Christmas may be over, but it seems Santa is still delivering good news for investors.

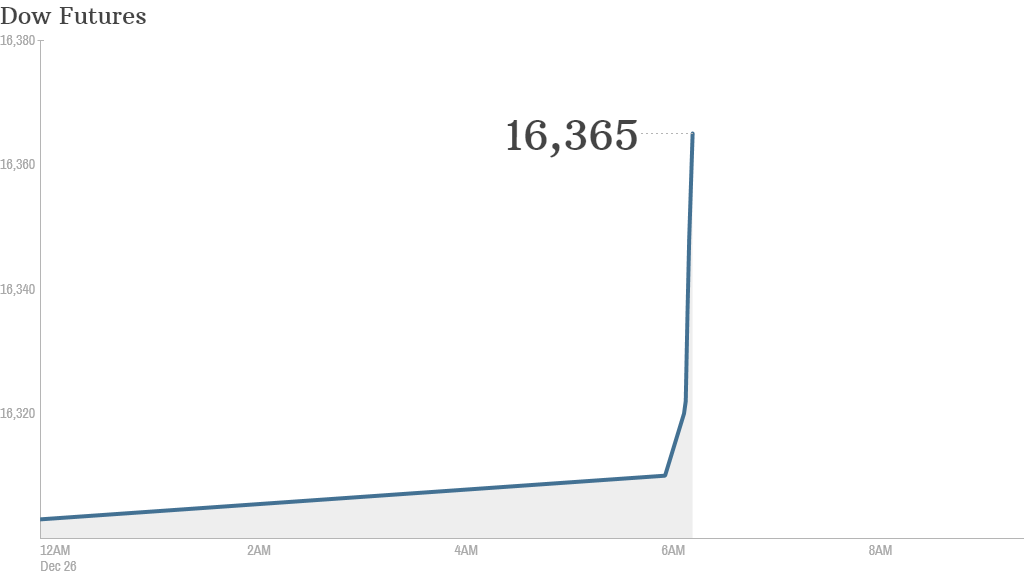

U.S. stock futures tilted higher early Thursday, pointing to a firm start when trading resumes after the Christmas holiday break. The Dow Jones industrial average added 0.4%, and the S&P 500 rose 0.5%.

Both indexes struck fresh all-time highs and the Nasdaq marked a new 13-year high, when markets last traded on Tuesday. The Dow hit its 49th record close this year.

On Thursday, investors returning from holiday will be watching initial job claims at 8:30 a.m. ET.

Related: Fear & Greed Index gets greedy again

Markets have certainly made big moves so far this year. The Dow and S&P 500 are both up more than 20%, while the Nasdaq has soared over 30%.

The broad rally puts the Dow on track for its best year since 2003 and the S&P 500 on pace for its best year since 1997.

This year's gains have been driven by ongoing economic stimulus from the Federal Reserve, increased confidence in the economy, solid corporate earnings growth, and more individual investors entering the stock market.

Related: China's $50 billion move to avert cash crunch

The Fed announced last week that it will modestly reduce its bond buying program in January. But many experts believe the bull market, which began in early 2009, will continue for a sixth year in 2014, albeit at a more modest pace.

Many European and Asian markets were closed for Boxing Day. Japan's Nikkei gained 1%, while China's benchmark index, the Shanghai Composite, dropped 1.6% on Thursday.