The bull market in stocks officially turns seven today.

It's the third longest stock market upswing in U.S. history. But dark clouds hover above this milestone birthday celebration.

The S&P 500 has nearly tripled (up 194% to be exact) since its low point on March 9, 2009. The surge reflects America's recovery from the Great Recession.

Yet the bull run has slowed considerably, especially in 2016. Stocks started the year with a scary plunge that was fueled by fears of a new global recession and worries about the downsides of cheap oil. Some even feared the bull market was near its death bed.

"The more fun part of the bull market is probably over," said Russ Koesterich, global chief investment strategist at BlackRock. "It doesn't mean stocks can't advance. But the gains are going to be more muted -- and accompanied by more volatility."

Thankfully, stocks have recovered from the panic attack. The Dow is up about 1,500 points from its February 11 low.

Related: Why the oil crash isn't a repeat of 2008 crisis

Still, the market freakout of 2016 highlights the serious challenges facing the bull market as it grows older.

After soaring 30% in 2013 and 11% the next year, the S&P 500 was basically flat in 2015. Not only has the market stopped smashing records, it's down 7% from its May all-time highs.

Seven may not sound very old, but in stock-market years it's practically senior-citizen status. Only two bulls have lived longer, led by the nine-year run that ended in March 2000.

"Time to buy the bull an AARP membership," jokes Howard Silverblatt, senior index analyst at S&P Dow Jones Indexes.

In some ways, this bull market anniversary should carry an asterisk. That's because the record books may actually need to be amended if a bear market (20% decline from previous highs) happens soon.

Sam Stovall, U.S. equity strategist at S&P Global Market Intelligence, explains it this way: If the stock market slips into a bear market before it hits a new record high, technically it would have never have turned seven years old.

"Should a 20% stumble occur first, this birthday crown will be revoked like Jim Thorpe's Olympic medals," Stovall wrote in a report.

Related: Investors are afraid...of missing a rebound

None of this is to say the stock market hasn't had a great run.

"This has been a long, powerful bull market. Think about the way the market looked in 2009," said Koesterich. "The fear was not simply a recession but of a global depression and meltdown of the financial system."

So where do stocks go from here? That's likely to be defined by three key themes: oil prices, the U.S. economy and the Federal Reserve.

Oil prices have rebounded strongly in recent weeks, lifting stocks. Investors have been obsessed with the consequences of cheap oil, including energy bankruptcies and job cuts. But some believe the oil rally may be overdone.

Related: America's B+ economy: Is this as good as it gets?

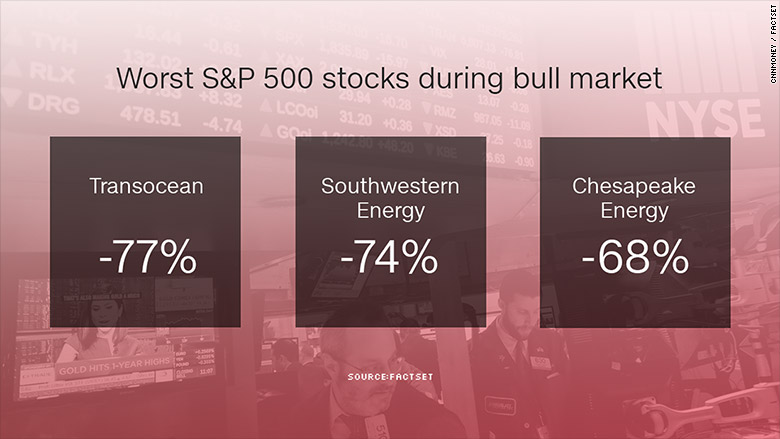

Stocks also need the U.S. economy to continue to weather the global storms. That would allow corporate profits -- the real driver of stock prices -- to rise, at least outside of the energy sector.

"If the U.S. continues to grow, stocks can do alright," said Koesterich.

Keep a close eye on the Federal Reserve as well. There's a huge gap between the Fed's plan to raise interest rates four times this year and Wall Street's projection of just one hike. Watch out for signs the Fed still plans to raise rates more aggressively than investors think the economy can handle.

Related: Gold rush! The yellow metal is in a bull market

If the bull market in stocks does have another year to run, history suggests it could be a strong one. Stovall said bull markets that lasted longer than three years tend to go "out with a bang," posting above-average final-year returns.

"Like a light bulb that glows brightest just before burning itself out, we may find that this bull market has one more illuminating year left in it before extinguishing itself in a blaze of glory," said Stovall.