The stock market is off to its worst start since the meltdown of 2008, but history says investors shouldn't panic yet.

There are plenty of reasons why stocks are likely to bounce back from their early 2015 jitters: The American economy is growing rapidly, the Fed's in no rush to hike rates and plunging oil prices should bring smiles to Main Street.

There's also the number three. As in, this is the third year of President Obama's final presidential term.

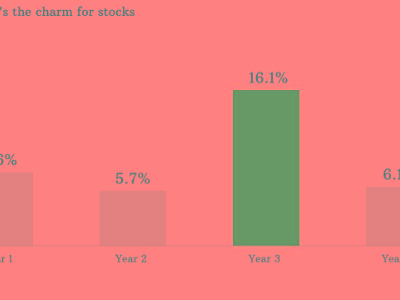

Since World War II, the S&P 500 has never suffered a loss during the third year of the presidential cycle, according to S&P Capital IQ.

Related: The stock market needs a correction. Here's why

Even more encouragingly, the index increased an average of 16.1% during this lucky third year, compared with the typical gain of 8.8% during all years.

"While history is a guide but never gospel, it is on the side of investors who believe this year could be up as well," said Sam Stovall, chief investment strategist at Capital IQ.

It's worth noting that twice -- in 1947 and 2011 -- the stock market failed to rally in the third year of the cycle. It ended the year virtually unchanged in both instances.

Related: Big Oil loses $200B as oil prices crash

Playing politics: So what's behind the good feelings on Wall Street during the third year of White House stints? Stovall points to pure politics.

"The party in power wants to stay in power and will traditionally try to do whatever it can to stimulate the economy and consumer confidence so voters feel more optimistic when they go back to the polls in Year 4," he said.

Investors have been anything but optimistic at the start of 2015. The S&P 500 tumbled 2.7% through the first three trading days of the year (although the market is rebounding Wednesday).

That's the worst start since 2008, according to BTIG. That poor start seven years ago foreshadowed a 38% market meltdown amid the financial crisis. Stocks also plunged 4.6% three days into 2000, a year that saw the S&P 500 decline 10% when the Dot-com bubble popped.

"Hardly the company one would like to keep," Dan Greenhaus, chief global strategist at BTIG, wrote in a report this week.

Related: Cheap oil - Main Street hates it, Wall Street loves it

Resilient markets: But market pullbacks are healthy, giving investors waiting on the sideline an entry point and preventing stocks from overheating.

That's especially true today given the fact that the stock market hasn't suffered a 10% correction since October 2011. To put that in perspective, Hollywood has churned out three different X-Men movies since then.

Pullbacks are quite common during the third year of presidential cycles, with 82% of them posting a decline of 5% or more, Stovall said.

"It just shows you the resiliency of the market to be able to bounce back," he said.