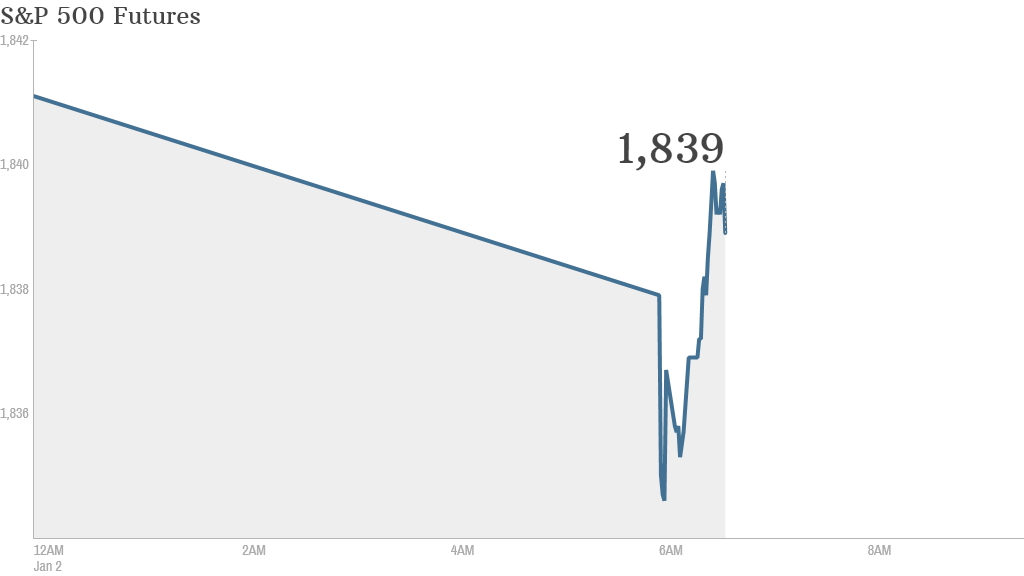

It looks like markets could be off to a weak start for the new year.

U.S. stock futures were modestly lower Thursday, after trending higher earlier. But volume will likely remain light as many traders are still off for the holidays.

A pair of economic reports may help drive markets on the first trading day of 2014.

At 8:30 a.m. ET, the Labor Department releases its weekly tally of initial jobless claims, which have been easing recently. At 10 a.m. ET, the the Institute for Supply Management will release its monthly manufacturing index, while the Census Bureau will release data on construction spending.

Shares of Fiat (FIADF) jumped 13% in Milan, Italy, after the automaker announced Wednesday it was buying full control of Chrysler.

Related: Fear & Greed Index shifts into extreme greed

U.S. stocks finished higher Tuesday -- the final trading day of 2013 -- with the Dow and S&P closing out 2013 with record highs. The Dow ended with a 26% gain, while the S&P 500 jumped more than 29% and the Nasdaq surged nearly 40%, to highs not seen since 2000.

Markets were closed around the world Wednesday for the New Year's holiday.

Related: Which world markets will be hot in 2014?

European markets were all moving lower in morning trading, with Germany's Dax index declining by 0.45%.

Most Asian markets ended the day with small gains. The Shanghai Composite index moved up by 0.9%.

The Tokyo Stock Exchange was closed for an extended New Year break.