Investors head into the shortened trading week hoping to make up lost ground.

Last week, markets snapped a four-week winning streak, as the reality of a life without Federal Reserve aid sunk in. The Dow Jones Industrial Average, the Nasdaq and the S&P 500 all ended lower for the week.

Investors were rattled by signs of a growing split within the Fed over the size of the central bank's bond buying program, which has long been a driver of the bull market over the last few years.

While U.S markets were closed on Monday in honor of Memorial Day, investors will have a fresh batch of economic data to contend with over the rest of the week.

The government releases its second estimate of the gross domestic product for the first three months of the year. The first estimate for GDP, the broadest measure of the U.S. economy, rose 2.5% in the quarter. Economists from Briefing.com expect that number to stay the same.

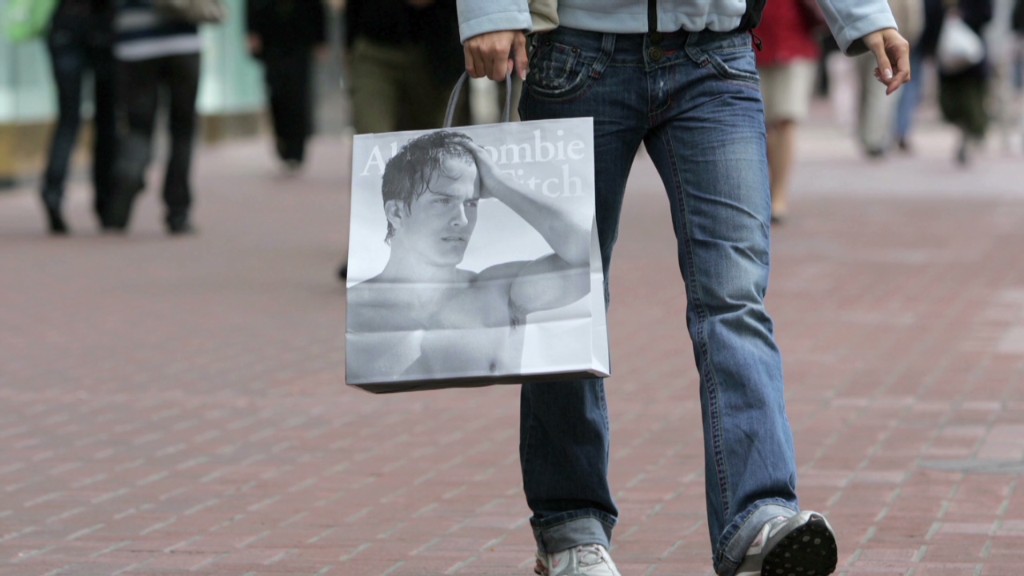

Several reports on how the consumer is feeling about the economy are due out throughout the week, including consumer confidence, personal income and spending and Michigan sentiment.

People will be looking to see if Americans are tightening their purse strings due to the payroll tax and delay in income tax refunds.

Wal-Mart (WMT), the nation's largest retailer, said these factors caused its customers to pull back in the first three months of the year.

The housing market will also be in focus this week, as the Case Shiller 20-city index and pending home sales will also be in play.