From Sheryl Sandberg and the Nasdaq to the graffiti artist who took stock instead of cash, here's who's riding high and lying low one year after the Facebook IPO.

Facebook's first day of trade was about as chaotic as it could have been, thanks to a Nasdaq (NDAQ) "technical error" that sent traders and brokerages into a tailspin.

First, Facebook started trading a half-hour late. Then, some traders began complaining that it didn't seem like their orders were being completed. Others found that they were getting shares at a higher price than they expected.

Nasdaq explained the error a few days later. Essentially, the exchange was overwhelmed with orders. Pundits slammed Nasdaq for the snafu, and brokerages promptly filed lawsuits against the exchange. UBS (UBS) said it lost $356 million due to the technical issues. In March, the Securities and Exchange Commission approved Nasdaq's plan to pay $62 million to banks that incurred losses due to the Facebook IPO. Both UBS and Citigrou (C)p called the proposal inadequate.

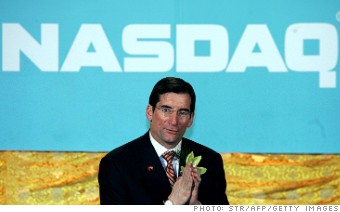

While heads didn't roll at Nasdaq, some wallets got thinner. Nasdaq CEO Robert Greifeld's bonus for 2012 was cut 62% to $1.35 million. The bonus for executive vice president Anna Ewing was also slashed. Nasdaq said in a regulatory filing that its compensation committee and board of directors "explicitly considered the Facebook IPO in connection with their review and determination of these reduced payouts."