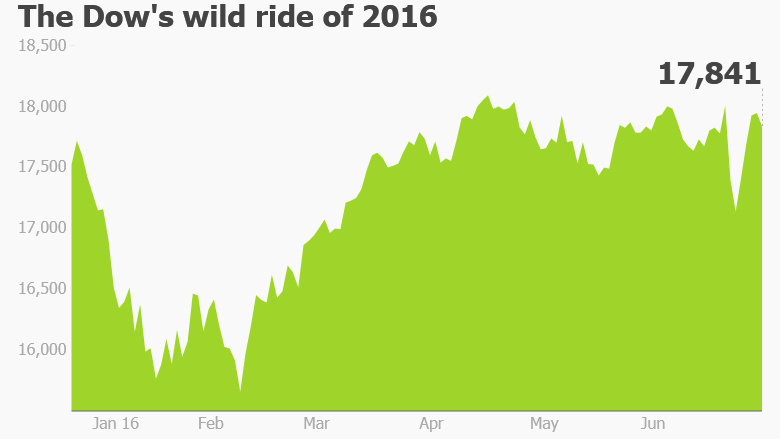

Call it the wild ride to nowhere.

For the past 14 months, U.S. stocks have been trapped on an insane voyage dominated by scary drops (see: Brexit plunge) and impressive comebacks (see: post-Brexit rebound).

But in the end, the American stock market has barely budged, and the S&P 500 has failed to reach new highs since May 2015.

The good news is that a CNNMoney survey of market strategists shows that few fear Brexit poses a Lehman-like risk to U.S. stocks like the 2008 Wall Street meltdown did. Indeed, within four days of the vote, U.S. stocks recovered most of their post-Brexit losses, though they are under renewed pressure this week.

The bad news is the survey reveals little enthusiasm about the stock market in the short to medium term and concern over what could lift stocks to new highs. Market experts pointed to so-so American economic growth, the lingering recession in corporate profits and stock prices that look historically expensive.

The combination of "high valuations and weak growth" means it may not be the best time to make a big bet on stocks, said Bruce McCain, chief investment strategist at KeyCorp.'s Key Private Bank.

Related: Brexit crash wiped out $3 trillion. Now what?

That doesn't mean Wall Street pros are calling for the end of the seven-year bull market in stocks.

As long as the U.S. economy keeps growing -- and few fear a near-term recession -- the market could keep grinding higher, albeit with continuing bursts of volatility.

"In the absence of inflation or a looming recession, stocks typically trend higher," said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management.

The biggest concern is that the market doesn't look cheap. Federal Reserve chief Janet Yellen recently warned that valuations for stocks "have increased to a level above their median of the past three decades."

Michael Block, chief strategist at Rhino Trading, agreed that stocks are "expensive," but cautioned that "they could get more expensive." Others note that valuations aren't ridiculous, like they were during the dotcom bubble of the late 1990s.

High overall market valuation "does not mean there aren't pockets of opportunity in U.S. stocks," said Kristina Hooper, U.S. investment strategist at Allianz Global Investors.

Related: Uh-oh. Is the stock market a bubble again?

But the best thing stocks have going for them right now may be how ridiculously expensive bonds are. They've never been pricier, thanks to a combination of emergency central bank programs (like negative interest rates) and a post-Brexit rush to the safety of government debt. Just this week the U.S. 10-year Treasury yield plunged to a record low.

All of this matters because investors who feel the need to put their money somewhere may be forced to conclude that stocks look like a better deal than bonds.

"The stock market is fairly priced in absolute terms, but cheap relative to bonds and cash. I'd be a buyer," said David Kelly, chief global strategist at JPMorgan Funds.

Rates could stay extremely low because Brexit appears to have further derailed the Federal Reserve's plans to raise interest rates several times this year. Few see more than one rate hike this year and some even think the next move may not happen until the middle of 2017 -- or later.

Related: Give me safety: U.S. bond yield hits record low

So what could trip up stocks the remainder of the year?

Investors are watching to see if the Brexit pain deepens in Europe -- especially with plunging bank stocks in Italy and elsewhere. They are also continuing to monitor China. Even though China has receded from the headlines, the country's economic transition remains wobbly and a sudden currency plunge or stock market crash could spook investors.

"The rapid debt accumulation still poses a major risk for financial markets globally," said Yves Cochez, chief investment strategist at Webster Bank.

Closer to home, the key will be whether the recession in corporate profits finally ends. It's no surprise that stocks have been at a standstill since earnings began declining in the third quarter of 2015.

"U.S. equities will only be able to make new highs if earnings recover," said Cochez.