1. GM exits Europe: General Motors (GM) has reached a deal to sell its money-losing European operations to the French maker of Peugeot and Citroen cars.

Announced early Monday, the agreement will create a new European autos giant, bringing the Opel and Vauxhall brands under the control of France's PSA. GM is also selling its European financial arm to PSA and French bank BNP Paribas (BNPQY).

The combined value of the deals is about $2.3 billion. Shares in PSA were 4% higher in Europe.

2. Deutsche Bank raising billions: Deutsche Bank (DB) is asking investors for $8.5 billion to help improve its financial health after two years of heavy losses. Germany's biggest bank announced plans for the huge share sale on Sunday along with another overhaul of its strategy.

Deutsche Bank said it will seek to raise about €8 billion ($8.5 billion) in the coming weeks -- its fourth capital hike since 2010. The four add up to a total of about €30 billion ($32 billion), more than the bank's current market value.

Shares in Deutsche Bank were trading 6% lower following the announcement.

3. Global markets: European markets were awash in red on Monday, with top indexes in France and Germany both off more than 0.5%.

Asian markets ended mixed. The Nikkei shed 0.5% after North Korea fired four ballistic missiles into waters off Japan.

Chinese stocks advanced after the government said Sunday that it's targeting growth of "around 6.5% or higher if possible" in 2017.

4. Fed sets U.S. agenda: U.S. markets closed flat on Friday after Fed chair Janet Yellen signaled that an interest rate hike would likely come when Fed leaders meet next week.

"The markets are locked, loaded and ready -- a move is priced in, near-unanimously expected by forecasts, who on balance now also agree with the Fed's projection of three moves this year," Societe Generale strategist Kit Juckes said Monday.

The only thing that could change the Fed's plan is weak economic data, giving extra significance to Friday's U.S. jobs report.

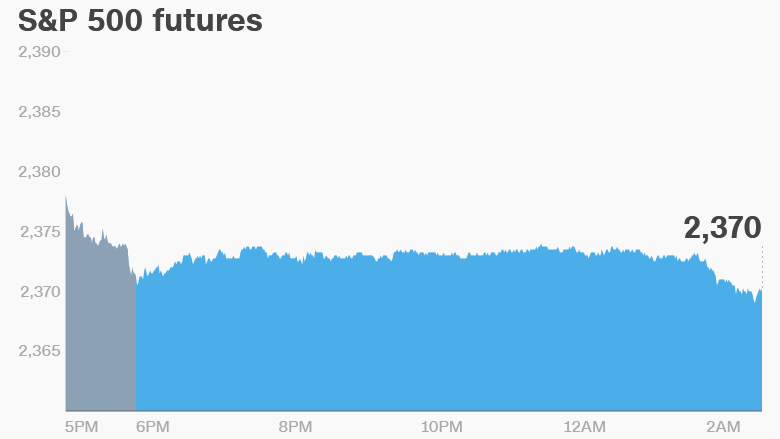

U.S. stock futures were pointing to a negative open on Monday, but they remain near record highs.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Data on U.S. factory orders will be released at 10:00 a.m. ET. Economists expect an increase of 1%.

Gallup's U.S. Consumer Spending Measure report will also be published Monday.

A smattering of U.S. companies are set to release earnings -- but no market heavyweights are on the schedule.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Monday - Gallup U.S. Consumer Spending Measure

Tuesday - Urban Outfitters earnings

Wednesday - "A Day Without a Woman" general strike

Thursday - Geneva International Motor Show

Friday - U.S. jobs report