dipped.

The U.K. government is set to announce new economic forecasts, and tax and spending plans.

Asian markets also diverged. Hong Kong's Hang Seng shed 1% while the Shanghai Composite extended recent gains to close at a fresh three-year high.

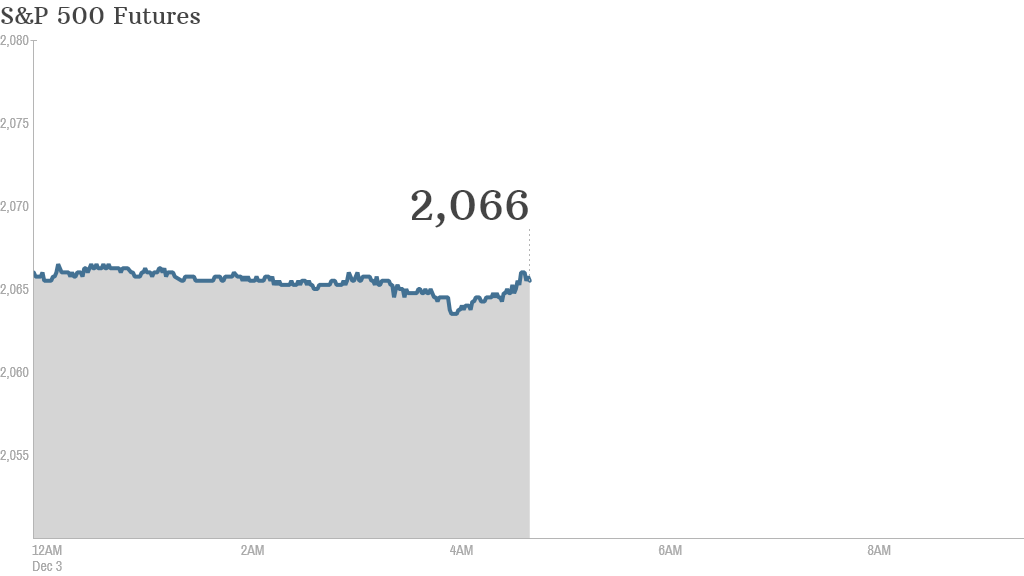

U.S. stock futures were pointing to a softer open, with the S&P 500 inching lower. It follows a strong finish across major U.S. markets Tuesday. The Dow soared 102 points to set a new record close, its 32nd of the year. Both the S&P 500 and the Nasdaq rose about 0.6%.

3. Economic highlights: It's a light day for economic news. The ADP's monthly employment report is due out at 8:15 a.m. ET, followed by the Fed's Beige Book at 2 p.m. ET. The monthly report gives anecdotal information about the economy from the 12 regional banks.

4. Earnings updates: Retailer Abercrombie & Fitch (ANF) and Brown-Forman (BFA), the maker of Jack Daniel's Tennessee Whiskey, will report earnings before the opening bell. Retailers Aeropostale (ARO), New York & Co (NWY), Pacific Sunware (PSUN) and Tilly's (TLYS) will report after the close.