|

February 10, 2004

Getting with the Program

Financial planner's clients owe him a debt of gratitude for helping them build wealth

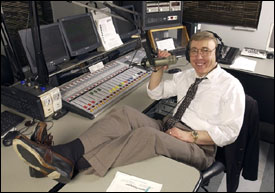

Schwartz, founder of the DEBT-$AVER program, also shares his financial expertise with reports on Denver radio station KEZW.

|

As personal bankruptcies in the U.S. reach an all-time high,

and average monthly credit card balances climb, Michael Schwartz, CFP®,

wants to assist people before they get financially in over their heads.

"Americans are slaves to debt," he says. That's

where his DEBT-$AVER program can help.

A software-based program developed by

Schwartz, DEBT-$AVER restructures mortgage

and other consumer debt via refinancing to lower

monthly payments. While many restructuring

plans expect clients to use the entire monthly savings

to pay down debt, Schwartz' program takes

a fresh approach. One-half of the savings goes

into an accumulation account, giving people the

ability to invest, spend or donate to charity.

Thus, clients can build for the future and still

become debt-free within 12 years. "It isn't magic,"

says Schwartz, president of Wealth Masters Inc. in

Greenwood Village, Colo. "It's just math -- and

smart repositioning to reach financial goals."

The program, which is offered by financial

professionals in 14 other states, encourages

homeowners and their planners to focus on debt

management, instead of only asset management.

"Many people aren't getting anywhere by

making their monthly payments," says Shirley

Bresson, an income tax preparer in California.

"DEBT-$AVER gets them past 'treading water'

with debt. It turns these people into savers."

A financial planner since 1976, Schwartz is

also financial news editor on local radio station

KEZW, providing daily market reports. His idea

for DEBT-$AVER came while he was on a radio

talk show, fielding repeated debt-related questions

from callers. He was inspired to create a way to let

people have their financial cake and eat it, too.

"Like in a diet, if too much is forbidden, you

won't stay on it very long," says Schwartz. "Our

program helps people eliminate debt while still

allowing them to build wealth."

|

|

Page disclaimer

This series profiles financial planners who take a fresh approach to help their clients or the community. To nominate a financial planner, click here.

Michael Schwartz offers securities through Multi-Financial Securities Corporation, member SIPC, a member of ING. Neither ING nor its companies are affiliated with FPA, Wealth Masters Inc., KEZW radio station or the CFP Board of Standards, Inc. In addition, ING does not endorse the financial planners featured in this article.This article is provided for informational purposes only and the views expressed may not be suitable in every situation. Consult your tax, legal and/or financial professional concerning your own situation. CFP® is a certification mark owned by the Certified Financial Planner Board of Standards, Inc.

|

|

|

|

HOW TO FIND A FINANCIAL PLANNER

|

CHOOSING THE RIGHT financial planner

need not be a confusing ordeal. Here

are five steps to help you find a planner

who will put your financial needs first:

CHOOSING THE RIGHT financial planner

need not be a confusing ordeal. Here

are five steps to help you find a planner

who will put your financial needs first:

Begin by asking family members,

friends or business associates who

have had success working with a

financial planner to recommend

names. Your attorney, accountant,

insurance agent and other financial

specialists can be good sources, too.

In addition to competency, a planner

should have integrity and a commitment

to ethical behavior. Ask for

a disclosure document that will

provide information about his or

her work experience, compensation

and methods of planning.

You can set up a personal interview.

Ask about educational background,

professional designations and affiliations,

and licenses to sell particular

financial products.

Keep your specific needs in mind.

Many planners specialize in working

with certain types of clients, such as

young families, small-business owners

or retirees. They may also have minimum

income and asset requirements.

Taking these variables into account,

FPA suggests that you interview at

least three different planners.

For more information on the value

of financial planning and how to find

a financial planning professional,

please visit www.fpanet.org.

|

|

|